Sincerely,

Richard

F. Rutkowski

President and

Chief Executive Officer

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

| Filed by a Party other than the Registrant o | ||

Check the appropriate box: |

||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

|

Microvision, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:* |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| o | Fee paid previously with preliminary materials. | |||

| * | Set forth the amount on which the filing fee is calculated and state how it was determined. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

MICROVISION, INC.

May 20, 2002

Dear Microvision Shareholder:

The Annual Meeting of Shareholders of Microvision, Inc. (the "Company"), will be held at the Olympic Ballroom of the Bellevue Club, 11200 Southeast Sixth Street, Bellevue, Washington on May 20, 2002, at 9:00 a.m. for the following purposes:

1. To elect ten directors to serve for the ensuing one year and until their respective successors are duly elected or appointed;

2. To approve an amendment to the Company's 1996 Stock Option Plan to increase the number of shares of common stock reserved for issuance under the plan by 2,500,000 shares, to a total of 8,000,000 shares;

3. To approve amendments to the Company's Independent Director Stock Option Plan, as follows:

4. To approve a special grant of options to purchase an aggregate of 57,232 shares of common stock made to the Independent Directors of the Company on October 24, 2001; and

5. To conduct any other business that may properly come before the meeting.

If you were a shareholder of record on April 10, 2002, you will be entitled to vote on the above matters. A list of shareholders as of the record date will be available for shareholder inspection at the headquarters of the Company, 19910 North Creek Parkway, Bothell, Washington, during ordinary business hours, from May 10, 2002, to the date of our Annual Meeting. The list also will be available for inspection at the Annual Meeting.

At the meeting, you will have an opportunity to ask questions about the Company and its operations. Whether or not you expect to attend the meeting in person, your shares should be represented and voted. After reading the enclosed Proxy Statement, please complete, sign, date, and promptly return the enclosed proxy card in the self-addressed envelope that we have included for your convenience. No postage is necessary if your proxy card is mailed in the United States. Alternatively, you may submit your proxy by telephone or via the Internet as indicated on the proxy card. Submitting

your proxy before the meeting will ensure the presence of a quorum at the meeting and will save the Company the expense of additional proxy solicitations. Sending in your proxy card, or voting by telephone or via the Internet, will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option.

Details of the business to be conducted at the meeting are more fully described in the accompanying Proxy Statement.

We look forward to seeing you. Thank you for your ongoing support of and interest in Microvision, Inc.

Sincerely,

Richard

F. Rutkowski

President and

Chief Executive Officer

April 16, 2002

Bothell, Washington

PLEASE MARK, SIGN, DATE AND RETURN YOUR PROXY

IN THE ENCLOSED ENVELOPE OR SUBMIT YOUR PROXY

BY TELEPHONE OR THE INTERNET

MICROVISION, INC.

19910 North Creek Parkway

Bothell, Washington 98011

PROXY STATEMENT FOR ANNUAL MEETING

OF SHAREHOLDERS

May 20, 2002

TABLE

OF CONTENTS

| INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 2 | ||

DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD |

4 |

||

PROPOSAL ONE: ELECTION OF DIRECTORS |

4 |

||

BOARD MEETINGS AND COMMITTEES |

7 |

||

DIRECTOR COMPENSATION |

7 |

||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

8 |

||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

8 |

||

PROPOSAL TWO: AMENDMENT TO THE 1996 STOCK OPTION PLAN |

8 |

||

PROPOSAL THREE: AMENDMENTS TO THE INDEPENDENT DIRECTOR STOCK OPTION PLAN |

11 |

||

PROPOSAL FOUR: APPROVAL OF SPECIAL OPTION GRANTS TO THE COMPANY'S INDEPENDENT DIRECTORS |

13 |

||

OTHER BUSINESS |

14 |

||

EXECUTIVE COMPENSATION AND OTHER MATTERS |

14 |

||

HOW WE COMPENSATE EXECUTIVE OFFICERS |

16 |

||

REPORT ON EXECUTIVE COMPENSATION FOR 2001 BY THE COMPENSATION COMMITTEE |

20 |

||

INFORMATION ABOUT MICROVISION COMMON STOCK OWNERSHIP |

21 |

||

STOCK PERFORMANCE GRAPH |

24 |

||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

24 |

||

AUDIT COMMITTEE REPORT |

25 |

||

INDEPENDENT ACCOUNTANTS |

27 |

||

INFORMATION ABOUT SHAREHOLDER PROPOSALS |

27 |

||

ADDITIONAL INFORMATION |

28 |

||

1

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

This Proxy Statement summarizes the information regarding the matters to be voted upon at the Annual Meeting. You do not need to attend the Annual Meeting, however, to vote your shares. You may simply complete, sign and return the enclosed proxy card or vote your shares by telephone or over the Internet in accordance with the instructions contained on the proxy card.

On April 10, 2002, our "record date" for determining shareholders entitled to vote at the Annual Meeting, there were 13,530,374 shares of common stock of the Company outstanding. If you owned shares of our common stock at the close of business on the record date, you are entitled to vote the shares you owned as of that date. We mailed this Proxy Statement to all shareholders entitled to vote their shares at the Annual Meeting on or about April 16, 2002.

If any other matter is presented, your proxy will vote in accordance with his best judgment. At the time we printed this Proxy Statement, we knew of no matters that needed to be acted on at the Annual Meeting other than those discussed in this Proxy Statement.

2

beneficial owner of the shares, or (ii) had discretionary voting authority but nevertheless refrained from voting on the matter.

The amendments to the 1996 Stock Option Plan and the Independent Director Stock Option Plan, and the approval of the special option grants to the independent directors, will be approved if the number of votes cast in favor of these proposals exceeds the number of votes cast against these proposals. Abstentions and broker non-votes will not be counted "for" or "against" the proposals and will have no effect on the outcome of the vote.

3

DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD

Proposal One: Election Of Directors

The Board of Directors oversees our business and affairs and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the President, other key executives and our principal advisers by reading the reports and other materials that we send them regularly and by participating in Board and committee meetings. Our directors hold office until their successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve.

Our Board of Directors will consist of ten members who will be elected at the Annual Meeting to serve until their successors are duly elected and qualified at the next annual meeting of shareholders, unless the director resigns or by reason of death or other cause is unable to serve in the capacity of director.

If any nominee is unable to stand for election, the shares represented by all valid proxies will be voted for the election of such substitute nominee as the Board of Directors may recommend. All of the nominees are currently directors of the Company. The Company is not aware that any nominee is or will be unable to stand for election.

Proxies received from shareholders, unless directed otherwise, will be voted FOR the election of the nominees listed below. THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" ALL OF THE NOMINEES NAMED BELOW AS DIRECTORS OF THE COMPANY.

Set forth below are the name, position held and age of each of the nominees for director of the Company. The principal occupation and recent employment history of each of the nominees are described below, and the number of shares of common stock beneficially owned by each nominee as of February 28, 2002, is set forth on page 21.

| Name |

Age |

Position |

||

|---|---|---|---|---|

| Richard F. Rutkowski(3) | 45 | Chief Executive Officer, President and Director | ||

| Stephen R. Willey | 48 | Executive Vice President and Director | ||

| Richard A. Raisig(3) | 54 | Chief Financial Officer, Vice President, Operations and Director | ||

| Jacqueline Brandwynne | 54 | Director | ||

| Jacob Brouwer(2)(3) | 75 | Director | ||

| Richard A. Cowell(2) | 54 | Director | ||

| Walter J. Lack(1)(2)(3) | 54 | Director | ||

| William A. Owens(1) | 61 | Director | ||

| Robert A. Ratliffe(1) | 41 | Director | ||

| Dennis Reimer(2) | 61 | Director |

Richard F. Rutkowski has served as Chief Executive Officer of the Company since September 1995, as President since July 1996, and as a director since August 1995. From November 1992 to May 1994, Mr. Rutkowski served as Executive Vice President of Medialink Technologies Corporation (formerly Lone Wolf Corporation), a developer of high-speed digital networking technology for multimedia applications in audio-video computing, consumer electronics and

4

telecommunications. From February 1990 to April 1995, Mr. Rutkowski was a principal of Rutkowski, Erickson, Scott, a consulting firm. Mr. Rutkowski also serves as a director of CMT Crimble Microtest.

Stephen R. Willey has served as Executive Vice President of the Company since October 1995 and as a director since June 1995. Mr. Willey served as the Company's technical liaison to the University of Washington's HIT Lab. From January 1994 to April 1996, Mr. Willey served as an outside consultant to the Company through The Development Group, Inc. ("DGI"), a business and technology consulting firm founded by Mr. Willey in 1985. Mr. Willey served as Division Manager CREO Products, Inc., an electro-optics equipment manufacturer, from June 1989 to December 1992. Mr. Willey serves as a director of eDispatch.com, Wireless Data Inc. and eVenture Capital Corporation.

Richard A. Raisig has served as Chief Financial Officer and Vice President, Operations of the Company since August 1996, as Secretary since April 1998, and as a director of the Company since March 1996. From June 1995 to August 1996, Mr. Raisig was Chief Financial Officer of Videx Equipment Corporation, a manufacturer and rebuilder of wire processing equipment for the cabling industry. From July 1992 to May 1995, Mr. Raisig was Chief Financial Officer and Senior Vice President-Finance for Killion Extruders, Inc., a manufacturer of plastic extrusion equipment. From February 1990 to July 1992, Mr. Raisig was Managing Director of Crimson Capital Company, an investment banking firm. Prior to 1990, Mr. Raisig was a Senior Vice President of Dean Witter Reynolds, Inc. Mr. Raisig is a Certified Public Accountant.

Jacqueline Brandwynne has served as a director of the Company since October 2000. Ms. Brandwynne is founder and CEO of Brandwynne Corporation, a venture capital business focusing on investments in communications, internet infrastructure and support, and fiber optics companies. Ms. Brandwynne founded Brandwynne Corporation in 1981. Ms. Brandwynne also owns and manages Very Private, a specialized consumer products and media company. Ms. Brandwynne is a business strategist with over twenty-five years of experience working with companies including Citicorp, where she was the Global Business Strategist, American Cyanamid, Bristol Myers/Clairol, Revlon, National Liberty Life, Seagram & Sons and Neutrogena. She has recently been appointed to the Board of the Fantastic Corporation and serves on several not-for-profit Boards, including the California Institute of the Arts, the Los Angeles Opera, and Amici Degli Uffici in Florence, Italy.

Jacob Brouwer has served as a director of the Company since July 1996. Mr. Brouwer is the Chairman and Chief Executive Officer of Brouwer Claims Canada & Co. Ltd., an insurance adjusting company that he founded in 1956. Mr. Brouwer has served as a director for numerous companies, including the Canadian National Railway Company, Grand Trunk Railway (USA), First Interstate Bank of Washington and First Interstate Bank of Canada, The Insurance Corporation of British Columbia, Air BC, Golden Tulip Hotels Ltd., Prime Resources Group Inc. (Homestake), and Pioneer Life Assurance Company and former Chairman of the International Financial Centre of British Columbia and Northwestel Inc. Mr. Brouwer currently serves as a Director of Doman Industries Inc., a major Canadian Forest Company, The Family Insurance Company, and Great Canadian Gaming Corporation and was recently appointed as a board member of the West Vancouver Police Commission for the Province of British Columbia. He also serves on the Board of Governors of several charitable organizations such as the YMCA, Vancouver Aquarium, the Vancouver Bach Choir and the PC Canada Fund.

Colonel Richard A. Cowell, USA, (Ret.) has served as a director of the Company since August 1996. Colonel Cowell is a Principal at Booz Allen & Hamilton, Inc. where he is involved in advanced concepts development and technology transition, joint and service experimentation, and the interoperability and integration of command and control systems for Department of Defense and other agencies. Prior to joining Booz Allen & Hamilton, Inc. in March of 1996, Colonel Cowell served in the United States Army for 25 years. Immediately prior to his retirement from the Army, Colonel Cowell served as Director of the Louisiana Maneuvers Task Force reporting directly to the Chief of Staff,

5

Army. Colonel Cowell has authored and received awards for a number of documents relating to the potential future capabilities of various services and agencies.

Walter J. Lack has served as a director of the Company since August 1995. Mr. Lack is a partner of Engstrom, Lipscomb & Lack, a Los Angeles, California law firm that he founded in 1974. Mr. Lack has acted as a special arbitrator for the Superior Court of the State of California since 1976 and for the American Arbitration Association since 1979. He is a member of the International Academy of Trial Lawyers and an Advocate of the American Board of Trial Advocates. Mr. Lack also serves as a director of HCCH Insurance Holdings, Inc., a multinational insurance company listed on The New York Stock Exchange. He is a director of SUPERGEN, Inc., a pharmaceutical company listed on NASDAQ, dedicated to the development of products for the treatment of various cancers. Mr. Lack has been involved in a number of start-up companies, both as an investor and as a director.

Admiral William A. Owens, USN, (Ret.) has served as a director of the Company since October 1998. Admiral Owens is the Vice Chairman and Co-Chief Executive Officer of Teledesic LLC, a satellite communications network company. Prior to joining Teledesic, Admiral Owens was President, Chief Operating Officer and Vice Chairman of the Board of Science Applications International Corporation ("SAIC"), a diversified high-technology research and engineering company. Prior to joining SAIC, Admiral Owens was Vice Chairman of the Joint Chiefs of Staff, the nation's second highest ranking military officer. From 1991 to 1993, Admiral Owens was deputy chief of Naval Operations for Resources, Warfare Requirements and Assessments, and from 1990 to 1991 served as commander of the U.S. Sixth Fleet. From 1988 to 1991, Admiral Owens served as senior military assistant to the Secretary of Defense. In 1988 Admiral Owens was the director of the Office of Program Appraisal for the Secretary of the Navy and in 1987 he served as commander of Submarine Group Six, the Navy's largest submarine group. Admiral Owens serves on the boards of Teledesic LLC, Symantec, Inc., Cray Inc., Polycom, Inc., British American Tobacco Industries, p.l.c., Nortel Networks Corporation, Telestra Corporation Limited and ViaSat, Inc.

Robert A. Ratliffe has served as a director of the Company since July 1996. Since 1996, Mr. Ratliffe has been Vice President and principal of Eagle River, Inc., an investment company specializing in the telecommunications and technology sectors, and has held various management positions for the firm's portfolio companies. From 1986 to 1996, Mr. Ratliffe served as Senior Vice President, Communications, for AT&T Wireless Services, Inc., and its predecessor, McCaw Cellular Communications, Inc., where he also served as Vice President of External Affairs and as Vice President of Acquisitions and Development. Prior to joining McCaw Cellular Communications, Inc., Mr. Ratliffe was a Vice President with Seafirst Bank.

General Dennis J. Reimer, USA, (Ret.) has served as a director of the Company since February 2000. General Reimer is the Director of the National Memorial Institute for the Prevention of Terrorism. General Reimer became the 33rd Chief of Staff, U.S. Army on June 20, 1995. Prior to that, he was the Commanding General of the United States Army, Forces Command, Fort McPherson, Georgia. During his military career he has commanded soldiers from company to Army level. General Reimer served in a variety of joint and combined assignments and has served two combat tours in Vietnam. He also served in Korea as the Chief of Staff, Combined Field Army and Assistant Chief of Staff for Operations and Training, Republic of Korea/United States Combined Forces Command. He served three other tours at the Pentagon as aide-de-camp to the Army Chief of Staff, General Creighton Abrams, as the Deputy Chief of Staff for Operations and Plans for the Army during Desert Storm, and as Army Vice Chief of Staff.

6

Board Meetings and Committees

The Board of Directors met six times during 2001. Each director attended at least 75% of the aggregate meetings of the Board and meetings of the Board committees on which they served. The Board also approved certain actions by unanimous written consent.

The Board of Directors has an Audit Committee, a Compensation Committee and a Finance Committee. There is no standing nominating or other committee that recommends qualified candidates to the Board for election as directors. The entire Board performs these duties.

The Audit Committee reviews the Company's accounting practices, internal accounting controls, and interim and annual financial results, and oversees the engagement of the Company's independent auditors. Messrs. Cowell, Brouwer, Lack and Reimer currently serve on the Audit Committee, with Mr. Cowell serving as Chairman. The Audit Committee met five times during 2001.

The Compensation Committee makes decisions on behalf of, and recommendations to, the Board regarding salaries, incentives and other forms of compensation for directors, officers and other key employees, and administers policies relating to compensation and benefits. The Compensation Committee also serves as the Plan Administrator for our stock option plans. The Compensation Committee's Report on Executive Compensation for 2001 is set forth below beginning on page 20. Messrs. Lack, Owens, and Ratliffe currently serve as members of the Compensation Committee, with Mr. Lack serving as Chairman. The Compensation Committee met three times during 2001.

The Finance Committee makes recommendations to the Board on matters related to financing and our capitalization. Messrs. Rutkowski, Brouwer, Lack, and Raisig are the current members of the Finance Committee, with Mr. Rutkowski serving as Chairman. The Finance Committee did not meet during 2001.

Director Compensation

Pursuant to the 1996 Independent Director Stock Plan (the "Director Stock Plan"), each non-employee director ("Independent Director") receives an annual award of common stock ("Annual Award") each time he or she is elected to the Board. The number of shares awarded in the Annual Award is equivalent to the result of $20,000 divided by the fair market value of a share on the date of the award, rounded to the nearest 100 shares (pro rated as appropriate if the Independent Director is elected or appointed to the Board at any time other than at the annual meeting of shareholders). Shares issued pursuant to an Annual Award vest in full on the earlier of one year from the date of grant or on the day prior to the next annual meeting of shareholders subsequent to the date on which the Annual Award was granted. If any shares awarded under the Director Stock Plan are forfeited, such shares will again be available for issuance under the Director Stock Plan. The Board terminated the Director Stock Plan, effective as of May 19, 2002, the vesting date of the annual award granted to the Independent Directors on June 6, 2001. No new grants will be made under the Director Stock Plan.

Pursuant to the Independent Director Stock Option Plan (the "Director Plan"), each Independent Director is granted a nonstatutory option to purchase 5,000 shares of common stock on the date on which he or she is elected, re-elected or appointed to the Board of Directors. Options granted pursuant to the Director Plan vest in full on the earlier of (i) the day prior to the date of the Company's annual meeting of shareholders next following the date of grant, or (ii) one year from the date of grant, provided the Independent Director continues to serve as a director on the vesting date. The exercise price is equal to the average closing price of the Company's common stock as reported on the Nasdaq

7

National Market during the ten trading days prior to the date of grant. If the proposed amendments to the Director Plan are approved by the shareholders at the Annual Meeting:

In addition, each Independent Director receives the following cash compensation for his or her service as a director:

Any Independent Director who is appointed to the Board would receive a pro rata portion of the annual fee based on the period remaining in the Board's current term of service. All directors are reimbursed for reasonable travel and other out-of-pocket expenses incurred in attending meetings of the Board of Directors.

Compensation Committee Interlocks And Insider Participation

Ms. Brandwynne, a director, served as a member of the Compensation Committee through April 2001. For information regarding Ms. Brandwynne's consulting relationship with the Company, see "Certain Relationships and Related Transactions" on page 24.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that our directors, executive officers and greater-than-10% shareholders file reports with the SEC relating to their initial beneficial ownership of the Company's securities and any subsequent changes. They must also provide us with copies of the reports.

Based on copies of reports furnished to us, we believe that all of these reporting persons complied with their filing requirements during 2001, except that Messrs. Sydnes, Tegreene, and Veeraraghavan, three of the Company's executive officers, each belatedly filed their Initial Statement of Beneficial Ownership on Form 3 and Mr. Willey, one of our executive officers and a director, filed one late Statement of Changes in Beneficial Ownership on Form 4 reporting five transactions. Ms. Brandwynne, one of our directors, belatedly filed her Initial Statement of Beneficial Ownership on Form 3 during 2000.

Proposal Two: Amendment to the 1996 Stock Option Plan

The Board of Directors has authorized an amendment to the Company's 1996 Stock Option Plan (the "Plan"). The amendment will increase the number of shares of common stock reserved for

8

issuance upon exercise of options granted under the Plan by 2,500,000 shares to a total of 8,000,000 shares.

The Board of Directors believes that the long term success of the Company is dependent upon the ability of the Company to attract, motivate and retain capable employees and that shareholder value is most effectively enhanced by aligning the interests of employees with those of shareholders. Accordingly, all employees are granted options as a part of their initial compensation arrangements, with the number of options granted based on the optionee's compensation level and, with respect to senior management, the optionee's responsibilities, special skills and experience, and other factors considered important by the Plan Administrator. In addition to making initial option grants to employees upon hire, the Company has an annual option grant program pursuant to which employees are awarded additional options based on the employee's level of compensation plus performance during the past year and expected contribution to the Company during the current year. The Plan is intended to enable the Company to provide employees with meaningful incentives and awards commensurate with their contributions and competitive with those incentives and awards offered by other companies. The amendment to the Plan will enable the Company to continue to grant the options needed to attract, motivate and retain employees.

The Board of Directors has determined the number of shares reserved for issuance under the Plan, including the number of additional shares proposed to be reserved for issuance under the Plan, based on the number of shares reserved for issuance upon exercise of outstanding option grants to current employees and future option grants that the Company expects to make to current and future employees through mid-2004.

On April 10, 2002, the last reported sale price of the Company's common stock on the Nasdaq National Market was $11.30 per share.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE AMENDMENT TO THE COMPANY'S 1996 STOCK OPTION PLAN TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE.

Summary of the Plan

The Plan, which was originally adopted and approved by the Company's Board of Directors and the shareholders in July and August 1996, respectively, currently provides for the grant of options to acquire a maximum of 5,500,000 shares of the Company's authorized but unissued common stock, subject to adjustments in the event of certain changes in the Company's capitalization. The Board of Directors of the Company has authorized, subject to shareholder approval at the Annual Meeting, an additional 2,500,000 shares of common stock to be reserved for issuance upon exercise of options granted under the Plan. Unless sooner terminated by the Board of Directors, the Plan will terminate in July 2006.

The Plan permits the Company to grant incentive stock options ("ISOs") and nonqualified stock options ("NSOs") at the discretion of a plan administrator (the "Plan Administrator") to any current or future employee, officer, consultant, or independent contractor of, or other advisor to, the Company or its subsidiaries. The Compensation Committee of the Board of Directors serves as Plan Administrator. Subject to the terms of the Plan, the Plan Administrator determines the terms and conditions of any options granted, including the exercise price, except that Mr. Rutkowski, the Company's President and Chief Executive Officer, and Mr. Raisig, the Company's Vice President, Operations and Chief Financial Officer, have been authorized by the Plan Administrator to approve and determine the terms and conditions of grants made to non-management employees. The Plan provides that the Plan Administrator must establish an exercise price for ISOs that is not less than the fair market value of the shares at the date of grant. If ISOs are granted to an employee who owns more than 10% of the voting stock of the Company, however, the Plan provides that the exercise price

9

must be not less than 110% of the fair market value of the shares at the date of grant and that the term of the ISOs may not exceed five years. The term of all other options granted under the Plan may not exceed ten years. At the time of grant, the Plan Administrator determines when options become exercisable. Options are not transferable other than by will or the laws of descent and distribution, and each option is exercisable during the lifetime of the optionee only by such optionee. In the event of a merger, consolidation or plan of exchange to which the Company is a party or a sale of all or substantially all of the Company's assets, the Board of Directors may elect one of the following alternatives: (i) outstanding options remain in effect in accordance with their terms; (ii) outstanding options may be converted into options to purchase stock in the surviving or acquiring corporation in the transaction; or (iii) outstanding options may be exercised within a 30-day period prior to the consummation of the transaction, at which time they will automatically expire, and the Board of Directors may accelerate the time frame for exercise of all options in full. Shares subject to options granted under the Plan that have lapsed or terminated may again be made subject to options granted under the Plan. Unless otherwise determined by the Plan Administrator or specified in the optionee's option agreement, following termination of employment by the Company other than for cause, resignation, retirement, disability or death, an option holder has three months during which to exercise his or her options before the options will automatically expire. The Board of Directors may at any time suspend, amend or terminate this Plan, provided that, except pursuant to or by reason of a transaction involving a corporate merger, consolidation, acquisition of property or stock, reorganization or liquidation to which the Company is a party, the approval of the Company's shareholders is necessary within twelve months before or after the adoption by the Board of Directors of any amendment that will increase the number of shares of common stock to be reserved for the issuance of options under the Plan; permit the granting of stock options to a class of persons other than those then-eligible to receive stock options under the Plan; or require shareholder approval under applicable law.

Federal Income Tax Consequences

The following is a general description of the U.S. federal income tax consequences of option grants under the Plan, and does not attempt to describe all potential tax consequences. State and local tax treatment, which is not discussed below, may vary from such federal income tax treatment. Furthermore, tax consequences are subject to change and an optionee's particular situation may be such that some variation of the described rules applies. As a result, optionees are advised to consult their own tax advisors as to the tax consequences of participating in the Plan.

Certain options authorized to be granted under the Plan are intended to qualify as ISOs for federal income tax purposes. An optionee will recognize no income upon grant or exercise of an ISO. However, the amount by which the fair market value (at the time of exercise) of the option shares exceeds the exercise price paid for those shares will be included in the calculation of the optionee's alternative minimum tax.

An optionee will generally recognize income, gain or loss, in the year in which the optionee makes a disposition of the ISO shares. If the optionee disposes of the shares more than two years after the date the ISO was granted and more than one year after the date the option was exercised, the optionee will recognize a long term capital gain equal to the excess of (i) the amount realized upon the disposition over (ii) the exercise price paid for the option shares. If the optionee disposes of the shares within the two-year or one-year periods, the optionee will recognize ordinary income at the time of the disqualifying disposition equal to the excess of (i) the fair market value of the shares on the option exercise date over (ii) the exercise price paid for those shares. If the disqualifying disposition is effected by means of an arm's length sale or exchange with an unrelated party, the ordinary income will be limited to the amount by which (i) the amount realized upon the disposition of the shares or (ii) their fair market value on the exercise date, whichever is less, exceeds the exercise price paid for the shares. Any additional gain recognized upon the disqualifying disposition will be capital gain, which will be

10

long-term if the shares have been held for more than one year following the exercise date of the option.

The Company will not be allowed any deduction for federal income tax purposes at either the time of the grant or exercise of an ISO. Upon any disqualifying disposition by an employee, the Company will be entitled to a deduction to the extent the employee realizes ordinary income.

Certain options authorized to be granted under the Plan are intended or may be treated as NSOs for federal income tax purposes. No income is realized by the grantee of an NSO until the option is exercised. At the time of exercise of an NSO, the optionee will realize ordinary compensation income, and the Company will generally be entitled to a deduction in the amount by which the market value of the shares subject to the option at the time of exercise exceeds the exercise price. The Company is required to withhold federal income taxes, federal Medicare taxes and applicable Social Security taxes on the income amount. Upon the sale of shares acquired upon exercise of an NSO, the excess of the amount realized from the sale over the market value of the shares on the date of exercise will be taxable as income from the sale or exchange of a capital asset. This gain will be long-term capital gain if the shares are held for more than one year prior to the sale.

Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), limits to $1,000,000 per person the amount that the Company may deduct for compensation paid to the Company's Chief Executive Officer or any of the Company's four highest compensated officers (other than the Chief Executive Officer) in any year. Under IRS regulations, in the event that any such officer makes a disqualifying disposition of an ISO or exercises an NSO, the Company's deduction can in certain circumstances be limited by the $1,000,000 cap on deductibility.

Proposal Three: Amendments to the Independent Director Stock Option Plan

The Board of Directors has authorized, subject to shareholder approval, five amendments to the Company's Independent Director Stock Option Plan (the "Director Plan").

The Board of Directors believes that the amendments to the Director Plan are necessary to continue to attract and retain high quality personnel as directors in an increasingly competitive market and to provide added incentive to such persons by linking the value of their compensation to enhanced shareholder value, as reflected by an increase in the valuation of the Company. If the shareholders approve the proposed amendments to the Director Plan at the Annual Meeting, (i) any new

11

Independent Director, upon his or her initial appointment or election, will be granted an option to purchase 15,000 shares, which option will be fully vested and immediately exercisable upon grant; (ii) each Independent Director, upon his or her initial appointment or election and upon each subsequent reelection to the Board of Directors (including reelection at the Annual Meeting), will be granted an additional option to purchase 15,000 shares that will vest and become exercisable in accordance with the Plan; (iii) the options to purchase 10,000 shares that were granted to each current Independent Director by the Board in October 2001 will become effective, and fully vested and exercisable; and (iv) the Plan Administrator may award, up to the limits of the Plan, discretionary option grants to Independent Directors.

The Board of Directors determined the estimated number of shares recommended to be reserved for issuance under the Director Plan based on the number of shares reserved for issuance upon the exercise of outstanding option grants to current Independent Directors and expected future grants to Independent Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE FOREGOING AMENDMENTS TO THE COMPANY'S INDEPENDENT DIRECTOR STOCK OPTION PLAN.

Summary of the Plan

The Director Plan was originally adopted by the Board in February 2000 and approved by the shareholders in June 2000. The Company currently has seven Independent Directors.

The Director Plan permits the Company to grant NSOs to the Company's Independent Directors. Under the Director Plan, as proposed to be amended, each Independent Director will be granted, upon his or her initial appointment or election, an option to purchase 15,000 shares of common stock that will be fully vested and immediately exercisable. Each Independent Director also will be granted, upon his or her initial appointment and upon each subsequent reelection to the Board of Directors, an option to purchase 15,000 shares that will vest in full on the earlier of (i) the day prior to the date of the Company's annual meeting of shareholders next following the date of the grant or (ii) one year from the date of grant, provided the Independent Director continues to serve as a director through the vesting date. If an Independent Director ceases to be a director for any reason other than death or disability before his or her term expires, then any outstanding unvested options issued under the Director Plan to such Independent Director will be forfeited. If any options awarded under the Director Plan are forfeited, the shares subject to such options will again be available for option grants under the Director Plan. If an Independent Director is unable to continue his or her service as a director as a result of his or her disability or death, all unvested options issued under the Director Plan to such Independent Director will become vested immediately as of the date of disability or death. In the event of a merger, consolidation or plan of exchange to which the Company is a party and in which the Company is not the survivor, or a sale of all or substantially all of the Company's assets, any unvested options issued under the Director Plan will vest automatically upon the closing of such transaction. No Independent Director may transfer any interest in unvested options issued under the Director Plan to any person other than to the Company.

The exercise price of options issued under the Director Plan is the average closing price of the Company's common stock as reported on the Nasdaq National Market during the ten trading days prior to the date of grant. The options will expire on the tenth anniversary of the date of grant.

The Board of Directors has reserved a total of 500,000 shares of common stock for issuance under the Director Plan. Unless earlier suspended or terminated by the Board, the Director Plan will continue in effect until the earlier of: (i) ten years from the date on which it was adopted by the Board, or (ii) the date on which all shares available for issuance under the Director Plan have been issued. The Plan may be administered by the Board of Directors or by a committee of directors and officers of the Company, except that only the Board of Directors may suspend, amend or terminate the

12

Director Plan. The Director Plan is administered in accordance with Section 162(m) of the Internal Revenue Code and the regulations thereto.

Federal Income Tax Consequences

Options granted under the Director Plan are treated as NSOs for U.S. federal tax purposes. For information regarding the federal income tax consequences of grants of options that are NSOs, see the discussion on NSOs and Section 162(m) in the "Federal Income Tax Consequences" section of Proposal Two.

Optionees are advised to consult their own tax advisors as to the tax consequences of participating in the Director Plan.

Proposal Four: Approval Of Special Option Grants To The Company's Independent Directors

The Board of Directors has authorized, subject to shareholder approval, a special grant of options to purchase an aggregate of 57,232 shares of the Company's common stock to the seven Independent Directors serving as of October 24, 2001. Pursuant to the special grant, Messrs. Brouwer, Cowell, Lack, Owens, Ratliffe and Reimer each received an option to purchase 8,867 shares of common stock and Ms. Brandwynne received an option to purchase 4,030 shares of common stock. Such options vest and are exercisable upon approval of the shareholders and are exercisable at $15.00 per share until they expire on October 24, 2011.

In October 2001, the Board authorized the award of special, non-routine stock options to employees of the Company, including the executive officers, and the Independent Directors, who held options with exercise prices greater than $16.00. The Board approved this special option grant because it is philosophically committed to the concept of employees and Independent Directors as owners of the Company and to maintain the incentive value of the Company's option program. The Board felt it appropriate to make the special option grants due to the very substantial and sustained decline in the overall stock market and particularly in small cap technology stocks. The Company intends to provide long-term incentives through its regular annual option grant program and, together with the annual grant program, the special grants help advance the Board's ownership philosophy.

These options were granted to the Independent Directors outside the Plan and the Director Plan because:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" APPROVAL OF THE SPECIAL NON-PLAN OPTION GRANTS MADE TO THE COMPANY'S INDEPENDENT DIRECTORS.

Federal Income Tax Consequences

Special grants of options are treated as NSOs for U.S. federal tax purposes. For information regarding the federal income tax consequences of grants of options that are NSOs, see the discussion on NSOs and Section 162(m) in the "Federal Income Tax Consequences" section of Proposal Two.

Optionees are advised to consult their own tax advisors as to the tax consequences of receiving special grants of options.

13

We know of no other matters to be voted on at the Annual Meeting. If, however, other matters are presented for a vote at the meeting, the proxy holders (the individuals designated on the proxy card) will vote your shares according to their judgment on those matters.

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive officers are appointed by our Board of Directors and hold office until their successors are elected and duly qualified. In addition to Messrs. Rutkowski, Willey, and Raisig, who also serve as directors of the Company, the following persons serve as executive officers of the Company:

William L. Sydnes has served as Chief Operating Officer of the Company since June 2001. Prior to joining the Company, from 1998 to 2000, Mr. Sydnes was Vice President, Product Development and Operations with SENSAR, Inc., a New Jersey-based firm that developed identification technology that verifies the identity of an individual utilizing the unique patterns of the iris of an individual's eyes. From 1994 to 1997, Mr. Sydnes was President and CEO for Sarnoff Real Time Corporation, which developed a family of scaleable massively parallel streaming servers. Mr. Sydnes was President of Commodore International Services Corporation, and served IBM for 18 years as a business unit manager for low-end systems where he helped define the base architecture for the IBM PC, XT, AT and PCjr. Mr. Sydnes holds a B.S. from Florida Atlantic University.

Clarence T. Tegreene has served as Chief Technology Officer of the Company since October 2001. Mr. Tegreene joined the Company in 1997 and served as Intellectual Property Counsel. Prior to joining the Company, from 1992 to 1997, Mr. Tegreene was an Associate with Seed & Berry, LLP, an intellectual property law firm in the Northwest, where he specialized in patent prosecution and related IP matters. From 1989 to 1992, Mr. Tegreene was an Associate with Cravath Swaine & Moore, a New York general practice law firm, where he specialized in corporate transactional work. Mr. Tegreene holds an M.S.E.E. degree from Georgia Tech and a J.D. (Law Review) from New York University. Before pursuing a law career, he was a research and design engineer at Motorola where he designed optical and microwave systems and components. Mr. Tegreene holds two patents relating to optical technology. Mr. Tegreene is a member of the Washington State Bar and is registered to practice before the U.S. Patent and Trademark Office.

Dr. V. G. Veeraraghavan has served as Senior Vice President, Research & Product Development of the Company since July 2001. Prior to joining the Company, from 1998 to 2001, Dr. Veeraraghavan served in senior management with Standard MEMS, a MEMS semiconductor fabrication, end-product packaging and systems integration firm. During his service with Standard MEMS, Dr. Veeraraghavan was, first, Vice President of its operations wafer foundry responsible for engineering and production of MEMS wafers and, second, was Vice President Business Development. From 1991 to 1998, Dr. Veeraraghavan served in various management positions at Lexmark International, Inc., a developer and manufacturer of novel color laser and inkjet solutions. Dr. Veeraraghavan holds an M.S. and a Doctorate in Materials Engineering from Purdue University and an M.B.A. from the University of Kentucky. He also received a B.S. in Science from the University of Madras (India) and a B.S. in Metallurgy from the Indian Institute of Science.

Andrew U. Lee has served as Vice President, Sales of the Company since 1997. Prior to joining the Company, from 1992 to 1997, Mr. Lee was Senior Director, National Systems Sales for AEI Music Network, Inc., the largest audio-visual systems integrator in the United States. From 1988 to 1991, Mr. Lee was Vice President of Sales and Marketing for ADB Industries, Inc., a manufacturer of precision mechanical assemblies for the medical, defense and aerospace industries. Mr. Lee holds a B.S. in Political Science from the University of California at Berkeley.

14

Todd R. McIntyre has served as Vice President of Business Development of the Company since 1996. Mr. McIntyre's experience in emerging markets includes business development and marketing with development stage companies in a variety of technology segments including wireless telecommunications products and services, internet software products, and digital and print media. Mr. McIntyre holds an M.B.A. from Stanford University and a B.A. from Hendrix College.

Thomas E. Sanko has served as Vice President of Marketing and Product Management at the Company since February 2001. Prior to joining the Company, from 1999 to 2001, Mr. Sanko was a consultant to Guidant Corp., a manufacturer of cardiovascular surgery products. From 1996 to 1999, Mr. Sanko was Business Manager at InControl, Inc., a manufacturer of electrophysiology products. Prior to 1996, Mr. Sanko served as Director of Marketing for Heart Technology, Inc., and earlier, for Davis and Geck. Both companies are medical device manufacturers. Mr. Sanko has an M.B.A. from the University of Michigan and a B.S. in Mechanical Engineering from the University of Pittsburgh.

Jeff T. Wilson has served as Vice President, Accounting of the Company since April 2002, as Controller and Principal Accounting Officer of the Company since August 1999 and as Director of Accounting of the Company from August 1999 to March 2002. Prior to joining the Company, from 1991 to 1999 Mr. Wilson served in various accounting positions for Siemens Medical Systems, Inc., a developer and manufacturer of medical imaging equipment. Prior to 1991, Mr. Wilson served as a manager with the accounting firm Price Waterhouse (currently PricewaterhouseCoopers LLP). Mr. Wilson is a certified public accountant. Mr. Wilson holds a B.S. in Accounting from Oklahoma State University.

Richard A. James has served as Director of Manufacturing Operations of the Company since January of 2001, and as Manufacturing Engineering Manager since February of 2000. Prior to joining the Company, from 1989 to 2000, Mr. James was an Engineering Manager at Raytheon Systems Company (formerly Hughes Aircraft Company), a large defense electronics contractor, where he lead the design, development, and manufacture of complex electro-optical test equipment for factory and maintenance applications. Mr. James holds a B.S. in Optical Engineering from the University of Rochester, New York.

15

How We Compensate Executive Officers

The following table sets forth the compensation awarded or paid to or earned by our Chief Executive Officer and our next four most highly compensated executive officers (the "Named Executive Officers"):

| |

|

|

|

|

Long-term Compensation Awards Securities Underlying Options(#) |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|

||||||||

| Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($) |

All Other Compensation(1) ($) |

||||||

| Richard F. Rutkowski, Chief Executive Officer and President |

2001 2000 1999 |

285,000 225,000 200,000 |

185,000 200,000 90,000 |

48,069 37,925 102,304 |

242,040 300,000 — |

|||||

Stephen R. Willey, Executive Vice President |

2001 2000 1999 |

245,000 185,000 170,000 |

145,000 127,000 70,000 |

31,037 14,705 87,856 |

86,628 72,000 — |

|||||

Richard A. Raisig, Chief Financial Officer and Vice President, Operations |

2001 2000 1999 |

215,000 170,000 150,000 |

110,000 105,000 60,000 |

55,819 378,587 74,195 |

142,210 204,000 — |

|||||

William L. Sydnes(2) Chief Operations Officer |

2001 |

94,957 |

55,000 |

69,483 |

285,000 |

|||||

Clarence T. Tegreene Chief Technology Officer |

2001 |

136,991 |

46,575 |

76,206 |

111,094 |

|||||

All Other Compensation amounts for 2000 include unrealized gains resulting from the exercise of nonqualified stock options reported as income of $23,900 and $362,930 for Messrs. Rutkowski, and Raisig, respectively. The amounts also include forgiveness of $14,000, $14,700 and $15,700 of interest for Messrs. Rutkowski, Willey and Raisig, respectively, under the Company's Executive Option Exercise Note Plan and Executive Loan Plan. For descriptions of the two plans, see "Executive Loan Plans" below.

All Other Compensation amounts for 1999 include special bonuses of $100,000, $80,000 and $70,000 awarded to Messrs. Rutkowski, Willey and Raisig, respectively, in connection with the redemption of the Company's publicly traded warrants. The amounts also include forgiveness of $2,304, $7,856 and $4,915 of interest for Messrs. Rutkowski, Willey and Raisig, respectively, under the Company's Executive Option Exercise Note Plan. For a description of the Executive Option Exercise Note Plan, see "Executive Loan Plans" below.

16

Stock Option Grants in the Last Fiscal Year

The following table sets forth information regarding options granted to the Named Executive Officers during the fiscal year ended December 31, 2001. All options were granted at an exercise price equal to or greater than the fair market value of our common stock as reflected by the closing price of the common stock on the Nasdaq National Market on the date of grant.

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

% of Total Options Granted to Employees in Fiscal Year |

|

|

||||||||

| |

Number of Securities Underlying Options Granted(#) |

|

|

|||||||||

| Name |

Exercise Price ($/Sh) |

Expiration Date |

||||||||||

| 5% ($) |

10% ($) |

|||||||||||

| Richard F. Rutkowski(2)(7) | 242,040 | 10.2% | 15.00 | 10/24/2011 | 2,050,653 | 5,415,846 | ||||||

| Stephen R. Willey(2)(7) | 86,628 | 3.6% | 15.00 | 10/24/2011 | 733,945 | 1,938,373 | ||||||

| Richard A. Raisig(2)(7) | 142,210 | 6.0% | 15.00 | 10/24/2011 | 1,204,856 | 3,182,067 | ||||||

| William L. Sydnes(2)(7) | 85,000 | 3.6% | 15.00 | 10/24/2011 | 720,152 | 1,901,945 | ||||||

| William L. Sydnes(3)(7) | 50,000 | 2.1% | 20.00 | 6/27/2011 | 605,276 | 1,556,133 | ||||||

| William L. Sydnes(4)(7) | 50,000 | 2.1% | 27.00 | 6/27/2011 | 255,276 | 1,206,133 | ||||||

| William L. Sydnes(4)(7) | 100,000 | 4.2% | 34.00 | 6/27/2011 | — | 1,712,266 | ||||||

| Clarence T. Tegreene(5) | 16,094 | 0.7% | 15.00 | 10/24/2011 | 136,354 | 360,117 | ||||||

| Clarence T. Tegreene(6) | 95,000 | 4.0% | 15.00 | 10/26/2011 | 888,438 | 2,258,763 | ||||||

17

Aggregated Option Values as of Year End 2001

The following table provides information regarding the aggregate number of options exercised during the fiscal year ended December 31, 2001, by each of the Named Executive Officers and the number of shares subject to both exercisable and unexercisable stock options as of December 31, 2001.

| |

|

|

Number of Securities Underlying Unexercised Options/SARs at Dec. 31, 2001(1) |

Value of Unexercised In-the-Money Options at Dec. 31, 2001(2) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Shares Acquired on Exercise |

|

||||||||||

| Name |

Value Realized ($) |

Exercisable ($) |

Unexercisable ($) |

|||||||||

| Exercisable |

Unexercisable |

|||||||||||

| Richard F. Rutkowski | 20,000 | 163,500 | 538,871 | 421,020 | 629,552 | — | ||||||

| Stephen R. Willey | — | — | 342,939 | 171,314 | 904,020 | — | ||||||

| Richard A. Raisig | 3,984 | 19,597 | 310,837 | 207,106 | 219,956 | — | ||||||

| William L. Sydnes | — | — | 67,500 | 217,500 | — | — | ||||||

| Clarence T. Tegreene | 5,000 | 76,206 | 32,648 | 147,071 | 15,470 | — | ||||||

In 1997, Mr. Rutkowski received options to purchase up to an aggregate of 340,000 shares of common stock for service to the Company through December 31, 2001, and Mr. Raisig received options to purchase up to an aggregate of 136,000 shares of common stock for service to the Company through December 31, 2000. In 1998, Mr. Willey received options to purchase up to an aggregate of 238,000 shares of common stock for service to the Company through December 31, 2002.

In connection with the extension of their employment agreements, in April 2000, Mr. Rutkowski was granted options to purchase up to 300,000 shares of common stock for services to the Company during the period January 1, 2002, through December 31, 2004; Mr. Willey was granted options to purchase up to 72,000 shares of common stock for services to the Company during the period January 1, 2003, through December 31, 2003; and Mr. Raisig was granted options to purchase up to 204,000 shares of common stock for services to the Company during the period January 1, 2001, through December 31, 2003.

In connection with his employment agreement, in June 2001, Mr. Sydnes was granted options to purchase up to 200,000 shares of common stock for services to the Company during the period June 27, 2001, through June 30, 2005. These options have ten-year terms and vest in 15 increments, 25,000 shares on December 31, 2001, 12,500 shares on March 31, 2002, 12,500 shares on June 30, 2002, and the remaining 150,000 shares vest equally in twelve quarterly installments beginning on September 30, 2002.

All of these options have ten-year terms and vest quarterly. The options of Messrs. Rutkowski, Willey, Raisig, and Sydnes will vest immediately and become exercisable upon the occurrence of certain events following a change in control. Upon termination of Messrs. Rutkowski, Willey, Raisig or Sydnes, without cause, options granted thereto will continue to vest and become exercisable until fully vested.

In October 2001, the Company issued additional grants as a means to re-establish and enhance the long-term incentive value of the Company's stock option policies for employees and Independent Directors. The Company issued 242,040, 86,628, 142,210, and 85,000 options to Messrs. Rutkowski, Willey, Raisig, and Sydnes, respectively. These grants were issued within the 1996 Plan. The conditions

18

of these options issued are the same as those under the 1996 Plan, except for vesting. Vesting of Messrs. Rutkowski, Willey, Raisig and Sydnes options occurs with the first 25% vesting on the grant date and the remainder vesting 25% on December 31, 2001, 25% on March 31, 2002, and 25% on June 30, 2002.

Employment Agreements

Effective October 1, 1997, the Company entered into an employment agreement with Mr. Rutkowski. Under the employment agreement, Mr. Rutkowski receives a base salary and an annual cash performance bonus in an amount determined by the Compensation Committee of the Board of Directors ("Compensation Committee"). Mr. Rutkowski also is entitled to all benefits offered generally to the Company's employees. In January 2001, the Compensation Committee adjusted Mr. Rutkowski's base salary to $285,000. In April 2000, the Compensation Committee extended the term of his employment agreement to December 31, 2004. Upon termination without cause, Mr. Rutkowski will be entitled to a severance payment of the greater of his current base salary, from the date of termination to December 31, 2004, or his current base salary for one year.

Effective October 1, 1998, the Company entered into an employment agreement with Mr. Willey. Under the employment agreement, Mr. Willey receives a base salary and an annual cash performance bonus in an amount determined by the Compensation Committee. Mr. Willey also is entitled to all benefits offered generally to the Company's employees. In January 2001, the Compensation Committee adjusted Mr. Willey's base salary to $245,000. In April 2000, the Compensation Committee extended the term of his employment agreement to December 31, 2003. Upon termination without cause, Mr. Willey will be entitled to a severance payment of the greater of his current base salary, from the date of termination to December 31, 2003, or his current base salary for one year.

Effective October 1, 1997, the Company entered into an employment agreement with Mr. Raisig. Under the employment agreement, Mr. Raisig receives a base salary and an annual cash performance bonus in an amount determined by the Compensation Committee. Mr. Raisig also is entitled to all benefits offered generally to the Company's employees. In January 2001, the Compensation Committee adjusted Mr. Raisig's base salary to $215,000. In April 2000, the Compensation Committee extended the term of Mr. Raisig's employment agreement to December 31, 2003. Upon termination without cause, Mr. Raisig will be entitled to a severance payment of the greater of his current base salary, from the date of termination to December 31, 2003, or his current base salary for one year.

Effective June 27, 2001, the Company entered into an employment agreement with Mr. Sydnes. Under the employment agreement, Mr. Sydnes receives a base salary and an annual cash performance bonus in an amount determined by the Compensation Committee. Mr. Sydnes also is entitled to all benefits offered generally to the Company's employees. For his services, Mr. Sydnes' annual salary for 2001 was $215,000. The agreement also includes a $100,000 relocation allowance. The term of his employment agreement shall end June 30, 2005, unless the Agreement is extended by the parties. Upon termination without cause, Mr. Sydnes will be entitled to a severance payment of the greater of his current base salary, from the date of termination to June 30, 2003, or his current base salary for one year.

Executive Loan Plans

The Company has adopted two loan plans under which Richard F. Rutkowski, Stephen Willey, Richard Raisig, and William L. Sydnes may borrow funds from the Company. Under the Executive Option Exercise Note Plan (the "Option Exercise Plan"), each executive may borrow up to two times their base salary from the Company, against full recourse promissory notes, to exercise options to purchase the Company's common stock. Under the Executive Loan Plan (the "Loan Plan"), adopted in July 2000, each executive may borrow funds from the Company on a line of credit. The combined

19

borrowings under both facilities may not exceed three times an executive's base salary. Mr. Rutkowski was granted a borrowing limit increase of an additional $500,000 during 2001. At the end of each year, the Company will forgive the interest that accrues under the loans if the executive remains employed by the Company. In 2001, the Company forgave $48,069, $31,037, $36,222, and $454 of interest for Messrs. Rutkowski, Willey, Raisig, and Sydnes, respectively. For additional details regarding loan balances and terms, see "Certain Relationships and Related Transactions" on page 24.

Certain Tax Considerations Related to Executive Compensation

As a result of Section 162(m) of the Internal Revenue Code of 1986, as amended, in the event that compensation paid by the Company to a "covered employee" (the chief executive officer and the next four highest paid employees) in a year were to exceed an aggregate of $1,000,000, the Company's deduction for such compensation could be limited to $1,000,000.

Report On Executive Compensation For 2001 By The Compensation Committee

Executive Compensation Philosophy

The Compensation Committee of the Board of Directors is comprised of three Independent Directors. The Compensation Committee is responsible for evaluating compensation levels and compensation programs for executives and for making appropriate compensation awards for executive management.

The executive compensation program of the Company is designed to attract, retain and motivate executive officers capable of leading the Company to meet its business objectives, to enhance long term shareholder value and to reward executive management based on contributions to both the short and long term success of the Company. The Compensation Committee's philosophy is for the Company to use compensation policies and programs that align the interests of executive management with those of the shareholders and to provide compensation programs that incentivize and reward both the short and long term performance of the executive officers based on the success of the Company in meeting its business objectives.

Executive Compensation Components

Base Salary. Base salaries for executive officers are set at levels believed by the Compensation Committee to be sufficient to attract and retain qualified executive officers based on the stage of development of the Company and the market practices of other companies. A change in base salary of an executive officer is based on an evaluation of the performance of the executive, prevailing market practices and of the performance of the Company as a whole. In determining base salaries, the Compensation Committee not only considers the short term performance of the Company, but also the success of the executive officers in developing and executing the Company's strategic plans, developing management employees and exercising leadership in the development of the Company.

Incentive Bonus. The Compensation Committee believes that a portion of the total cash compensation for executive officers should be based on the Company's success in meeting its short term performance objectives and contributions by the executive officers that enable the Company to meet its long term objectives, and has structured the executive compensation program to reflect this philosophy. This approach creates a direct incentive for executive officers to achieve desired short term corporate goals that also further the long term objectives of the Company, and places a significant portion of each executive officer's annual compensation at risk.

Stock Options. The Compensation Committee believes that equity participation is a key component of the Company's executive compensation program. Stock options are awarded by the Compensation Committee to executive officers primarily based on their responsibilities, past

20

performance, expected contributions to the Company's growth and development and marketplace practices. These awards are designed to retain executive officers and to motivate them to enhance shareholder value by aligning the financial interests of executive officers with those of shareholders. Stock options provide an effective incentive for management to create shareholder value over the long term because the full benefits of the option grants cannot be realized unless an appreciation in the price of the Company's common stock occurs over a number of years.

Compensation of Chief Executive Officer

Based on the executive compensation policy and components described above, the Compensation Committee recommended the salary and incentive bonus received by Richard F. Rutkowski, the President and Chief Executive Officer of the Company for services rendered in fiscal 2001. Mr. Rutkowski received a base salary of $285,000 for 2001 and also earned a bonus of $185,000 for the year. In addition, Mr. Rutkowski was granted options to purchase 242,040 shares of common stock at an exercise price of $15.00 per share. One-quarter of these options were vested and exercisable upon grant, and the remainder vest in equal installments on December 31, 2001, March 31, 2002, and June 30, 2002. Mr. Rutkowski earned the bonus based upon achieving technical successes, progress made in the staffing and organizational development of the Company, and advances in the market acceptance and commercialization of the Company's technology. The Company also forgave $48,069 in interest on $1,460,000 owed to the Company by Mr. Rutkowski under the Company's Executive Option Exercise Loan Plan and Executive Loan Plan.

Compensation Committee

Walter J. Lack, Chairman

William A. Owens

Robert Ratliffe

INFORMATION ABOUT MICROVISION COMMON STOCK OWNERSHIP

The following table shows as of February 28, 2002, the number of shares of common stock held by all persons we know to beneficially own at least 5% of the Company's common stock, the Company's directors, the executive officers named in the executive compensation table on page 16 of this Proxy Statement, and all directors and executive officers as a group.

| Name and Address of Beneficial Owner |

Number of Shares(1) |

Percentage of Common Stock(2) |

||

|---|---|---|---|---|

| WM Advisors, Inc. 1201 Third Avenue 22nd Floor Seattle, WA 98101-3000 |

955,870 | 7.4% | ||

Richard F. Rutkowski(3) c/o Microvision, Inc. 11910 North Creek Parkway Bothell, WA 98011 |

857,222 |

6.3% |

||

Stephen R. Willey(4) c/o Microvision, Inc. 19910 North Creek Parkway Bothell, WA 98011 |

547,831 |

4.1% |

||

21

Richard A. Raisig(5) c/o Microvision, Inc. 19910 North Creek Parkway Bothell, WA 98011 |

413,206 |

3.1% |

||

Walter Lack(6) c/o Engstrom, Lipscomb & Lack 10100 Santa Monica Blvd., 16th Floor Los Angeles, CA 90067 |

202,504 |

1.6% |

||

Jacqueline Brandwynne(7) c/o Brandwynne Corporation 649 Stone Canyon Road Los Angeles, CA 90077 |

112,986 |

* |

||

William L. Sydnes(8) c/o Microvision, Inc. 19910 North Creek Parkway Bothell, WA 98011 |

101,250 |

* |

||

Clarence T. Tegreene(9) c/o Microvision, Inc. 19910 North Creek Parkway Bothell, WA 98011 |

36,671 |

* |

||

Robert Ratliffe(6) c/o Eagle River 2300 Carillon Point Kirkland, WA 98033-7353 |

32,517 |

* |

||

Richard Cowell(6) c/o Microvision, Inc. 19910 North Creek Parkway Bothell, WA 98011 |

25,067 |

* |

||

Jacob Brouwer(6) c/o Brouwer Claims 1200 West Pender Street, Suite 306 Vancouver, BC, Canada V6E2S9 |

24,867 |

* |

||

William A. Owens(6) c/o Teledesic 1445 120th Avenue NE Bellevue, WA 98005 |

24,867 |

* |

||

Dennis Reimer(6) P.O. Box 889 Oklahoma City, OK 71301 |

20,167 |

* |

||

All executive officers and directors as a group (18 persons)(10) |

2,754,414 |

18.3% |

22

23

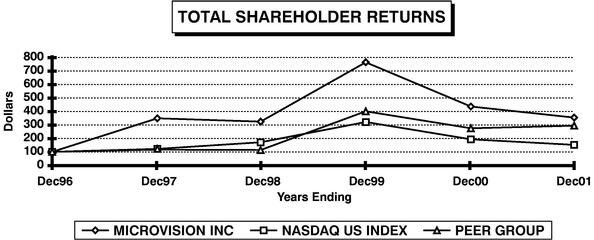

The following graph compares the cumulative total shareholder return on an initial $100 investment in the Company's common stock since December 31, 1996, to two indices: the Nasdaq Stock Market Index and an index of peer companies selected by the Company ("Peer Index"). The companies in the Peer Index are as follows: Kopin Corporation, Planar Corporation, and Three-Five Systems, Inc. The past performance of the Company's common stock is not an indication of future performance. We cannot assure you that the price of the Company's common stock will appreciate at any particular rate or at all in future years.

| |

Date |

Microvision |

Nasdaq Stock Market Index |

Company Determined Peer Index |

|||

|---|---|---|---|---|---|---|---|

| 12/31/96 | 100.00 | 100.00 | 100.00 | ||||

| 12/31/97 | 350.00 | 122.48 | 118.33 | ||||

| 12/31/98 | 325.00 | 172.68 | 114.78 | ||||

| 12/31/99 | 765.25 | 320.89 | 400.31 | ||||

| 12/31/00 | 437.50 | 193.01 | 274.70 | ||||

| 12/31/01 | 356.00 | 153.15 | 294.54 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In August 2000, the Company entered into a five year consulting agreement with Jacqueline Brandwynne, a director of the Company. In consideration for entering into the agreement, the Company issued warrants to purchase an aggregate of 100,000 shares of common stock to Ms. Brandwynne. The warrants grant Ms. Brandwynne the right to purchase up to 100,000 shares of common stock at a price of $34.00 per share. The warrants vest over three years and the unvested portion of the warrants are subject to remeasurement at each balance sheet date during the vesting period. The original value of the warrants was estimated at $2,738,000. Due to fluctuations in the Company stock price, the value at December 31, 2001 was estimated at $1,720,000.

24

The Company has adopted two executive loan plans under which Richard F. Rutkowski, Stephen R. Willey, Richard A. Raisig and William L. Sydnes may borrow funds from the Company. The following table lists certain information describing each executive's loans as of December 31, 2001.

| |

Option Exercise Plan |

Loan Plan |

Total |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mr. Rutkowski— | ||||||||||

| Balance outstanding | $ | 138,000 | $ | 1,217,000 | $ | 1,355,000 | ||||

| Highest aggregate bal. during year | $ | 218,000 | $ | 1,242,000 | $ | 1,460,000 | ||||

Mr. Willey— |

||||||||||

| Balance outstanding | $ | 183,000 | $ | 370,000 | $ | 553,000 | ||||

| Highest aggregate bal. during year | $ | 185,000 | $ | 370,000 | $ | 555,000 | ||||

Mr. Raisig— |

||||||||||

| Balance outstanding | — | $ | 645,000 | $ | 645,000 | |||||

| Highest aggregate bal. during year | — | $ | 645,000 | $ | 645,000 | |||||

Mr. Sydnes— |

||||||||||

| Balance outstanding | — | $ | 20,000 | $ | 20,000 | |||||

| Highest aggregate bal. during year | — | $ | 20,000 | $ | 20,000 | |||||

Other Information— |

||||||||||

| Interest Rate Range | 4.64%-6.21% | 5.43%-6.22% | 4.64%-6.22% | |||||||

Under the Option Exercise Plan, each note is payable in full upon the earliest of (1) December 31, 2004; (2) the sale of all of the shares acquired with the note; (3) pro rata upon the partial sale of shares acquired with the note, or (4) within 90 days of the officer's termination of employment.

Under the Loan Plan, the advances must be repaid within one year of the executive's termination of employment.

Role of the Audit Committee

The Audit Committee operates under a written charter adopted by the Board of Directors.

The Audit Committee's primary role is to assist the Board of Directors in its general oversight of the Company's financial reporting, internal controls and audit functions. The Audit Committee provides advice, counsel and direction to management and the auditors on the basis of the information it receives and discussions with management and the auditors. The Audit Committee is also responsible for overseeing the engagement and independence of the Company's independent auditors.

Among other matters, the Audit Committee monitors the activities and performance of the Company's internal and external auditors, including the audit scope, external audit fees, auditor independence matters and the extent to which the independent auditor may be retained to perform non-audit services. The Audit Committee and the Board of Directors have ultimate authority and responsibility to select, evaluate and, when appropriate, replace the Company's independent auditor. The Audit Committee also reviews the results of the internal and external audit work with regard to the adequacy and appropriateness of the Company's financial, accounting and internal controls. Management and independent auditor presentations to and discussions with the Audit Committee also cover various topics and events that may have significant financial impact or are the subject of discussions between management and the independent auditor. In addition, the Audit Committee generally oversees the Company's internal compliance programs.

25

Membership and Meetings

The Audit Committee is composed of four non-employee directors, each of whom is an "independent director" under the rules of the Nasdaq National Market governing the qualifications of audit committees. The Audit Committee held five meetings during the fiscal year ended December 31, 2001.

Review of the Company's Audited Financial Statements

The Audit Committee has reviewed and discussed the audited consolidated financial statements of the Company for the fiscal year ended December 31, 2001 with the Company's management and management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has discussed with PricewaterhouseCoopers LLP, the Company's independent auditors for the fiscal year ended December 31, 2001, the matters required to be discussed by Statement of Auditing Standards No. 61, as amended (Communication with Audit Committees). The Audit Committee also reviewed with the independent auditors their judgments as to the quality and the acceptability of the Company's accounting principles and such other matters as are required to be discussed with audit committees under generally accepted accounting standards.

The Audit Committee received from PricewaterhouseCoopers LLP the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees) and discussed with the firm its independence. Based on the review and discussions noted above, and subject to the limitations on the role and responsibilities of the Audit Committee referred to below and in the Charter of the Audit Committee, the Audit Committee recommended to the Board of Directors that the Company's audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2001 for filing with the Securities and Exchange Commission.

Limitations on Role and Responsibilities of Audit Committee and Use and Application of Audit Committee Report