SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 |

|

Microvision, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

MICROVISION, INC.

NOTICE OF 2003 ANNUAL MEETING

June 24, 2003

Dear Microvision Shareholder:

The Annual Meeting of Shareholders of Microvision, Inc. (the "Company"), will be held at the Meydenbauer Center, 11100 NE 6th Street, Bellevue, Washington on June 24, 2003, at 9:00 a.m. for the following purposes:

1. To adopt and approve the Agreement and Plan of Merger with a newly-formed, wholly owned subsidiary of the Company to effect a reincorporation of the Company from the state of Washington to the state of Delaware;

2. To elect nine directors to serve until the next annual meeting; and

3. To conduct any other business that may properly come before the meeting.

Details of the business to be conducted at the meeting are more fully described in the accompanying Proxy Statement. Please read it carefully before casting your vote.

If you were a shareholder of record on April 22, 2003, you will be entitled to vote on the above matters. A list of shareholders as of the record date will be available for shareholder inspection at the headquarters of the Company, 19910 North Creek Parkway, Bothell, Washington 98011, during ordinary business hours, from June 15, 2003 to the date of our Annual Meeting. The list also will be available for inspection at the Annual Meeting.

Whether or not you plan to attend the annual meeting, your vote is very important.

After reading the enclosed Proxy Statement, you are encouraged to vote by (1) toll-free telephone call, (2) the Internet or (3) completing, signing and dating the enclosed proxy card and returning it as soon as possible in the accompanying postage prepaid (if mailed in the U.S) return envelope. If you are voting by telephone or the Internet, please follow the instructions on the proxy card. You may revoke your proxy at any time before it is voted by following the instructions provided below.

If you need assistance voting your shares, please call

MORROW & CO., INC. at (800) 607-0088

The Board of Directors recommends a vote FOR the proposed merger and reincorporation because they and management believe that it is essential to be able to draw upon well-established principles of corporate governance in making legal and business decisions, that the established principles of Delaware corporate law provide a reliable foundation on which the Company's governance decisions can be based, that shareholders may benefit from the predictability provided by Delaware's principles of corporate governance. The Board of Directors also believes that it is important, in connection with the reincorporation, to increase the number of shares of common stock and preferred stock that the Company is authorized to issue. Please note that reincorporation in Delaware will not affect the physical location of the Company, and that the Company does not intend to move its corporate offices from Washington.

The Board of Directors also recommends a vote FOR election of nine directors.

With respect to the proposed merger and reincorporation, shareholders are or may be entitled to assert dissenters' rights pursuant to Chapter 23B.13 of the Revised Code of Washington. See the discussion of this proposal in the Proxy Statement for more information about dissenters' rights and a copy of such Chapter.

At the meeting, you will have an opportunity to ask questions about the Company and its operations. You may attend the meeting and vote your shares in person even if you return your proxy card or vote by telephone or Internet. Your proxy (including a proxy granted by telephone or the Internet) may be revoked by sending in another signed proxy card with a later date, sending a letter revoking your proxy to the Company's Secretary in Bothell, Washinton, voting again by telephone or Internet, or attending the annual meeting and voting in person.

We look forward to seeing you. Thank you for your ongoing support of and interest in Microvision, Inc.

| Sincerely, | ||

/s/ RICHARD F. RUTKOWSKI Richard F. Rutkowski Chief Executive Officer |

||

April 30, 2003 Bothell, Washington |

MICROVISION, INC.

19910 North Creek Parkway

Bothell, Washington 98011

PROXY STATEMENT FOR ANNUAL MEETING

OF SHAREHOLDERS

June 24, 2003

| INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 1 | |

DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD |

4 |

|

Proposal—Adoption and Approval of the Merger Agreement and Reincorporation |

4 |

|

Proposal—Election Of Directors |

15 |

|

Board Meetings and Committees |

18 |

|

Director Compensation |

19 |

|

Compensation Committee Interlocks And Insider Participation |

19 |

|

Section 16(a) Beneficial Ownership Reporting Compliance |

19 |

|

OTHER BUSINESS |

20 |

|

EXECUTIVE COMPENSATION AND OTHER MATTERS |

20 |

|

Executive Compensation |

22 |

|

Stock Option Grants in the Last Fiscal Year |

22 |

|

Aggregated Option Values as of Year End 2002 |

23 |

|

Employment Agreements |

24 |

|

Executive Loan Plans |

25 |

|

Certain Tax Considerations Related to Executive Compensation |

25 |

|

Report On Executive Compensation For 2002 By The Compensation Committee |

25 |

|

INFORMATION ABOUT MICROVISION COMMON STOCK OWNERSHIP |

28 |

|

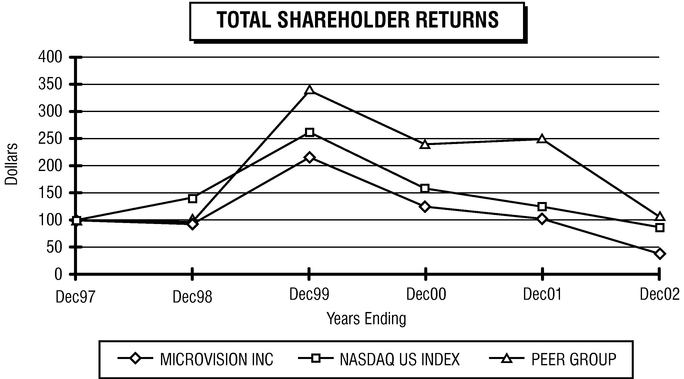

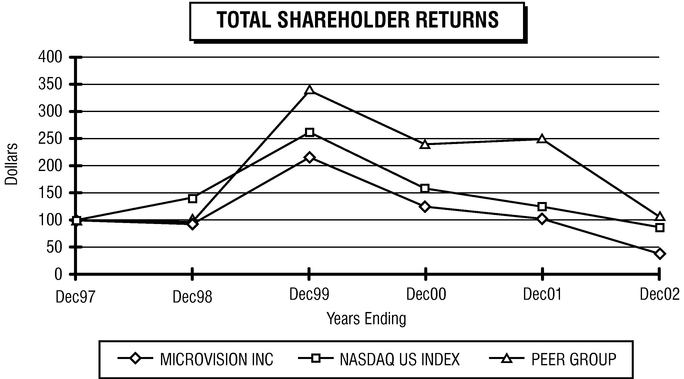

STOCK PERFORMANCE GRAPH |

30 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

31 |

|

AUDIT COMMITTEE REPORT |

31 |

|

INDEPENDENT ACCOUNTANTS |

33 |

|

INFORMATION ABOUT SHAREHOLDER PROPOSALS |

34 |

|

ADDITIONAL INFORMATION |

34 |

|

Annual Report |

34 |

|

Incorporation by Reference |

34 |

|

Voting by Telephone or The Internet |

35 |

i

Appendix A—Agreement and Plan of Merger

Appendix B—Microvision, Inc. Certificate of Incorporation

Appendix C—Microvision, Inc. Bylaws

Appendix D—WBCA Dissenters' Rights

ii

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

This Proxy Statement summarizes the information regarding the matters to be voted upon at the Annual Meeting. You do not need to attend the Annual Meeting, however, to vote your shares. You may simply complete, sign and return the enclosed proxy card or vote your shares by telephone or over the Internet in accordance with the instructions contained on the proxy card.

On April 22, 2003, our "record date" for determining shareholders entitled to vote at the Annual Meeting, there were 17,798,583 shares of common stock of the Company outstanding. If you owned shares of our common stock at the close of business on the record date, you are entitled to one vote for each share of common stock you owned as of that date. We began mailing this Proxy Statement on or about April 30, 2003 to all shareholders entitled to vote their shares at the Annual Meeting.

If any other matter is presented, your proxy will vote in accordance with his best judgment. At the time we printed this Proxy Statement, we knew of no matters that needed to be acted on at the Annual Meeting other than those discussed in this Proxy Statement.

1

2

3

DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD

Proposal—Adoption and Approval of the Merger Agreement and Reincorporation

BACKGROUND OF THE MERGER AND REINCORPORATION

The Board of Directors has approved and recommends that the shareholders approve changing the Company's state of incorporation from Washington to Delaware through the merger described below (the "Reincorporation Proposal" or the "Proposed Reincorporation"). Throughout this portion of the Proxy Statement, the term "Microvision-WA" refers to the corporation now incorporated under the laws of the state of Washington and the term "Microvision-DE" refers to Microvision, Inc., the newly-formed Delaware corporation, a wholly owned subsidiary of Microvision-WA, and proposed successor to Microvision-WA.

The Merger Agreement.

If the Reincorporation Proposal is approved, Microvision-WA will merge into Microvision-DE (the "Merger"). Upon completion of the Merger (the "Effective Time"), Microvision-WA will cease to exist and Microvision-DE will be the surviving entity and continue to operate the business of the Company under the name Microvision, Inc. Pursuant to the Agreement and Plan of Merger between Microvision-WA and Microvision-DE (the "Merger Agreement"), each outstanding share of Microvision-WA common stock, no par value, will automatically be converted into one share of Microvision-DE common stock, $.001 par value. You will not be required to exchange your existing stock certificates for new certificates. After the Merger, Microvision-DE's common stock will be traded on the Nasdaq National Market under the symbol "MVIS."

At the Effective Time, Microvision-DE will also assume and continue the outstanding stock options and all other employee benefit plans of Microvision-WA. Each outstanding and unexercised option, warrant or other right to purchase shares of Microvision-WA common stock will become an option, warrant or right to purchase the same number of shares of Microvision-DE common stock on the same terms and conditions and at the same exercise price applicable to any such Microvision-WA option, warrant or right as of the Effective Time.

The Merger Agreement and the Proposed Reincorporation have been unanimously approved by the Board of Directors. If approved by the shareholders, it is anticipated that the Effective Time of the Merger will be as soon as practicable following the Annual Meeting of Shareholders. However, pursuant to the Merger Agreement, the Merger may be abandoned or the Merger Agreement may be amended by the Board of Directors (except that certain principal terms may not be amended without further shareholder approval) either before or after shareholder approval has been obtained and prior to the Effective Time of the Proposed Reincorporation.

Certain Shareholder Rights.

Shareholders are urged to read carefully the following sections of this Proxy Statement before voting on the Reincorporation Proposal. For example, the Certificate of Incorporation and Bylaws of Microvision-DE will be materially different from the Microvision-WA governing documents.

Shareholders are or may be entitled to assert dissenters' rights under Chapter 23B.13 of the Revised Code of Washington, and this Proxy Statement is accompanied by a copy of that chapter. Shareholders of Microvision-WA meeting certain requirements may have dissenters' rights of appraisal with respect to the Reincorporation Proposal and the discussion of dissenters' rights should be read closely. See the more complete discussion under "Dissenters' Rights" below.

4

The summary set forth below is qualified in its entirety by reference to the Microvision-WA Articles of Incorporation and Bylaws, the Microvision-DE Certificate of Incorporation and Bylaws, Washington law and Delaware law. The Microvision-DE Certificate of Incorporation and Bylaws are included with this Proxy Statement as Appendix B and Appendix C.

PRINCIPAL REASONS FOR THE MERGER AND REINCORPORATION

The Board of Directors and management believe that it is essential to be able to draw upon well-established principles of corporate governance in making legal and business decisions. The Board of Directors and management believe that the established principles of Delaware corporate law provide a reliable foundation on which the Company's governance decisions can be based. The Company believes that shareholders may benefit from the predictability provided by Delaware's principles of corporate governance. The Board of Directors also believes that it is important, in connection with the Reincorporation, to increase the number of shares of common stock and preferred stock that the Company is authorized to issue.

Prominence, Predictability and Flexibility of Delaware Law.

For many years, Delaware has followed a policy of encouraging incorporation in that state and, in furtherance of that policy, has been a leader in adopting, construing and implementing comprehensive, flexible corporate laws responsive to the legal and business needs of corporations organized under its jurisdiction. Many corporations have chosen Delaware initially as a state of incorporation or have subsequently changed corporate domicile to Delaware in a manner similar to that proposed by the Company. Because of Delaware's prominence as the state of incorporation for many major corporations, both the legislature and courts in Delaware have demonstrated an ability and a willingness to act quickly and effectively to meet changing business needs. The Delaware courts have developed considerable expertise in dealing with corporate issues and a substantial body of case law has developed construing Delaware law and establishing public policies with respect to corporate legal affairs.

Balanced Officer and Director Liability.

Both Washington and Delaware law permit a corporation to include provisions in its governing documents that reduce or limit the personal monetary liability of directors and officers in certain circumstances. However, the Company believes that, for the reasons described above, Delaware law regarding a corporation's ability to limit director liability and indemnify directors and officers is more developed and provides more certainty and predictability to individuals serving as directors than Washington law. While the Company has not encountered difficulty in retaining directors and officers, the Company believes that obtaining the protections available under Delaware law will assist it in keeping and attracting well-qualified directors. Please see "Interest of the Board of Directors and Officers" below for additional discussion of limiting officer and director liability and indemnification.

The Board believes that Delaware law strikes an appropriate balance with respect to personal liability of directors and officers, and that reincorporating in Delaware will enhance the Company's ability to recruit and retain directors and officers in the future, while providing appropriate protection for shareholders from possible abuses by directors and officers. Delaware law permits a corporation to eliminate or limit the personal liability of its directors to the corporation or any of its shareholders for monetary damages for breach of fiduciary duty as a director of the corporation. However, directors' personal liability cannot be eliminated under Delaware law for bad faith conduct, conduct the person did not reasonably believe to be in, or not opposed to, the best interest of the corporation, and, with respect to criminal actions, conduct that the person had no reasonable cause to believe was lawful.

5

Increase Authorized Common Stock.

The Company has 31,250,000 shares of common stock authorized to be issued. As of April 15, 2003, approximately 17.8 million shares of common stock were issued and outstanding; approximately 9.9 million shares were reserved for issuance pursuant to outstanding options and warrants and reserved for future grants under the Company's stock option plans; and approximately 3.6 million shares of common stock remained available for issuance. After the consummation of the Proposed Reincorporation, the Company would have 100,000,000 shares of authorized common stock. While the Company does not have any specific plans to issue additional shares of capital stock, the Board of Directors believes that it is desirable to have available a substantial number of authorized but unissued shares of common stock that may be issued from time to time to support the Company's long term growth plan and to meet the full range of the Company's capital needs for the foreseeable future, to take advantage of acquisition opportunities, to provide for stock splits or stock dividends, to provide for stock options and other equity incentives due to future growth, and for other general corporate purposes. In the event the Company does issue additional shares, existing stockholders may experience dilution of their ownership in the Company.

General Effects of Proposed Reincorporation.

The Reincorporation Proposal will effect a change in the legal domicile of the Company, but not its physical location. The Proposed Reincorporation will not result in any change in the business, management, fiscal year, assets or liabilities (except to the extent of legal and other costs of effecting the reincorporation and maintaining ongoing corporate status) or location of the principal facilities of the Company.

If the Proposed Reincorporation is approved, the directors who are elected by Microvision-WA at the Annual Meeting will become the directors of Microvision-DE. The officers of Microvision-WA immediately prior to the Merger will be the officers of Microvision-DE immediately after the Merger.

All stock options, warrants or other rights to acquire common stock of Microvision-WA will automatically be converted into options, warrants or rights to purchase the same number of shares of Microvision-DE common stock at the same price per share, upon the same terms, and subject to the same conditions. Microvision-WA's other employee benefit arrangements also will be continued by Microvision-DE upon the terms and subject to the conditions currently in effect.

The charter documents of Microvision-DE, however, will differ materially from those of Microvision-WA to conform to Delaware law and to make other changes the Board deems appropriate, as described in more detail below.

Possible Disadvantages of Reincorporating.

If the Merger Agreement and the Proposed Reincorporation are adopted and approved, the Company would be subject to the Delaware Business Combination Statute which may deter certain acquisitions of the Company in transactions that are not approved by the Board of Directors. In addition, Delaware law has been criticized on the grounds that it does not afford minority shareholders all the same substantive rights and protections that are available under the laws of a number of other states (including Washington). For example, as a Delaware corporation, the Company would not be required under Delaware law to obtain shareholder approval, or to grant appraisal rights, in connection with certain kinds of mergers and corporate reorganizations which under Washington law may be subject to those requirements. Additional material differences between the Delaware law and Washington law are described in this Proxy Statement. The Board of Directors believes that the advantages of reincorporation to the Company and its shareholders outweigh its possible disadvantages.

6

THE GOVERNING DOCUMENTS OF MICROVISION-WA AND MICROVISION-DE AND RELEVANT CORPORATE LAWS

The provisions of the Certificate of Incorporation and Bylaws of Microvision-DE and the Articles of Incorporation and Bylaws of Microvision-WA differ in certain material respects. Although all of the differences are not set forth in the Proxy Statement, the following summary outlines the significant changes in the charter documents that will govern the Company in the event that the Proposed Reincorporation is approved and effected.

This summary references the two relevant corporate codes: the Washington Business Corporation Act ("WBCA" or "Washington law"), which governs Microvision-WA, and the Delaware General Corporation Law ("DGCL" or "Delaware law"), which governs Microvision-DE. The corporate laws of Washington and Delaware differ in many respects. Although all of the differences are not set forth in this Proxy Statement, certain provisions that could materially affect the rights of shareholders are summarized below.

Authorized Capital Stock.

The Articles of Incorporation of Microvision-WA (the "Microvision-WA Articles") currently authorize the Company to issue up to 31,250,000 shares of common stock, no par value, and 31,250,000 shares of Preferred Stock, no par value. None of Microvision-WA's Preferred Stock is issued or outstanding.

The Certificate of Incorporation of Microvision-DE (the "Microvision-DE Certificate") authorizes the issuance of up to 100,000,000 authorized shares of common stock, $0.001 par value, and up to 25,000,000 shares of Preferred Stock, $0.001 par value. Microvision-DE currently has 100 shares of common stock issued to Microvision-WA. None of Microvision-DE's Preferred Stock is issued or outstanding. As provided in the Microvision-WA Articles, Microvision-DE's Certificate provides that the Board of Directors is entitled to determine the powers, preferences and rights, and the qualifications, limitations or restrictions, of the authorized and unissued Preferred Stock.

Limiting Personal Liability of Directors.

Washington law provides that a corporation's articles of incorporation may include a provision that prospectively eliminates or limits, to a degree not inconsistent with law, the personal liability of a director to the corporation or its shareholders for monetary damages for conduct as a director. The provision, however, may not eliminate or limit liability of a director for acts or omissions that involve intentional misconduct by a director, a knowing violation of law by a director, for unlawful distributions, or for any transaction from which the director will personally receive a benefit in money, property or services to which the director is not legally entitled. Microvision-WA's Articles include such a provision limiting director liability.

Under Delaware law, a corporation may adopt a provision in its certificate of incorporation that prospectively eliminates or limits, with certain exceptions, the personal liability of a director to the corporation or its stockholders for monetary damages for breach of the director's fiduciary duty as a director. Under the DGCL, however, a corporation is not allowed to eliminate or limit director monetary liability for (i) breaches of the director's duty of loyalty to the corporation or its stockholders; (ii) acts or omissions not in good faith or involving intentional misconduct or a knowing violation of law; (iii) unlawful dividends, stock repurchases or redemptions; or (iv) transactions from which the director received an improper personal benefit. No such provision may eliminate or limit the liability of a director for any act or omission occurring prior to the date when such provision becomes effective. The Microvision-DE Certificate eliminates the liability of officers and directors to the fullest extent permissible under Delaware law subject to the DGCL limitations.

7

Indemnification of Directors and Officers.

Under Washington law, a corporation may indemnify a director, officer, employee or agent of the corporation against liability if the person (i) acted in good faith, (ii) reasonably believed, in the case of conduct in the individual's official capacity with the corporation, that the individual's conduct was in its best interests and, in all other cases, that the individual's conduct was at least not opposed to its best interests and (iii) in the case of any criminal proceeding, the individual had no reasonable cause to believe the individual's conduct was unlawful. Notwithstanding the foregoing, a corporation may not indemnify a director, officer, employee or agent in connection with a proceeding by or in the right of the corporation in which the individual was adjudged liable to the corporation or in connection with any other proceeding charging improper personal benefit to the individual, whether or not involving action in the individual's official capacity, in which the individual was adjudged liable on the basis that any personal benefit was improperly received by the individual.

The Microvision-WA Articles authorize the Company to indemnify its directors as determined by the Board of Directors. Microvision-WA's Bylaws generally provide that the Company shall indemnify its directors and may indemnify its officers, against expenses actually and reasonably incurred by them in connection with the defense of any action, suit or proceeding in which they are made parties by reason of being or having been a director (or, if applicable, an officer) of the corporation.

Under Delaware law, a corporation may indemnify any director, officer, employee or agent made or threatened to be made party to any threatened, pending or completed action, suit or proceeding so long as such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal proceedings, had no reasonable cause to believe that his or her conduct was unlawful. In the case of a proceeding by or in the right of the corporation (for example, a stockholder derivative suit), a corporation may indemnify an officer, director, employee or agent if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation except that, where the person is adjudged to be liable to the corporation, only the court in the proceeding may determine to what extent, despite adjudication of liability but in view of all the circumstances of the case, indemnification, if any, is proper. A director, officer, employee, or agent who is successful, on the merits or otherwise, in defense of any proceeding that is subject to the DGCL's indemnification provisions, must be indemnified by the corporation for reasonable expenses incurred therein, including attorneys' fees.

Microvision-DE's Certificate provides for the fullest indemnification by the Company allowable under the DGCL for any person involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative, because of the fact that the person is or was a director or officer of Microvision-DE or serving in such capacity, or as an employee or trustee, for another entity at the request of Microvision-DE. Such indemnification continues after the person has ceased to be a director or officer and also is for the benefit of the heirs, executors and administrators of the person. Such person is also entitled to advancements of expenses provided that the person makes an undertaking to repay such advancements in the event that a court determines that indemnification was impermissible in the matter.

Size of the Board of Directors.

Under Washington law, the number of directors is to be fixed in the articles of incorporation or bylaws but requires that there is at least one director.

Similarly, Delaware law allows the number of directors to be fixed in the manner provided in the bylaws, unless the number of directors is fixed in the certificate of incorporation. If the number is fixed in the certificate of incorporation, a change in the number of directors may be made only by amendment to the certificate of incorporation.

8

The Microvision-DE Bylaws provide that the number of directors shall be fixed from time to time by resolution of a majority of the then-authorized number of directors, but in no event shall be less than seven nor more than eleven. Thus, as is currently the case for Microvision-WA, a majority of the Board of Directors of Microvision-DE could increase the size of the Board up to the prescribed maximum number of eleven and appoint directors to fill the newly created board seats for the remainder of the term of office without further shareholder approval.

Delaware law permits the certificate of incorporation of a corporation, the initial bylaws or a bylaw adopted by the stockholders to provide that directors be divided into one, two or three classes. The term of office of one class of directors shall expire each year with the terms of office of no two classes expiring the same year. Microvision-DE has not established a classified Board of Directors.

Cumulative Voting for Directors.

Under Washington law, unless the articles of incorporation provide otherwise, shareholders are entitled to use cumulative voting in the election of directors. Microvision-WA's Articles do not permit cumulative voting.

Delaware law permits cumulative voting if provided in the certificate of incorporation. The Microvision-DE Certificate does not provide for cumulative voting rights.

Special Stockholder Meetings.

Under Washington law, a special meeting of shareholders may be called in a public company by the Board of Directors or any persons authorized to do so by the articles of incorporation or bylaws, and if the articles so provide, by a designated percentage of shareholders who are entitled to vote at such meeting. The Microvision-WA Articles provide that the Chairman of the Board of Directors, the President, a majority of the Board of Directors or the holders of at least 25% of all votes entitled to be cast on any issue proposed to be considered at such meeting may call a special meeting of stockholders.

Under Delaware law, a special meeting of stockholders may be called by the Board of Directors or by any other person authorized to do so in the certificate of incorporation or the bylaws. The Microvision-DE Certificate provides that a special meeting may be called by a majority of the Board of Directors, the Chairman of the Board, the Chief Executive Officer (or, if there is no Chief Executive Officer, the President) or as otherwise provided in the Bylaws. The Microvision-DE Bylaws provide that the holders of at least 25% of all votes entitled to be cast on any issue proposed to be considered at such meeting may also call a special meeting of stockholders.

Filling Vacancies on the Board of Directors.

The Bylaws of Microvision-WA provide, and Washington law permits, in the absence of a contrary provision in the articles of incorporation, that vacancies on the board, including a vacancy due to an increase in the number of directors, be filled by a vote of the remaining directors with the newly elected directors to serve the remainder of the term of the board seat being filled.

The Microvision-DE Bylaws provide, and Delaware law permits, that vacancies in the Board of Directors resulting from death, resignation, removal or otherwise and newly created directorships resulting from any increase in the authorized number of directors may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director.

Actions by Written Consent of Stockholders.

Under Washington law, the shareholders of a public company may act without a meeting by unanimous written consent.

9

Delaware law provides that stockholders may execute an action by written consent in lieu of a stockholder meeting where the stockholders consenting represent the votes necessary to approve such action at a meeting. The Microvision-DE Certificate provides that at any time during which a class of capital stock of the Company is registered under Section 12 of the Securities Exchange Act of 1934 or any similar successor statute, stockholders of such class of the Company may not take any action by written consent.

Amendment to the Microvision-WA Articles of Incorporation and Bylaws and the Microvision-DE Certificate of Incorporation and Bylaws.

Washington law authorizes a corporation's board of directors to make certain changes to its articles of incorporation without shareholder action. These changes include changes in corporate name, the par value of its stock, and the number of outstanding shares when effectuating a stock split or stock dividend in the corporation's own shares. Other amendments to the articles of incorporation of a Washington corporation that is public must be approved by a majority of all the votes entitled to be cast by any voting group entitled to vote on the amendment unless a higher number is specified in the Company's articles. The Microvision-WA Articles provide that they may be amended with the vote of two-thirds of the outstanding shares entitled to vote thereon.

Under Delaware law, all amendments to a corporation's certificate of incorporation require the approval of stockholders holding a majority of the voting power of the corporation outstanding and entitled to vote on a matter unless a higher proportion is specified in the certificate of incorporation. Separate voting by class is required by law in certain circumstances where the amendment would adversely affect the rights of such holders. Microvision-DE's Certificate does not require a higher or lower proportion than a majority.

Since the Microvision-DE Certificate may be amended by the vote of a majority of outstanding shares entitled to vote thereon, approval of the Proposed Reincorporation will reduce the number of shares required to amend the Certificate of Incorporation, and will potentially make it easier for the Company to effect changes to its governing documents.

Both the Microvision-WA and Microvision-DE Bylaws may be amended by the vote of two-thirds of the outstanding shares entitled to vote thereon.

Anti-takeover Protections.

Washington law prohibits a "target corporation," with certain exceptions, from engaging in certain "significant business transactions" (such as a merger, certain asset sales or issuance of additional shares) with an "acquiring person" who acquires more than 10% of the voting securities of a target corporation for a period of five years after such acquisition, unless the transaction or the initial acquisition of shares is approved by a majority of the members of the target corporation's board of directors prior to the date of the share acquisition that resulted in the acquiring person owning more than 10% of the voting securities of the target corporation.

Delaware law has a similar provision that governs Microvision-DE. Except under certain circumstances, Section 203 of the DGCL prohibits a "business combination" between the corporation and an "interested stockholder" within three years of the stockholder becoming an "interested stockholder." Generally, an "interested stockholder" is a person or group that directly or indirectly controls or has the right to acquire or control the voting or disposition of 15% or more of the outstanding voting stock of or is an affiliate or associate of the corporation and became the owner of 15% or more of such voting stock at any time within the previous three years. A "business combination" is defined broadly to include, among other things, (i) mergers and sales or other dispositions of 10% or more of the assets of a corporation with or to an interested stockholder; (ii) certain transactions resulting in the issuance or transfer to the interested stockholder of any stock

10

of the corporation or its subsidiaries; (iii) certain transactions which would result in increasing the proportionate share of the stock of a corporation or its subsidiaries owned by the interested stockholder; and (iv) receipt by the interested stockholder of the benefit (except proportionately as a stockholder) of any loans, advances, guarantees, pledges or other financial benefits.

Under Section 203 of the DGCL, a business combination between a corporation and an interested stockholder is prohibited unless (i) prior to the date the person became an interested stockholder, the board of directors approves either the business combination or the transaction which results in the person becoming an interested stockholder; (ii) upon consummation of the transaction that resulted in the person becoming an interested stockholder, that person owns at least 85% of the corporation's voting stock outstanding at the time the transaction is commenced (excluding shares owned by persons who are both directors and officers and shares owned by employee stock plans in which participants do not have the right to determine confidentially whether shares will be tendered in a tender or exchange offer); or (iii) the business combination is approved by the board of directors and authorized by the affirmative vote (at an annual or special meeting and not by written consent) of at least 662/3% of the outstanding voting stock not owned by the interested stockholder.

These restrictions placed on interested stockholders by Section 203 of the DGCL do not apply under certain circumstances, including, but not limited to, the following: (i) if the corporation's original certificate of incorporation contains a provision expressly electing not to be governed by Section 203 of the DGCL; or (ii) if the corporation, by action of its stockholders, adopts an amendment to its bylaws or certificate of incorporation expressly electing not to be governed by Section 203 of the DGCL, provided that such an amendment is approved by the affirmative vote of not less than a majority of the outstanding shares entitled to vote. Such an amendment, however, generally will not be effective until 12 months after its adoption and will not apply to any business combination with a person who became an interested stockholder at or prior to such adoption. Microvision-DE has not elected to take itself outside of the coverage of Section 203 of the DGCL.

The Company is not aware of any specific effort by any party to assume control of the Company. Both the WBCA and the DGCL include provisions affecting acquisitions and business combinations and the possibility that Section 203 of the DGCL may impede or delay the consummation of any merger or other change of control transaction is not among the principal reasons for the reincorporation.

Mergers, Acquisitions and Other Transactions.

Under Washington law, a merger, share exchange, consolidation, sale of substantially all of a corporation's assets other than in the regular course of business, or dissolution of a public corporation must be approved by the affirmative vote of a majority of directors when a quorum is present and by two-thirds of all votes of shareholders entitled to be cast by each voting group entitled to vote as a separate group, unless a higher or lower (but not less than a majority) proportion is specified in the articles of incorporation. Microvision-WA's Articles provide for a majority shareholder approval requirement.

Under Delaware law, a merger, consolidation, sale of all or substantially all of a corporation's assets other than in the regular course of business or dissolution of a corporation must be approved by a majority of the outstanding shares entitled to vote. No vote of stockholders of a constituent corporation surviving a merger is required, however (unless the corporation provides otherwise in its certificate of incorporation), if (i) the merger agreement does not amend the certificate of incorporation of the surviving corporation; (ii) each share of stock of the surviving corporation outstanding before the merger is an identical outstanding or treasury share after the merger; and (iii) the number of shares to be issued by the surviving corporation in the merger does not exceed twenty (20%) of the shares outstanding immediately prior to the merger.

11

Class Voting.

Under Washington law, a corporation's articles of incorporation may authorize one or more classes of shares that have special, conditional or limited voting rights, including the right to vote on certain matters as a group. All of Microvision-WA's outstanding shares currently are common stock and therefore always vote as a single class. Under Washington law, a corporation's articles of incorporation may not limit the rights of holders of a class to vote as a group with respect to certain amendments to the articles of incorporation and certain mergers that adversely and separately affect the rights of holders of that class.

Delaware law requires voting by separate classes only with respect to amendments to the certificate of incorporation that adversely affect the holders of those classes or that increase or decrease the aggregate number of authorized shares or the par value of the shares of those classes.

Transactions with Officers and Directors.

Washington law provides a safe harbor for enforcing transactions between a corporation and one or more of its directors. A transaction in which a director has a personal interest may not be enjoined, set aside or give rise to damages if (i) it is approved by a majority of the qualified directors on the board of directors or an authorized committee, but in either case no fewer than two qualified directors; (ii) it is approved by the affirmative vote of all qualified shares; or (iii) at the time of commitment, the transaction was fair to the corporation. For purposes of this provision, "qualified director" is one who does not have (a) a conflicting interest respecting the transaction; or (b) a familial, financial, professional or employment relationship with a non-qualified director which relationship would reasonably be expected to exert an influence on the qualified director's judgment when voting on the transaction. "Qualified shares" are defined generally as shares other than those beneficially owned, or the voting of which is controlled, by a director who has a conflicting interest respecting the transaction.

Delaware law provides that contracts or transactions between a corporation and one or more of its officers or directors or an entity in which they have an interest is not void or voidable solely because of such interest or the participation of the director or officer in a meeting of the board of directors or a committee which authorizes the contract or transaction if (i) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the board of directors or the committee, and the board of directors or committee in good faith authorizes the contract or transaction by the affirmative votes of a majority of disinterested directors, even though the disinterested directors are less than a quorum; (ii) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders; or (iii) the contract or transaction is fair as to the corporation as of the time it is authorized and approved or ratified by the board of directors, a committee thereof or the stockholders.

Removal of Directors.

Under Washington law, the shareholders may remove one or more directors with or without cause but only at a special meeting called for the purpose of removing the director. If a director is elected by holders of one or more authorized classes or series of shares, only the holders of those classes or series of shares may participate in the vote to remove the director. Where cumulative voting is permitted, if less than the entire board is to be removed, no director may be removed if the number of votes sufficient to elect the director under cumulative voting is voted against the director's removal. The Bylaws of Microvision-WA provide that any director may be removed with cause by the holders of at least two-thirds of the shares entitled to elect such director.

Under Delaware law, any director or the entire board of directors may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of

12

directors, except that, in the case of a corporation having cumulative voting, if less than the entire board is to be removed, no director may be removed without cause if the votes cast against such director's removal would be sufficient to elect such director if then cumulatively voted at an election of the entire board of directors. Additionally, in the case of a corporation that has a staggered board, no director may be removed without cause. The Microvision-DE Certificate requires the vote of two-thirds of outstanding shares entitled to vote to remove a director with or without cause.

Preemptive Rights.

Under Washington law, a shareholder possesses preemptive rights unless such rights are specifically denied in the articles of incorporation. The Microvision-WA Articles deny preemptive rights.

Under Delaware law, a stockholder does not possess preemptive rights unless such rights are specifically granted in the certificate of incorporation. The Microvision-DE Certificate does not provide for preemptive rights.

Dividend Sources.

Under Washington law, a board of directors may authorize a corporation to make distributions to its shareholders subject to any restrictions imposed by the articles of incorporation, provided that no distribution may be made if after giving it effect (i) the corporation would not be able to pay its debts as they become due in the usual course of business, or (ii) the corporation's total assets would be less than the sum of its total liabilities plus (unless the articles of incorporation permit otherwise) the amount that would be needed, if the corporation were to be dissolved at the time of distribution, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the distribution. The Microvision-WA Articles do not provide additional requirements regarding the distribution of dividends.

Under Delaware law, a board of directors may authorize a corporation to make distributions to its stockholders, subject to any restrictions in its certificate of incorporation, either (i) out of surplus; or (ii) if there is no surplus, out of net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. Under Delaware law, no distribution out of net profits is permitted, however, if the corporation's capital is less than the amount of capital represented by the issued and outstanding stock of all classes having a preference upon the distribution of assets, until such deficiency has been repaired. The Microvision-DE Certificate does not provide additional requirements regarding the distribution of dividends.

Duration Of Proxies.

Under Washington law, no proxy is valid for more than eleven months unless a longer period is expressly provided in the proxy.

Generally, under Delaware law, no proxy is valid for more than three years after its date unless otherwise provided in the proxy.

Appraisal or Dissenters' Rights.

Under Washington law, a shareholder is entitled to dissent and, upon perfection of his or her appraisal right, to obtain fair value of his or her shares in the event of certain corporate actions, including certain mergers, consolidations, share exchanges, sales of substantially all of the corporation's assets and amendments to the corporation's articles of incorporation that materially and adversely affect shareholder rights. The Proposed Reincorporation may give rise to dissenter's rights for Microvision-WA shareholders. See the section below entitled "DISSENTERS' RIGHTS" for further details.

13

Under Delaware law, appraisal rights are available only in connection with certain mergers or consolidations, unless otherwise provided in the corporation's certificate of incorporation. In the event of certain mergers or consolidations, unless the certificate of incorporation otherwise provides, the DGCL does not provide appraisal rights if (i) the shares of the corporation are listed on a national securities exchange or designated as a "National Market System" security or held of record by more than 2,000 shareholders (as long as in the merger the shareholders receive shares of the surviving corporation or any other corporation whose shares are listed on a national securities exchange, designated as a National Market System security, or held of record by more than 2,000 shareholders); or (ii) the corporation is the surviving corporation and no vote of its shareholders is required for the merger under the DGCL.

TAX CONSEQUENCES

The following is a discussion of certain federal income tax considerations that may be relevant to holders of Microvision-WA common stock, who will receive Microvision-DE common stock in exchange for their Microvision-WA common stock as a result of the Proposed Reincorporation. The discussion does not address all of the federal income tax consequences of the Proposed Reincorporation that may be relevant to particular Microvision-WA shareholders, such as dealers in securities, or those Microvision-WA shareholders who acquired their shares upon the exercise of stock options, nor does it address the tax consequences to holders of options or warrants to acquire Microvision-WA common stock. Furthermore, no other federal tax considerations and no foreign, state, or local tax considerations are addressed herein. IN VIEW OF THE VARYING NATURE OF SUCH TAX CONSEQUENCES, EACH SHAREHOLDER IS URGED TO CONSULT HIS OR HER OWN TAX ADVISOR AS TO THE SPECIFIC TAX CONSEQUENCES OF THE PROPOSED REINCORPORATION, INCLUDING THE APPLICABILITY OF FEDERAL, STATE, LOCAL OR FOREIGN TAX LAWS. This discussion is based on the Internal Revenue Code of 1986, as amended (the "Code"), the applicable Treasury Regulations promulgated thereunder, judicial authority and current administrative rulings and practices in effect on the date of this Proxy Statement.

The Proposed Reincorporation is expected to qualify as a reorganization within the meaning of Section 368(a) of the Code, with the following federal income tax consequences:

(a) No gain or loss will be recognized by holders of Microvision-WA common stock upon receipt of Microvision-DE common stock pursuant to the Proposed Reincorporation;

(b) The aggregate tax basis of the Microvision-DE common stock received by each shareholder in the Proposed Reincorporation will equal the aggregate tax basis of the Microvision-WA common stock surrendered in exchange therefor;

(c) The holding period of the Microvision-DE common stock received by each shareholder of Microvision-WA will include the period during which such shareholder held the Microvision-WA common stock surrendered in exchange therefor, provided that such Microvision-WA common stock was held by the shareholder as a capital asset at the time of the Proposed Reincorporation; and

(d) No gain or loss will be recognized by Microvision-WA or Microvision-DE in connection with the Proposed Reincorporation.

The Company has not requested a ruling from the Internal Revenue Service (the "IRS") or an opinion of counsel with respect to the federal income tax consequences of the Proposed Reincorporation under the Code. The Company believes that such a ruling and opinion are unnecessary and would add unneeded cost and delay because it knows of no reason why the IRS should challenge the described income tax consequences of the Proposed Reincorporation. However, a successful IRS challenge to the reorganization status of the Proposed Reincorporation would result in material adverse tax consequences to Microvision-WA, and in a shareholder recognizing gain or loss

14

with respect to each share of Microvision-WA common stock exchanged in the Proposed Reincorporation.

DISSENTERS' RIGHTS

The Proposed Reincorporation may create dissenters' rights under Washington law. Shareholders are or may be entitled to assert dissenters' rights under Chapter 23B.13 of the Revised Code of Washington. A copy of such Chapter is included with these proxy materials. A shareholder who wishes to assert dissenters' rights must (a) deliver to the Company before the vote is taken written notice of the shareholder's intent to demand payment for the shareholder's shares if the Proposed Reincorporation is effected, and (b) not vote such shares in favor of the Proposed Reincorporation. The Company will not treat a vote against this proposal as a notice sufficient to meet such requirements. A vote for this proposal will serve as a waiver of dissenters' rights pursuant to Chapter 23B.13. Shareholders are encouraged to examine Chapter 23B.13 for more information on the nature and limitations of such dissenters' right and the manner in which a shareholder, if the shareholder so desires, must perfect such rights.

EFFECTIVE TIME OF THE REINCORPORATION

Subject to the terms and conditions of the Proposed Reincorporation, we intend to file appropriate merger documents with the Washington Secretary of State and the Delaware Secretary of State as soon as practicable after an adoption and approval of the Plan of Merger and the Proposed Reincorporation by the Company's shareholders. The reincorporation will become effective at the time specified in the merger document filed in Delaware, after the last of such filings is completed. We presently contemplate that such filings will be made on or about June 24, 2003.

INTEREST OF BOARD OF DIRECTORS AND OFFICERS

The Reincorporation Proposal may benefit the members of the Board of Directors and our officers. Since Delaware law may be more favorable to their interests as officers and directors in that it affords predictability with respect to the application of indemnification provisions and limitations on liability, the Board of Directors and officers of the Company may be viewed as having a personal interest in the approval of the Proposed Reincorporation to the potential detriment of the shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ADOPTION AND APPROVAL OF THE MERGER AGREEMENT AND THE PROPOSED REINCORPORATION.

Proposal—Election Of Directors

The Board of Directors oversees our business and affairs and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chief Executive Officer, other key executives and our principal advisers by reading the reports and other materials that we send them regularly and by participating in Board and committee meetings. Our directors hold office until their successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve.

Richard Raisig resigned from our Board of Directors in August 2002, but still serves as the Company's Chief Financial Officer and Vice President, Operations. Our Board of Directors continues to seek, from time to time, an additional board member to fill this vacancy who brings expertise in technology and commercialization and delivery. Until this vacancy is filled, our Board of Directors will consist of nine members who will be elected at the Annual Meeting to serve until their successors are

15

duly elected and qualified at the next annual meeting of shareholders, unless the director resigns or by reason of death or other cause is unable to serve in the capacity of director. Proxies cannot be voted for a greater number of persons than the number of nominees named.

If any nominee is unable to stand for election, the shares represented by all valid proxies will be voted for the election of such substitute nominee as the Board of Directors may recommend. All of the nominees are currently directors of the Company. The Company is not aware that any nominee is or will be unable to stand for election.

Proxies received from shareholders, unless directed otherwise, will be voted FOR the election of the nominees listed below. THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" ALL OF THE NOMINEES NAMED BELOW AS DIRECTORS OF THE COMPANY.

Set forth below are the name, position held and age of each of the nominees for director of the Company. The principal occupation and recent employment history of each of the nominees are described below, and the number of shares of common stock beneficially owned by each nominee as of April 15, 2003, is set forth on pages 28-29.

| Name |

Age |

Position |

||

|---|---|---|---|---|

| Richard F. Rutkowski(3) | 47 | Chief Executive Officer, Director | ||

| Stephen R. Willey | 49 | President, Director | ||

| Jacqueline Brandwynne(3) | 65 | Director | ||

| Jacob Brouwer(2)(3) | 76 | Director | ||

| Richard A. Cowell(2) | 55 | Director | ||

| Walter J. Lack(1)(2)(3) | 55 | Chairman of the Board, Director | ||

| William A. Owens(1) | 62 | Director | ||

| Robert A. Ratliffe(1) | 42 | Director | ||

| Dennis Reimer(2) | 63 | Director |

Richard F. Rutkowski has served as Chief Executive Officer of the Company since September 1995 and as a director since August 1995. Mr. Rutkowski served as the Company's President from July 1996 to August 2002. From November 1992 to May 1994, Mr. Rutkowski served as Executive Vice President of Medialink Technologies Corporation (formerly Lone Wolf Corporation), a developer of high-speed digital networking technology for multimedia applications in audio-video computing, consumer electronics and telecommunications. From February 1990 to April 1995, Mr. Rutkowski was a principal of Rutkowski, Erickson, Scott, a consulting firm. Mr. Rutkowski also serves as a director of CMT Crimble Microtest.

Stephen R. Willey has served as President of the Company since August 2002 and as a director since June 1995. Mr. Willey served as the Company's Executive Vice President from October 1995 to August 2002, and an Industrial Fellow for the University of Washington's HIT Lab from October 1993 to October 1996. From January 1994 to April 1996, Mr. Willey served as an outside consultant to the Company through The Development Group, Inc. ("DGI"), a business and technology consulting firm founded by Mr. Willey in 1985. Mr. Willey served as Division Manager CREO Products, Inc., an electro-optics equipment manufacturer, from June 1989 to December 1992. Mr. Willey serves as a director of Pro.Net Communications, Inc., AirIQ, Inc., CMT Crimble Microtest and eVenture Capital Corporation.

16

Jacqueline Brandwynne has served as a director of the Company since October 2000. Ms. Brandwynne is President and CEO of Brandwynne Corporation, a business focusing on marketing healthcare products. Ms. Brandwynne founded Brandwynne Corporation in 1981. Ms. Brandwynne also owns and manages Very Private, a specialized consumer products and media company. Ms. Brandwynne is a business strategist with over twenty-five years of experience working with companies including Citicorp, where she was the Global Business Strategist, American Cyanamid, Bristol Myers/Clairol, Revlon, National Liberty Life, Seagram & Sons and Neutrogena. She has recently been appointed to the Board of the Fantastic Corporation and serves on several not-for-profit Boards, including the California Institute of the Arts, the Los Angeles Opera, and Amici Degli Uffici in Florence, Italy.

Jacob Brouwer has served as a director of the Company since July 1996. Mr. Brouwer is the Chairman and Chief Executive Officer of Brouwer Claims Canada & Co. Ltd., an insurance adjusting company that he founded in 1986. Mr. Brouwer has served as a director for numerous companies, including the Canadian National Railway Company, Grand Trunk Railway (USA), First Interstate Bank of Washington and First Interstate Bank of Canada, The Insurance Corporation of British Columbia, Air BC, Golden Tulip Hotels Ltd., Prime Resources Group Inc. (Homestake), and Pioneer Life Assurance Company and former Chairman of the International Financial Centre of British Columbia and Northwestel Inc. Mr. Brouwer currently serves as a Director of Doman Industries Limited, a major Canadian Forest Company, The Family Insurance Company, and Great Canadian Gaming Corporation and was recently appointed as a board member of the West Vancouver Police Commission for the Province of British Columbia. He also serves on the Board of Governors of several charitable organizations such as the YMCA, Vancouver Aquarium, the Vancouver Bach Choir and the PC Canada Fund.

Colonel Richard A. Cowell, USA, (Ret.) has served as a director of the Company since August 1996. Colonel Cowell is a Principal at Booz Allen & Hamilton, Inc. where he is involved in advanced concepts development and technology transition, joint and service experimentation, and the interoperability and integration of command and control systems for Department of Defense and other agencies. Prior to joining Booz Allen & Hamilton, Inc. in March of 1996, Colonel Cowell served in the United States Army for 25 years. Immediately prior to his retirement from the Army, Colonel Cowell served as Director of the Louisiana Maneuvers Task Force reporting directly to the Chief of Staff, Army. Colonel Cowell has authored and received awards for a number of documents relating to the potential future capabilities of various services and agencies.

Walter J. Lack has served as a director of the Company since August 1995. Mr. Lack is a partner of Engstrom, Lipscomb & Lack, a Los Angeles, California law firm that he founded in 1974. Mr. Lack has acted as a special arbitrator for the Superior Court of the State of California since 1976 and for the American Arbitration Association since 1979. He is a member of the International Academy of Trial Lawyers and an Advocate of the American Board of Trial Advocates. Mr. Lack also serves as a director of HCCH Insurance Holdings, Inc., a multinational insurance company listed on The New York Stock Exchange. He is a director of SUPERGEN, Inc., a pharmaceutical company listed on NASDAQ, dedicated to the development of products for the treatment of various cancers. Mr. Lack has been involved in a number of start-up companies, both as an investor and as a director.

Admiral William A. Owens, USN, (Ret.) has served as a director of the Company since October 1998. Since August 1998, Admiral Owens has been the Vice Chairman and Co-Chief Executive Officer of Teledesic LLC, a satellite communications network company. Prior to joining Teledesic, Admiral Owens was President, Chief Operating Officer and Vice Chairman of the Board of Science Applications International Corporation ("SAIC"), a diversified high-technology research and engineering company. Prior to joining SAIC, Admiral Owens was Vice Chairman of the Joint Chiefs of Staff, the nation's second highest ranking military officer. From 1991 to 1993, Admiral Owens was deputy chief of Naval Operations for Resources, Warfare Requirements and Assessments, and from 1990 to 1991 served as commander of the U.S. Sixth Fleet. From 1988 to 1991, Admiral Owens served

17

as senior military assistant to the Secretary of Defense. In 1988 Admiral Owens was the director of the Office of Program Appraisal for the Secretary of the Navy and in 1987 he served as commander of Submarine Group Six, the Navy's largest submarine group. Admiral Owens serves on the boards of Teledesic LLC, Symantec, Inc., Cray Inc., Polycom, Inc., British American Tobacco Industries, p.l.c., Nortel Networks Corporation, Telestra Corporation Limited, ViaSat, Inc, IDT Corporation, Wireless Facilities, Inc. and Metal Storm Limited.

Robert A. Ratliffe has served as a director of the Company since July 1996. From 1996 through April 2003, Mr. Ratliffe was Vice President and principal of Eagle River, Inc., an investment company specializing in the telecommunications and technology sectors, and held various management positions for the firm's portfolio companies. From 1986 to 1996, Mr. Ratliffe served as Senior Vice President, Communications, for AT&T Wireless Services, Inc., and its predecessor, McCaw Cellular Communications, Inc., where he also served as Vice President of External Affairs and as Vice President of Acquisitions and Development. Prior to joining McCaw Cellular Communications, Inc., Mr. Ratliffe was a Vice President with Seafirst Bank.

General Dennis J. Reimer, USA, (Ret.) has served as a director of the Company since February 2000. General Reimer is the Director of the National Memorial Institute for the Prevention of Terrorism. General Reimer became the 33rd Chief of Staff, U.S. Army on June 20, 1995. Prior to that, he was the Commanding General of the United States Army, Forces Command, Fort McPherson, Georgia. During his military career he has commanded soldiers from company to Army level. General Reimer served in a variety of joint and combined assignments and has served two combat tours in Vietnam. He also served in Korea as the Chief of Staff, Combined Field Army and Assistant Chief of Staff for Operations and Training, Republic of Korea/United States Combined Forces Command. He served three other tours at the Pentagon as aide-de-camp to the Army Chief of Staff, General Creighton Abrams, as the Deputy Chief of Staff for Operations and Plans for the Army during Desert Storm, and as Army Vice Chief of Staff. General Reimer serves on the boards of DRS Technologies, Inc., Plato Learning Inc. and Mutual of America Life Insurance Company.

The Board of Directors met six times during 2002. Each director, other than Mr. Ratliffe, attended at least 75% of the aggregate meetings of the Board and meetings of the Board committees on which they served. Mr. Ratliffe attended 57% of the aggregate meetings of the Board and the Compensation Committee. The Board also approved certain actions by unanimous written consent.

The Board of Directors has an Audit Committee, a Compensation Committee and a Finance Committee. There is no standing nominating or other committee that recommends qualified candidates to the Board for election as directors. The entire Board performs these duties.

The Audit Committee reviews the Company's accounting practices, internal accounting controls, and interim and annual financial results, and oversees the engagement of the Company's independent auditors. Messrs. Cowell, Brouwer, Lack and Reimer currently serve on the Audit Committee, with Mr. Cowell serving as Chairman. The Audit Committee met six times during 2002.

The Compensation Committee makes decisions on behalf of, and recommendations to, the Board regarding salaries, incentives and other forms of compensation for directors, officers and other key employees, and administers policies relating to compensation and benefits. The Compensation Committee also serves as the Plan Administrator for our stock option plans. The Compensation Committee's Report on Executive Compensation for 2002 is set forth below beginning on page 25. Messrs. Lack, Owens, and Ratliffe currently serve as members of the Compensation Committee, with Mr. Lack serving as Chairman. The Compensation Committee met one time during 2002.

The Finance Committee makes recommendations to the Board on matters related to financing and our capitalization. Messrs. Rutkowski, Brouwer and Lack and Ms. Brandwynne are the current

18

members of the Finance Committee, with Mr. Rutkowski serving as Chairman. The Finance Committee met four times during 2002.

Pursuant to the Independent Director Stock Option Plan (the "Director Plan"), each Independent Director is granted a nonstatutory option to purchase 15,000 shares of common stock on the date on which he or she is elected or appointed to the Board of Directors. These options are fully vested and immediately exercisable upon the date of grant. Each Independent Director also receives, upon his or her initial appointment or election and upon each subsequent reelection to the Board of Directors, an option to purchase 15,000 shares that will vest in full on the earlier of (i) the day prior to the date of the Company's annual meeting of shareholders next following the date of grant, or (ii) one year from the date of grant, provided the Independent Director continues to serve as a director on the vesting date. If an Independent Director ceases to be a director for any reason other than death or disability before his or her term expires, then any outstanding unvested options issued under the Director Plan to such Independent Director will be forfeited. Options vested as of the date of termination are exercisable through the date of expiration. The exercise price is equal to the average closing price of the Company's common stock as reported on the Nasdaq National Market during the ten trading days prior to the date of grant. The options expire on the tenth anniversary of the date of grant.

In addition, each Independent Director receives the following cash compensation for his or her service as a director:

At the July 25, 2002 meeting of the Board, the directors agreed to reduce the cash compensation payable to each Independent Director by ten percent until the first meeting following the date on which the closing price of the Company's common stock on the Nasdaq was at least double the $2.99 closing price on July 25, 2002. The compensation reduction was effective until the Board meeting on December 19, 2002, following the December 6, 2002 closing price of $6.47.

Any Independent Director who is appointed to the Board would receive a pro rata portion of the annual fee based on the period remaining in the Board's current term of service. All directors are reimbursed for reasonable travel and other out-of-pocket expenses incurred in attending meetings of the Board of Directors.

Compensation Committee Interlocks And Insider Participation

Ms. Brandwynne, a director, served as a member of the Compensation Committee through April 2001. For information regarding Ms. Brandwynne's consulting relationship with the Company, see "Certain Relationships and Related Transactions" on page 31.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that our directors, executive officers and greater-than-10% shareholders file reports with the SEC relating to their initial beneficial ownership of the Company's securities and any subsequent changes. They must also provide us with copies of the reports.

Based on copies of reports furnished to us, we believe that all of these reporting persons complied with their filing requirements during 2002.

19

We know of no other matters to be voted on at the Annual Meeting. If, however, other matters are presented for a vote at the meeting, the proxy holders (the individuals designated on the proxy card) will vote your shares according to their judgment on those matters.

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive officers are appointed by our Board of Directors and hold office until their successors are elected and duly qualified. In addition to Messrs. Rutkowski and Willey, who also serve as directors of the Company, the following persons serve as executive officers of the Company:

Richard A. Raisig, age 55, has served as Chief Financial Officer and Vice President, Operations of the Company since August 1996. Mr. Raisig served as the Company's Secretary from April 1998 to May 2002 and as a director of the Company from March 1996 to August 2002. From June 1995 to August 1996, Mr. Raisig was Chief Financial Officer of Videx Equipment Corporation, a manufacturer and rebuilder of wire processing equipment for the cabling industry. From July 1992 to May 1995, Mr. Raisig was Chief Financial Officer and Senior Vice President-Finance for Killion Extruders, Inc., a manufacturer of plastic extrusion equipment. From February 1990 to July 1992, Mr. Raisig was Managing Director of Crimson Capital Company, an investment banking firm. Prior to 1990, Mr. Raisig was a Senior Vice President of Dean Witter Reynolds, Inc. Mr. Raisig is a Certified Public Accountant.

William L. Sydnes, age 58, has served as Chief Operating Officer of the Company since June 2001. Prior to joining the Company, from 1998 to 2000, Mr. Sydnes was Vice President, Product Development and Operations with SENSAR, Inc., a New Jersey-based firm that developed identification technology that verifies the identity of an individual utilizing the unique patterns of the iris of an individual's eyes. From 1994 to 1997, Mr. Sydnes was President and CEO for Sarnoff Real Time Corporation, which developed a family of scaleable massively parallel streaming servers. Mr. Sydnes was President of Commodore International Services Corporation, and served IBM for 18 years as a business unit manager for low-end systems where he helped define the base architecture for the IBM PC, XT, AT and PCjr. Mr. Sydnes holds a B.S. from Florida Atlantic University.

Clarence T. Tegreene, age 43, has served as Chief Technology Officer of the Company since October 2001. Mr. Tegreene joined the Company in 1997 and served as Intellectual Property Counsel. Prior to joining the Company, from 1992 to 1997, Mr. Tegreene was an Associate with Seed & Berry, LLP, an intellectual property law firm in the Northwest, where he specialized in patent prosecution and related IP matters. From 1989 to 1992, Mr. Tegreene was an Associate with Cravath Swaine & Moore, a New York general practice law firm, where he specialized in corporate transactional work. Mr. Tegreene holds an M.S.E.E. degree from Georgia Tech and a J.D. (Law Review) from New York University. Before pursuing a law career, he was a research and design engineer at Motorola where he designed optical and microwave systems and components. Mr. Tegreene holds four patents relating to optical technology. Mr. Tegreene is a member of the Washington State Bar and is registered to practice before the U.S. Patent and Trademark Office.

Dr. V. G. Veeraraghavan, age 52, has served as Senior Vice President, Research & Product Development of the Company since July 2001. Prior to joining the Company, from 1998 to 2001, Dr. Veeraraghavan served in senior management with Standard MEMS, a MEMS semiconductor fabrication, end-product packaging and systems integration firm. During his service with Standard MEMS, Dr. Veeraraghavan was, first, Vice President of its operations wafer foundry responsible for engineering and production of MEMS wafers and, second, was Vice President Business Development. From 1991 to 1998, Dr. Veeraraghavan served in various management positions at Lexmark International, Inc., a developer and manufacturer of novel color laser and inkjet solutions. Dr. Veeraraghavan holds an M.S. and a Doctorate in Materials Engineering from Purdue University

20

and an M.B.A. from the University of Kentucky. He also received a B.S. in Science from the University of Madras (India) and a B.S. in Metallurgy from the Indian Institute of Science.

Andrew U. Lee, age 51, has served as Vice President, Sales of the Company since 1997. Prior to joining the Company, from 1992 to 1997, Mr. Lee was Senior Director, National Systems Sales for AEI Music Network, Inc., the largest audio-visual systems integrator in the United States. From 1988 to 1991, Mr. Lee was Vice President of Sales and Marketing for ADB Industries, Inc., a manufacturer of precision mechanical assemblies for the medical, defense and aerospace industries. Mr. Lee holds a B.S. in Political Science from the University of California at Berkeley.

Todd R. McIntyre, age 41, has served as Vice President of Business Development of the Company since 1996. Mr. McIntyre's experience in emerging markets includes business development and marketing with development stage companies in a variety of technology segments including wireless telecommunications products and services, internet software products, and digital and print media. Mr. McIntyre holds an M.B.A. from Stanford University and a B.A. from Hendrix College.

Thomas E. Sanko, age 48, has served as Vice President of Marketing and Product Management at the Company since February 2001. Prior to joining the Company, from 1999 to 2001, Mr. Sanko was a consultant to Guidant Corp., a manufacturer of cardiovascular surgery products. From 1996 to 1999, Mr. Sanko was Business Manager at InControl, Inc., a manufacturer of electrophysiology products. Prior to 1996, Mr. Sanko served as Director of Marketing for Heart Technology, Inc., and earlier, for Davis and Geck. Both companies are medical device manufacturers. Mr. Sanko has an M.B.A. from the University of Michigan and a B.S. in Mechanical Engineering from the University of Pittsburgh.

Thomas M. Walker, age 38, joined the Company in May 2002 and serves as Vice President, General Counsel and Secretary. Prior to joining, Mr. Walker served as Senior Vice President, General Counsel and Secretary of Advanced Radio Telecom Corp., a publicly held technology and services company where he managed domestic and international legal affairs from April 1996 to April 2002. Prior to that, Mr. Walker advised publicly and privately held businesses while practicing in the Los Angeles offices of the law firms of Pillsbury Winthrop and Buchalter, Nemer Fields and Younger. Mr. Walker holds a B.A. from Claremont McKenna College and a J.D. from the University of Oregon.