| Sincerely, |

|

|

| Thomas M. Walker Secretary |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

MICROVISION, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

MICROVISION, INC.

NOTICE OF 2008 ANNUAL MEETING

JUNE 25, 2008

Dear Microvision Shareholder:

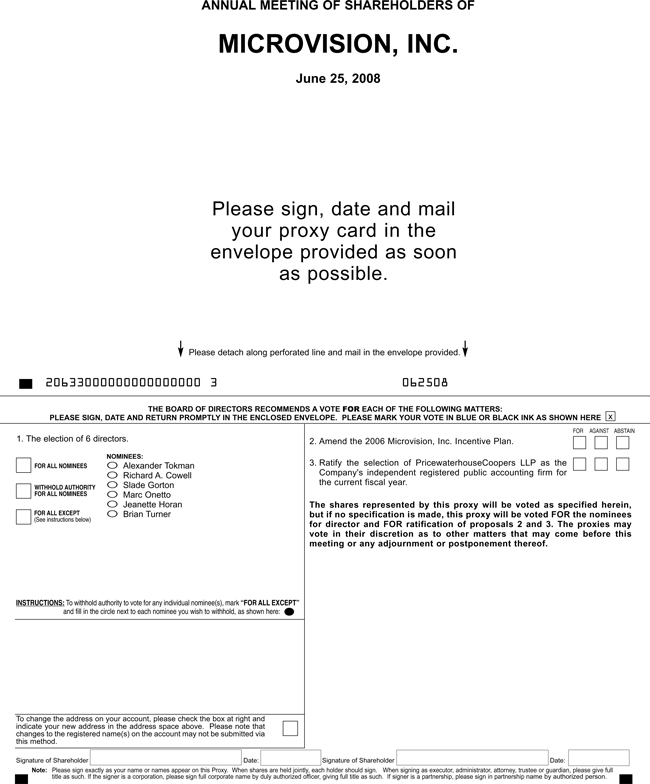

The Annual Meeting of Shareholders of Microvision, Inc. (the “Company”), will be held at the Meydenbauer Center, 11100 NE 6th Street, Bellevue, Washington 98004 on June 25, 2008 at 9:00 a.m. for the following purposes:

| 1. | To elect six directors to serve until the next annual meeting; |

| 2. | To amend the 2006 Microvision, Inc. Incentive Plan; |

| 3. | To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the current fiscal year; and |

| 4. | To conduct any other business that may properly come before the meeting and any adjournment or postponement of the meeting. |

Details of the business to be conducted at the meeting are more fully described in the accompanying Proxy Statement. Please read it carefully before casting your vote.

If you were a shareholder of record on April 28, 2008, you will be entitled to vote on the above matters. A list of shareholders as of the record date will be available for shareholder inspection at the headquarters of the Company, 6222 185th Avenue NE, Redmond, Washington 98052, during ordinary business hours, from June 15, 2008 to the date of the Annual Meeting. The list also will be available for inspection at the Annual Meeting.

Important!

Whether or not you plan to attend the Annual Meeting, your vote is very important.

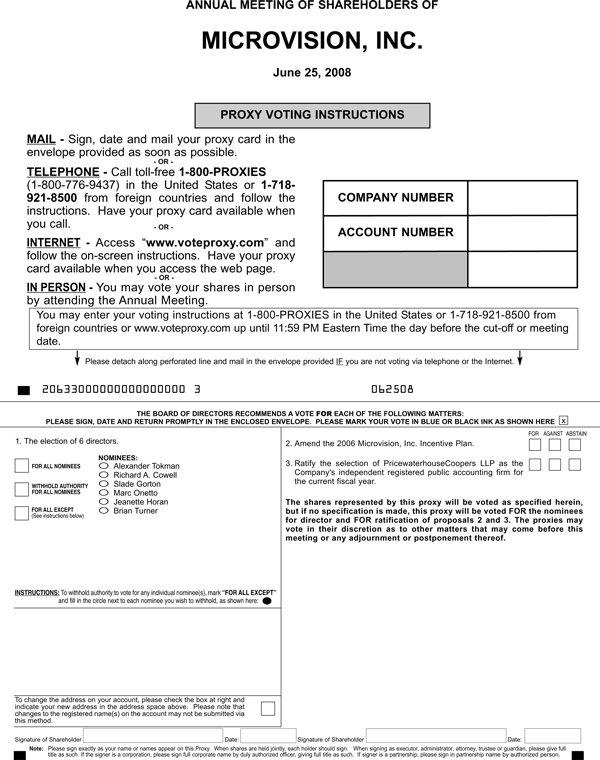

After reading the enclosed Proxy Statement, you are encouraged to vote by (1) toll-free telephone call, (2) the Internet or (3) completing, signing and dating the enclosed proxy card and returning it as soon as possible in the accompanying postage prepaid (if mailed in the U.S.) return envelope. If you are voting by telephone or the Internet, please follow the instructions on the proxy card. You may revoke your proxy at any time before it is voted by following the instructions provided below.

Important Notice Regarding the Availability of Proxy Materials for the Shareholders Meeting To Be Held on June 25, 2008. The proxy materials and the annual report to stockholders are available at

http://www.microvision.com/investors/proxy.html.

If you need assistance voting your shares, please call Investor Relations at (425) 936-6847.

The Board of Directors recommends a vote FOR the election of six nominees for directors, a vote FOR the amendment to the 2006 Microvision, Inc. Incentive Plan and a vote FOR ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm.

At the meeting, you will have an opportunity to ask questions about the Company and its operations. You may attend the meeting and vote your shares in person even if you return your proxy card or vote by telephone or the Internet. Your proxy (including a proxy granted by telephone or the Internet) may be revoked by sending in another signed proxy card with a later date, sending a letter revoking your proxy to the Company’s Secretary in Redmond, Washington, voting again by telephone or Internet, or attending the Annual Meeting and voting in person.

We look forward to seeing you. Thank you for your ongoing support of and interest in Microvision, Inc.

| Sincerely, |

|

|

| Thomas M. Walker Secretary |

April 29, 2008

Redmond, Washington

MICROVISION, INC.

6222 185th Avenue NE

Redmond, Washington 98052

PROXY STATEMENT FOR ANNUAL MEETING

OF SHAREHOLDERS

June 25, 2008

| 1 | ||

| 3 | ||

| 3 | ||

| 5 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| Proposal Two—Amendment to the 2006 Microvision, Inc. Incentive Plan |

10 | |

| Proposal Three—Ratification of the Selection of Independent Registered Public Accounting Firm |

14 | |

| 14 | ||

| 15 | ||

| 15 | ||

| 18 | ||

| 19 | ||

| 20 | ||

| 21 | ||

| 21 | ||

| 22 | ||

| 23 | ||

| 24 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 28 | ||

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| Q: | Why did you send me this Proxy Statement? |

| A: |

We sent you this Proxy Statement and the enclosed proxy card because the Board of Directors of the Company (the “Board” or the “Board of Directors”) is soliciting your proxy to vote at the 2008 Annual Meeting of Shareholders (the “Annual Meeting”). The Annual Meeting will be held at the Meydenbauer Center, 11100 NE 6th Street, Bellevue, Washington 98004 on June 25, 2008, at 9:00 a.m. |

This Proxy Statement summarizes the information regarding the matters to be voted upon at the Annual Meeting. You do not need to attend the Annual Meeting, however, to vote your shares. You may simply complete, sign, and return the enclosed proxy card or vote your shares by telephone or over the Internet in accordance with the instructions contained on the proxy card.

On April 28, 2008 there were 56,739,862 shares of common stock of the Company outstanding. If you owned shares of our common stock at the close of business on the record date, you are entitled to one vote for each share of common stock you owned as of that date. We began mailing this Proxy Statement on or about May 5, 2008 to all shareholders entitled to vote their shares at the Annual Meeting.

| Q: | How many votes do I have? |

| A: | You have one vote for each share of common stock that you owned on the record date. The proxy card will indicate the number of shares. |

| Q: | How do I vote by proxy? |

| A: | If you properly cast your vote by either executing and returning the enclosed proxy card or by voting your proxy by telephone or via the Internet, and your vote is not subsequently revoked by you, your vote will be voted in accordance with your instructions. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board as follows: |

| • | “FOR” the election of each of the nominees for director, |

| • | “FOR” the proposed amendment to the 2006 Microvision, Inc. Incentive Plan, and |

| • | “FOR” ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm. |

If any other matter is presented, your proxy will vote in accordance with his best judgment. At the time we printed this Proxy Statement, we knew of no matters that needed to be acted on at the Annual Meeting other than those discussed in this Proxy Statement.

| Q: | May my broker vote for me? |

| A: | Under the rules of the National Association of Securities Dealers, if your broker holds your shares in its “street” name, the broker may vote your shares on routine matters even if it does not receive instructions from you. At the Annual Meeting your broker may, without instructions from you, vote on Proposal 1 and Proposal 3, but not Proposal 2. |

| Q: | What are abstentions and broker non-votes? |

| A: | An abstention represents the action by a shareholder to refrain from voting “for” or “against” a proposal. “Broker non-votes” represent votes that could have been cast on a particular matter by a broker, as a shareholder of record, but that were not cast because the broker (i) lacked discretionary voting authority on the matter and did not receive voting instructions from the beneficial owner of the shares or (ii) had discretionary voting authority but nevertheless refrained from voting on the matter. |

| Q: | May I revoke my proxy? |

| A: | Yes. You may change your mind after you send in your proxy card or vote your shares by telephone or via the Internet by following these procedures. To revoke your proxy: |

| • | Send in another signed proxy card with a later date; |

1

| • | Send a letter revoking your proxy to Microvision’s Secretary at the Company’s offices in Redmond, Washington; |

| • | Vote again by telephone or Internet; or |

| • | Attend the Annual Meeting and vote in person. |

| Q: | How do I vote in person? |

| A: | If you plan to attend the Annual Meeting and vote in person, we will give you a ballot when you arrive. If your shares are held in a brokerage account or by another nominee, these proxy materials are being forwarded to you together with a voting instruction card. Follow the instructions on the voting instruction card in order to vote your shares by proxy or in person. Alternatively, you may contact the person in whose name your shares are registered and obtain a proxy from that person and bring it to the Annual Meeting. |

| Q: | What is the quorum requirement for the meeting? |

| A: | The quorum requirement for holding the meeting and transacting business is a majority of the outstanding shares entitled to be voted. The shares may be present in person or represented by proxy at the meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. |

| Q: | What vote is required to approve the election of directors? |

| A: | The six nominees for director who receive the most votes will be elected. So, if you do not vote for a nominee, or you “withhold authority to vote” for a nominee, your vote will not count either “for” or “against” the nominee. Abstentions and broker non-votes will have no effect on the outcome of voting for directors. |

| Q: | What vote is required to approve the proposed amendment to the 2006 Microvision, Inc. Incentive Plan? |

| A: | The amendment to the 2006 Microvision, Inc. Incentive Plan will be approved if the number of votes cast in favor of this proposal exceeds the number of votes cast against this proposal. Abstentions and broker non-votes will not be counted “for” or “against” the proposal and will have no effect on the outcome of the vote. |

| Q: | What vote is required to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm? |

| A: | The selection of PricewaterhouseCoopers LLP will be ratified if the number of votes cast in favor of this proposal exceeds the number of votes cast against this proposal. Abstentions and broker non-votes will not be counted “for” or “against” the proposal and will have no effect on the outcome of the vote. |

| Q: | Is voting confidential? |

| A: | We keep all the proxies and ballots private as a matter of practice. |

| Q: | What are the costs of soliciting these proxies? |

| A: | The Company will pay all the costs of soliciting these proxies. In addition to the solicitation of proxies by mail, our officers and employees also may solicit proxies by telephone, fax or other electronic means of communication, or in person. We will reimburse banks, brokers, nominees, and other fiduciaries for the expenses they incur in forwarding the proxy materials to you. |

| Q: | Who should I call if I have any questions? |

| A: | If you have any questions about the Annual Meeting, voting or your ownership of Microvision common stock, please call us at (425) 936-6847 or send an e-mail to ir@microvision.com. |

2

DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD

Proposal One—Election Of Directors

The Board of Directors of the Company oversees the Company’s business and affairs and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself in day-to-day operations of the Company. The directors keep themselves informed through discussions with the Chief Executive Officer, other key executives, and the Company’s principal advisers by reading the reports and other materials that the Company sends them regularly and by participating in Board and committee meetings. The Company’s directors hold office until their successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve. Until any vacancy is filled, the Board of Directors will consist of the members who are elected at the Annual Meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named.

If any nominee is unable to stand for election, the shares represented by all valid proxies will be voted for the election of such substitute nominee as the Board of Directors may recommend. All of the nominees are currently directors of the Company. The Company is not aware that any nominee is or will be unable to stand for election.

Proxies received from shareholders, unless directed otherwise, will be voted FOR the election of the nominees listed below.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES NAMED BELOW AS DIRECTORS OF THE COMPANY.

Set forth below are the name, position held and age of each of the nominees for director of the Company. The principal occupation and recent employment history of each nominee is described below, and the number of shares of common stock beneficially owned by each nominee as of April 28, 2008 is set forth on pages 23 and 24.

| Name |

Age | Position | ||

| Richard A. Cowell (2)(3)* |

60 | Director | ||

| Slade Gorton (1)(3)* |

80 | Director | ||

| Jeanette Horan (1)(2)* |

52 | Director | ||

| Marc Onetto (1)* |

57 | Director | ||

| Alexander Tokman |

46 | Director, President and Chief Executive Officer | ||

| Brian Turner (2)(3)* |

48 | Director |

| * | Independent Director |

| (1) | Member of the Compensation Committee |

| (2) | Member of the Audit Committee |

| (3) | Member of the Nominating and Corporate Governance Committee |

Colonel Richard A. Cowell, USA, (Ret.) has served as a director of the Company since August 1996. Colonel Cowell is a Principal at Booz Allen Hamilton, Inc. where he is involved in advanced concepts development and technology transition, joint and service experimentation, and the interoperability and integration of command and control systems for Department of Defense and other agencies. Prior to joining Booz Allen Hamilton, Inc. in March of 1996, Colonel Cowell served in the United States Army for 25 years. Immediately prior to his retirement from the Army, Colonel Cowell served as Director of the Louisiana Maneuvers Task Force reporting directly to the Chief of Staff, Army. Colonel Cowell has authored a number of articles relating to the potential future capabilities of various services and agencies.

3

Slade Gorton joined the Company as a director in September 2003. Mr. Gorton is currently Of Counsel at the law firm of Kirkpatrick & Lockhart Preston Gates Ellis LLP. Prior to joining the firm, he represented Washington State in the United States Senate for 18 years. Mr. Gorton began his political career in 1958 as a Washington State Representative and went on to serve as State House Majority Leader. In 1968 he was elected Attorney General of Washington State where he served until 1980. Mr. Gorton also served on the President’s Consumer Advisory Council (1975-77), the Washington State Criminal Justice Training Commission (1969-1981), the National Commission on Federal Election Reform (2001), and was chairman of the Washington State Law & Justice Commission (1969-76). Mr. Gorton also served in the U.S. Army, U.S. Air Force, and the U.S. Air Force Reserves. Mr. Gorton was a Commissioner on the National Commission on Terrorist Attacks upon the United States (“9-11 Commission”). Mr. Gorton is currently a member of the National Commission on War Powers and is co-Chairman of the National Transportation Policy Project. Mr. Gorton is a director of Vigilos, Inc. and on the advisory board of Intermedia Partners VIII, L.P.

Jeanette Horan joined the Company as a director in June 2006. Ms Horan is currently Vice President, Enterprise Business Transformation for IBM where she leads IBM’s transformation to a globally integrated enterprise. Prior to her current position, she was Vice President, Business Process and Architecture Integration from July 2006 to April 2007 where she led IBM’s internal business process transformation and information technology portfolio. Prior to this, Ms. Horan was Vice President, Information Management from January 2004 to July 2006 and Vice President Strategy, IBM Software Group from January 2003 to January 2004, where she was responsible for strategic alliances with key platform partners and led strategic and operational planning processes. From May 1998 to December 2002, Ms. Horan was also Vice President, Development for the Lotus brand and led worldwide product management, development and technical support.

Marc Onetto joined the Company as a director in March 2006. Mr. Onetto is currently Senior Vice President, Worldwide Operations for Amazon.com, Inc. Prior to his current position, Mr. Onetto was Executive Vice President of Worldwide Operations for Solectron, a $10 billion global provider of electronics manufacturing and integrated supply-chain services to OEMs, from June 2003 to June 2006. He joined Solectron after a 15 year career with General Electric where he most recently was Vice President of GE Corporate’s European operations. From 1992 to 2002, Mr. Onetto held several senior leadership positions at GE Medical Systems as head of its global supply chain and operations, global quality, and global process engineering. He was one of GE’s Six Sigma pioneers and spearheaded the quality culture transformation across GE Medical Systems. Prior to GE, Mr. Onetto served 12 years with Exxon Corporation in supply operations, information systems and finance.

Alexander Tokman has served as President, Chief Executive Officer and a director of the Company since January 2006. Mr. Tokman served as Microvision’s President and Chief Operating Officer from July 2005 to January 2006. From April 1995 to July 2005, Mr. Tokman served in various cross functional and cross-business leadership positions at GE Healthcare, a subsidiary of General Electric, most recently as a General Manager of its Global Molecular Imaging and Radiopharmacy unit from May 2003 to June 2005. From November 1989 to March 1995, Mr. Tokman served as technical programs lead and a head of I&RD at Tracor Applied Sciences a subsidiary of then Tracor, Inc. Mr. Tokman has both a M.S. and B.S. in Electrical Engineering from the University of Massachusetts, Dartmouth. He also is a certified Six Sigma and DFSS Black Belt and Master Black Belt.

Brian Turner has served as a director of the Company since July 2006. Mr. Turner has been Chief Financial Officer of Coinstar Inc. since 2003. Prior to his current position, from 2001 to 2003, he served as Senior Vice President of Operations, Chief Financial Officer and Treasurer of Real Networks, Inc., a digital media and technology company. Prior to Real Networks, from 1999 to 2001, Mr. Turner was employed by BSquare Corp., a software company, where he initially served as Senior Vice President of Operations, Chief Financial Officer and Secretary, before being promoted to President and Chief Operating Officer. From 1995 to 1999, Mr. Turner was Chief Financial Officer and Vice President of Administration of Radisys Corp., an embedded software company. Mr. Turner’s experience also includes 13 years at PricewaterhouseCoopers LLP where he held several positions including Director, Corporate Finance.

4

The Board of Directors met eight times during 2007. All directors attended at least 75% of the aggregate meetings of the Board and meetings of the Board committees on which they served. The Board also approved certain actions by unanimous written consent. The Company has adopted a policy that each of the Company’s Directors be requested to attend the Company’s Annual Meeting each year. All directors attended the Company’s Annual Meeting in 2007.

Independence Determination

No director will be deemed to be independent unless the Board affirmatively determines that the director has no material relationship with the Company, directly or as an officer, share owner, or partner of an organization that has a relationship with the Company. The Board observes all criteria for independence set forth in the Nasdaq listing standards and other governing laws and regulations.

In its annual review of director independence, the Board considers all commercial, banking, consulting, legal, accounting, charitable, or other business relationships any director may have with the Company. As a result of its annual review, the Board has determined that all of the directors, with the exception of Alexander Tokman, are independent (the “Independent Directors”). The Independent Directors are identified by an asterisk on the table above.

The Nasdaq listing standards have both objective tests and a subjective test for determining who is an “independent director.” The objective tests state, for example, that a director is not considered independent if he or she is an employee of the Company or is a partner in or executive officer of an entity to which the Company made, or from which the Company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year. The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. None of the non-employee directors were disqualified from “independent” status under the objective tests. In assessing independence under the subjective test, the Board took into account the standards in the objective tests, and reviewed and discussed additional information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and the Company’s management. Based on all of the foregoing, as required by Nasdaq rules, the Board made a subjective determination as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Board has not established categorical standards or guidelines to make these subjective determinations, but considers all relevant facts and circumstances.

In addition to the Board-level standards for director independence, the directors who serve on the Audit Committee each satisfy standards established by the Securities and Exchange Commission (the “SEC”) providing that to qualify as “independent” for the purposes of membership on that Committee, members of audit committees may not accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company other than their director compensation.

Committees

The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The Board of Directors has adopted a written charter for each of these Committees. The full text of each charter is available on the Company’s website located at www.microvision.com.

The Audit Committee

The Board of Directors has an Audit Committee which assists the Board of Directors by monitoring and overseeing: (1) the accounting and financial reporting processes of the Company and the audits of the financial

5

statements of the Company, (2) the integrity of the financial statements of the Company, (3) compliance by the Company with legal and regulatory requirements, and (4) the performance of the Company’s internal finance and accounting personnel and its independent auditors. The Audit Committee conducts discussions related to the Company’s earnings announcements and periodic filings, as well as numerous other informal meetings and communications among the Chair, various Audit Committee members, the independent auditors and/or members of the Company’s management. Messrs. Cowell and Turner and Ms. Horan currently serve on the Audit Committee, with Mr. Cowell serving as Chairman. The Audit Committee met five times during 2007.

Among other matters, the Audit Committee monitors the activities and performance of the Company’s external auditors, including the audit scope, external audit fees, auditor independence matters and the extent to which the independent auditor may be retained to perform non-audit services. The Audit Committee and the Board of Directors have ultimate authority and responsibility to select, evaluate and, when appropriate, replace the Company’s independent auditor. The Audit Committee also reviews the results of the external audit work with regard to the adequacy and appropriateness of the Company’s financial, accounting and internal controls. Management and independent auditor presentations to and discussions with the Audit Committee also cover various topics and events that may have significant financial impact or are the subject of discussions between management and the independent auditor. In addition, the Audit Committee generally oversees the Company’s internal financial controls and financial disclosure procedures. Additional information relating to the Audit Committee appears below under the heading “Audit Committee Report” beginning on page 25.

The “audit committee financial experts” designated by the Board are Col. Richard A. Cowell (Ret.) and Brian Turner, each an independent director. Col. Cowell holds a degree in accounting and has served for seven years as Chair of the Company’s Audit Committee. During his twenty-five years of service in the United States Army, Col. Cowell oversaw and actively supervised various complex governmental projects that involved government accounting with a breadth and level of complexity comparable to accounting issues raised by the Company’s financial statements, including issues relating to estimates, accruals, and reserves. Since retiring from the Army, Col. Cowell has served as a Principal at Booz Allen Hamilton, where he provides consulting services relating to significant government projects and grants which involve significant and complex accounting issues. Mr. Turner has seven years experience as a chief financial officer of three public companies and has thirteen years of experience in various roles at PricewaterhouseCoopers LLP, including Director, Corporate Finance. Mr. Turner has been actively involved in and has supervised the preparation of financial statements that present a breadth and complexity of issues comparable to accounting issues raised by the Company’s financial statements.

The Compensation Committee

The Compensation Committee makes decisions on behalf of, and recommendations to, the Board regarding salaries, incentives and other forms of compensation for directors, officers, and other key employees, and administers policies relating to compensation and benefits. The Compensation Committee also serves as the Plan Administrator for the Company’s stock option plans. The Compensation Committee Report is set forth below on page 18. Messrs. Gorton and Onetto and Ms. Horan currently serve as members of the Compensation Committee, with Mr. Onetto serving as chairman. The Compensation Committee met three times during 2007.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee: (1) counsels the Board of Directors with respect to Board and Committee structure and membership, and (2) reviews and develops the Company’s corporate governance guidelines. In fulfilling its duties, the Nominating and Corporate Governance Committee, among other things, will:

| • | establish criteria for nomination to the Board and its committees, taking into account the composition of the Board as a whole; |

| • | identify, review, and recommend director candidates for the Board; |

6

| • | recommend directors for election at the annual meeting of shareholders and to fill new or vacant positions; |

| • | establish policies with respect to the process by which shareholders of the Company may recommend candidates to the Nominating and Corporate Governance Committee for consideration for nomination as a director; |

| • | assess and monitor, with Board involvement, the performance of the Board; and |

| • | recommend Directors for membership on Board Committees. |

Messrs. Cowell, Gorton and Turner currently serve as members of the Nominating and Corporate Governance Committee, with Mr. Gorton serving as Chairman. The Nominating and Corporate Governance Committee met one time during 2007.

The Nominating and Corporate Governance Committee will consider recommendations for directorships submitted by shareholders, or groups of shareholders, that have beneficially owned at least 5% of the Company’s outstanding shares of common stock for at least one year prior to the date the nominating shareholder submits a candidate for nomination as a director. A nominating shareholder or group of nominating shareholders may submit only one candidate for consideration. Shareholders who wish the Nominating and Corporate Governance Committee to consider their recommendations for nominees for the position of director should submit their request in writing no later than the 120th calendar day before the anniversary of the date the prior year’s annual meeting proxy statement was released to shareholders. Such written requests should be submitted to the Nominating and Corporate Governance Committee care of the Corporate Secretary, Microvision, Inc., 6222 185th Avenue NE, Redmond, Washington 98052, and must contain the following information:

| • | The name, address, and number of shares of common stock beneficially owned by the nominating shareholder and each participant in a nominating shareholder group (including the name and address of all beneficial owners of more than 5% of the equity interests of an nominating shareholder or participant in a nominating shareholder group); |

| • | A representation that the nominating shareholder, or nominating shareholder group, has been the beneficial owner of more than 5% of the Company’s outstanding shares of common stock for at least one year and will continue to beneficially own at least 5% of the Company’s outstanding shares of common stock through the date of the annual meeting; |

| • | A description of all relationships, arrangements, or understandings between or among the nominating shareholder (or any participant in a nominating shareholder group) and the candidate or any other person or entity regarding the candidate, including the name of such person or entity; |

| • | All information regarding the candidate that the Company would be required to disclose in a proxy statement filed pursuant to the rules and regulations of the SEC with respect to a meeting at which the candidate would stand for election; |

| • | Confirmation that the candidate is independent, with respect to the Company, under the independence requirements established by the Company, the SEC, and Nasdaq listing requirements, or, if the candidate is not independent with respect to the Company under all such criteria, a description of the reasons why the candidate is not independent; |

| • | The consent of the candidate to be named as a nominee and to serve as a member of the Board if nominated and elected; |

| • | A representation signed by the candidate that if elected he or she will: (1) represent all shareholders of the Company in accordance with applicable laws, and the Company’s certificate of incorporation, by-laws, and other policies; (2) comply with all rules, policies, or requirements generally applicable to non-employee directors; and (3) upon request, complete and sign customary Directors and Officers Questionnaires. |

7

In its assessment of each potential candidate, the Nominating and Corporate Governance Committee will review the nominee’s judgment, experience, independence, understanding of the Company’s or other related industries and such other factors the Nominating and Corporate Governance Committee determines are pertinent in light of the current needs of the Board. The Nominating and Corporate Governance Committee will also take into account the ability of a director to devote the time and effort necessary to fulfill his or her responsibilities.

Nominees may be suggested by directors, members of management, and, as described above, by shareholders. In identifying and considering candidates for nomination to the Board, the Nominating and Corporate Governance Committee considers, in addition to the requirements set out in the Nominating and Corporate Governance Committee charter, quality of experience, the needs of the Company and the range of talent and experience represented on the Board.

Shareholder Communication with the Board of Directors

The Company has adopted written procedures establishing a process by which shareholders of the Company can communicate with the Board of Directors regarding various topics related to the Company. A shareholder desiring to communicate with the Board, or any individual director, should send his or her written message to the Board of Directors (or the applicable director or directors) care of the Corporate Secretary, Microvision, Inc., 6222 185th Avenue NE, Redmond, Washington 98052. Each submission will be forwarded, without editing or alteration, by the Secretary to the Board, or the applicable director or directors, on or prior to the next scheduled meeting of the Board. The Board will determine the method by which such submission will be reviewed and considered. The Board may also request the submitting shareholder to furnish additional information it may reasonably require or deem necessary to sufficiently review and consider the submission of such shareholder.

Director Compensation for 2007

The following table provides information concerning the Company’s non-employee directors during 2007. Alexander Tokman was not paid additional compensation for his service as director and his compensation is fully reflected in the other tables contained in this proxy statement.

| Name |

Fees Earned Or Paid in Cash ($)(1) |

Option Awards ($) (2)(3) |

Total ($) | |||

| Richard A. Cowell |

63,223 | 36,886 | 90,942 | |||

| Slade Gorton |

60,223 | 36,886 | 87,942 | |||

| Jeanette Horan |

58,223 | 36,886 | 85,942 | |||

| Marc Onetto |

54,223 | 36,886 | 81,942 | |||

| Brian Turner |

58,223 | 36,886 | 85,942 |

| (1) | Excludes annual retainer fees of $7,777 that were earned and reported in 2006 but paid in 2007 for each of Mr. Cowell, Mr. Gorton, Ms. Horan, Mr. Onetto and Mr. Turner. |

| (2) | Reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007, calculated in accordance with Statement of Financial Accounting Standards (FAS) No. 123(R), and includes amounts from awards granted prior to 2007. In accordance with SEC rules, these amounts exclude estimates of forfeitures. The underlying valuation assumptions are disclosed in footnote 13 to the Company’s audited financial statements filed with its Annual Report on Form 10-K for fiscal 2007. |

8

| (3) | The following table shows the number of outstanding shares underlying option awards for each of the Company’s non-employee directors as of December 31, 2007: |

| Outstanding Option Awards | ||

| Richard A. Cowell |

123,867 | |

| Slade Gorton |

90,000 | |

| Jeanette Horan |

60,000 | |

| Marc Onetto |

60,000 | |

| Brian Turner |

60,000 |

Pursuant to the Independent Director Stock Option Plan (the “Director Plan”), each Independent Director is granted a nonstatutory option to purchase 15,000 shares of common stock on the date on which he or she is first elected or appointed to the Board of Directors. These options are fully vested and immediately exercisable upon the date of grant. Each Independent Director also receives, upon his or her initial appointment or election and upon each subsequent reelection to the Board of Directors, an option to purchase 15,000 shares that will vest in full on the earlier of (i) the day prior to the date of the Company’s annual meeting of shareholders next following the date of grant, or (ii) one year from the date of grant, provided the Independent Director continues to serve as a director on the vesting date. If an Independent Director ceases to be a director for any reason other than death or disability before his or her term expires, then any outstanding unvested options issued under the Director Plan to such Independent Director will be forfeited. Options vested as of the date of termination for any reason other than death or disability are exercisable through the date of expiration. The exercise price for each option is equal to the closing price of the Company’s common stock as reported on the Nasdaq Global Market on the date of grant. The options generally expire on the tenth anniversary of the date of grant.

In addition, each Independent Director receives the following cash compensation for his or her service as a director:

| • | A fee of $20,000 that accrues as of the date of appointment or election to the Board of Directors, and as of the date of each subsequent reelection; |

| • | A fee of $3,000 for the Board chair or $2,000 per director for each Board meeting attended by the director; and |

| • | A fee of $3,000 for the committee chair or $2,000 per committee member for each committee meeting attended by the director that is held on a day other than a day on which a Board meeting is held. |

All directors are reimbursed for reasonable travel and other out-of-pocket expenses incurred in attending meetings of the Board of Directors.

Compensation Committee Interlocks And Insider Participation

All members of the Compensation Committee during 2007 were independent directors, and none of them were the Company’s employees or former employees. During 2007, none of our executive officers served on the compensation committee (or equivalent), or the board of directors, of another entity whose executive officer(s) served on the Company’s Compensation Committee or Board of Directors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s directors, executive officers, and greater-than 10% shareholders file reports with the SEC relating to their initial beneficial ownership of the Company’s securities and any subsequent changes. They must also provide the Company with copies of the reports.

9

Based solely on a review of the copies of such forms in the Company’s possession, and on written representations from reporting persons, the Company believes that all of these reporting persons complied with their filing requirements during 2007, except that Mr. Wilson, an executive officer of the Company, belatedly filed one Statement of Changes of Beneficial Ownership of Securities on Form 4, reporting five transactions.

The Company has adopted a code of ethics applicable to the Company’s principal executive officer, principal financial officer, and principal accounting officer, known as the Code of Ethics for Microvision Executives. The Company has also adopted a code of conduct applicable to the Company’s directors, officers, and employees, known as the Code of Conduct. The Code of Ethics for Microvision Executives and the Code of Conduct are available on the Company’s website. In the event the Company amends or waives any of the provisions of the Code of Ethics for Microvision Executives applicable to its principal executive officer, principal financial officer, and principal accounting officer, it intends to disclose the same on the Company’s website at www.microvision.com.

Proposal Two—Amendment to the 2006 Microvision, Inc. Incentive Plan

The Board of Directors has authorized an amendment to the 2006 Microvision, Inc. Incentive Plan (the “Incentive Plan”), subject to shareholder approval. The amendment will alter the Incentive Plan in two ways: (i) increase the number of shares of common stock reserved for issuance upon exercise of options granted under the Incentive Plan by 3,400,000 to a total of 11,400,000 shares and (ii) allow non-employee directors to participate in the Incentive Plan. The purpose of the Incentive Plan is to advance the interests of the Company by providing for the grant to participants of stock-based and other incentive awards, all as more fully described below. Under the Company’s Independent Director Stock Option Plan (the “Director Plan”), each non-employee director is granted, upon his or her initial appointment or election and upon each subsequent reelection to the Board of Directors, an option to purchase 15,000 shares that will vest in full on the earlier of (i) the day prior to the date of the Company’s annual meeting of shareholders next following the date of grant, or (ii) one year from the date of grant, provided the non-employee director continues to serve as a director on the vesting date. We intend to make such grants at this annual meeting as provided in the Director Plan. We would then only have 25,000 shares available for future grant under the Director Plan. We do not intend to issue options with respect to any of the remaining shares under the Director Plan. Making non-employee directors eligible to participate in the Incentive Plan will provide the Company with increased flexibility for providing incentive for the non-employee directors through grants of stock-based and other incentive awards available under the Incentive Plan.

On April 28, 2008, the last reported sale price of the Company’s common stock on the Nasdaq Global Market was $3.04 per share.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE FOREGOING AMENDMENT TO THE 2006 MICROVISION, INC. INCENTIVE PLAN.

Summary of the Incentive Plan

The Incentive Plan amended, restated and renamed our 1996 Stock Option Plan. The Incentive Plan was originally adopted by the Board in April 2006 and approved by the shareholders in September 2006. The Incentive Plan will terminate on the tenth anniversary of the date of approval by the shareholders, unless earlier terminated by the Board. A maximum of 8,000,000 shares of common stock may be delivered in satisfaction of awards made under the Incentive Plan. The maximum number of shares of common stock for which stock options may be granted to any person in any calendar year and the maximum number of shares of common stock subject to stock appreciation rights, or “SARs,” granted to any person in any calendar year will each be 2,000,000. The maximum benefit that will be paid to any person under other awards in any calendar year will be,

10

to the extent paid in shares, 2,000,000 shares, and, to the extent paid in cash, $3,000,000. In the event of a stock dividend, stock split or other change in our capital structure, the Administrator will make appropriate adjustments to the limits described above and will also make appropriate adjustments to the number and kind of shares of stock or securities subject to awards, any exercise prices relating to awards and any other provisions of awards affected by the change. The Administrator may also make similar adjustments to take into account other distributions to stockholders or any other event, if the Administrator determines that adjustments are appropriate to avoid distortion in the operation of the Incentive Plan and to preserve the value of awards.

Administration. The Board of Directors administer the Incentive Plan. The term “Administrator” is used in this proxy statement to refer to the person (the Board and their delegates) charged with administering the Incentive Plan. The Administrator has full authority to determine who will receive awards and to determine the types of awards to be granted as well as the amounts, terms, and conditions of any awards. Awards may be in the form of options, SARs, restricted or unrestricted stock, deferred stock, other stock-based awards, or cash awards, and any such award may be a performance-based award. The Administrator has the right to determine any questions that may arise regarding the interpretation and application of the provisions of the Incentive Plan and to make, administer, and interpret such rules and regulations as it deems necessary or advisable. Determinations of the Administrator made under the Incentive Plan are conclusive and bind all parties.

Eligibility. Participation is limited to those employees, as well as consultants and advisors, who are selected by the Administrator to receive an award. Upon shareholder approval of the amendment to the Incentive Plan non-employee directors will be eligible to participate in the Incentive Plan. The group of persons from which the Administrator will select participants currently consists of approximately 158 individuals.

Stock Options. The Administrator may, from time to time, award options to any participant subject to the limitations described above. Stock options give the holder the right to purchase shares of common stock of the Company within a specified period of time at a specified price. Two types of stock options may be granted under the Incentive Plan: incentive stock options, or “ISOs”, which are subject to special tax treatment as described below, and nonstatutory options, or “NSOs.” Eligibility for ISOs is limited to employees of the Company and its subsidiaries.

The exercise price of an ISO cannot be less than the fair market value of the common stock at the time of grant. In addition, the expiration date of an ISO cannot be more than ten years after the date of the original grant. In the case of NSOs, the exercise price and the expiration date are determined in the discretion of the Administrator. The Administrator also determines all other terms and conditions related to the exercise of an option, including the consideration to be paid, if any, for the grant of the option, the time at which options may be exercised and conditions related to the exercise of options.

Stock Appreciation Rights. The Administrator may grant SARs under the Incentive Plan. An SAR entitles the holder upon exercise to receive an amount in cash or common stock or a combination thereof (as determined by the Administrator) computed by reference to appreciation in the value of a share of common stock above a base amount which may not be less than fair market value on the date of grant.

Stock Awards; Deferred Stock. The Incentive Plan provides for awards of nontransferable shares of restricted common stock, as well as unrestricted shares of common stock. Awards of restricted stock and unrestricted stock may be made in exchange for past services or other lawful consideration. Generally, awards of restricted stock are subject to the requirement that the shares be forfeited or resold to the Company unless specified conditions are met. Subject to these restrictions, conditions and forfeiture provisions, any recipient of an award of restricted stock will have all the rights of a stockholder of the Company, including the right to vote the shares and to receive dividends. Other awards under the Incentive Plan may also be settled with restricted stock. The Incentive Plan also provides for deferred grants (“deferred stock”) entitling the recipient to receive shares of common stock in the future on such conditions as the Administrator may specify. Any stock award or award of deferred stock resulting in a deferral of compensation subject to Section 409A of the Code will be construed to the maximum extent possible consistent with the requirements of Section 409A of the Code.

11

Performance Awards. The Administrator may also make awards subject to the satisfaction of specified performance criteria. Performance awards may consist of common stock or cash or a combination of the two. The performance criteria used in connection with a particular performance award will be determined by the Administrator. In the case of performance awards intended to qualify for exemption under Section 162(m) of the Internal Revenue Code, the Administrator will use objectively determinable measures of performance in accordance with Section 162(m) that are based on any or any combination of the following (determined either on a consolidated basis or, as the context permits, on a divisional, subsidiary, line of business, project or geographical basis or in combinations thereof): sales; revenues; assets; expenses; earnings before or after deduction for all or any portion of interest, taxes, depreciation, or amortization, whether or not on a continuing operations or an aggregate or per share basis; return on equity, investment, capital or assets; one or more operating ratios; borrowing levels, leverage ratios or credit rating; market share; capital expenditures; cash flow; stock price; stockholder return; sales of particular products or services; customer acquisition or retention; acquisitions and divestitures (in whole or in part); joint ventures and strategic alliances; spin-offs, split-ups and the like; reorganizations; or recapitalizations, restructurings, financings (issuances of debt or equity) or refinancings. The Administrator will determine whether the performance targets or goals that have been chosen for a particular performance award have been met.

General Provisions Applicable to All Awards. Neither ISOs nor, except as the Administrator otherwise expressly provides, other awards may be transferred other than by will or by the laws of descent and distribution. During a recipient’s lifetime an ISO and, except as the Administrator may provide, other non-transferable awards requiring exercise may be exercised only by the recipient. Shares delivered under the Incentive Plan may consist of either authorized but unissued or treasury shares. The number of shares delivered upon exercise of a stock option is determined net of any shares transferred by the optionee to the Company (including through the holding back of shares that would otherwise have been deliverable upon exercise) in payment of the exercise price or tax withholding.

Mergers and Similar Transactions. In the event of a consolidation or merger in which the Company is not the surviving corporation or which results in the acquisition of substantially all of the Company’s stock by a person or entity or by a group of persons or entities acting together, or in the event of a sale of substantially all of the Company’s assets or a dissolution or liquidation of the Company, the following rules will apply except as otherwise provided in an Award:

| • | If the transaction is one in which there is an acquiring or surviving entity, the Administrator may provide for the assumption of some or all outstanding awards or for the grant of new awards in substitution therefor by the acquiror or survivor. |

| • | If the transaction is one in which holders of common stock will receive a payment (whether cash, non-cash or a combination), the Administrator may provide for a “cash-out”, with respect to some or all awards, equal in the case of each affected award to the excess, if any, of (A) the fair market value of one share of common stock times the number of shares of common stock subject to the award, over (B) the aggregate exercise or purchase price, if any, under the award (in the case of an SAR, the aggregate base price above which appreciation is measured), in each case on such payment terms and other terms, and subject to such conditions, as the Administrator determines. |

| • | If there is no assumption or substitution of any award requiring exercise, each such outstanding award will become fully exercisable prior to the completion of the transaction on a basis that gives the holder of the award a reasonable opportunity to exercise the award and participate in the transaction as a stockholder. |

| • | Each award, other than outstanding shares of restricted stock, unless assumed will terminate upon consummation of the transaction. |

| • | Any share of common stock delivered pursuant to the “cash-out” or acceleration of an award, as described above, may, in the discretion of the Administrator, contain such restrictions, if any, as the Administrator deems appropriate to reflect any performance or other vesting conditions to which the |

12

| award was subject. In the case of restricted stock, the Administrator may require that any amounts delivered, exchanged or otherwise paid in respect of such stock in connection with the transaction be placed in escrow or otherwise made subject to such restrictions as the Administrator deems appropriate to carry out the intent of the Incentive Plan. |

Amendment. The Administrator may at any time or times amend the Incentive Plan or any outstanding Award for any purpose which may at the time be permitted by law, and may at any time terminate the Incentive Plan as to any future grants of awards. The Administrator may not, however, alter the terms of an Award so as to affect adversely the Participant’s rights under the Award without the Participant’s consent, unless the Administrator expressly reserved the right to do so at the time of the Award.

Federal Income Tax Consequences

The following discussion summarizes certain federal income tax consequences of the issuance and receipt of options under the Incentive Plan under the law as in effect on the date of this proxy statement. The summary does not purport to cover federal employment tax or other federal tax consequences that may be associated with the Incentive Plan, nor does it cover state, local or non-U.S. taxes.

ISOs. In general, an optionee realizes no taxable income upon the grant or exercise of an ISO. However, the exercise of an ISO may result in an alternative minimum tax liability to the optionee. With certain exceptions, a disposition of shares purchased under an ISO within two years from the date of grant or within one year after exercise produces ordinary income to the optionee (and a deduction to the Company) equal to the value of the shares at the time of exercise less the exercise price. Any additional gain recognized in the disposition is treated as a capital gain for which the Company is not entitled to a deduction. If the optionee does not dispose of the shares until after the expiration of these one- and two-year holding periods, any gain or loss recognized upon a subsequent sale is treated as a long-term capital gain or loss for which the Company is not entitled to a deduction.

NSOs. In general, in the case of a NSO, the optionee has no taxable income at the time of grant but realizes income in connection with exercise of the option in an amount equal to the excess (at the time of exercise) of the fair market value of the shares acquired upon exercise over the exercise price; a corresponding deduction is available to the Company; and upon a subsequent sale or exchange of the shares, any recognized gain or loss after the date of exercise is treated as capital gain or loss for which the Company is not entitled to a deduction.

In general, an ISO that is exercised by the optionee more than three months after termination of employment is treated as an NSO. ISOs are also treated as NSOs to the extent they first become exercisable by an individual in any calendar year for shares having a fair market value (determined as of the date of grant) in excess of $100,000.

The Administrator may award stock options that are exercisable for restricted stock. Under Section 83 of the Code, an optionee who exercises an NSO for restricted stock will generally have income only when the stock vests. The income will equal the fair market value of the stock at that time less the exercise price. However, the optionee may make a so-called “83(b) election” in connection with the exercise to recognize taxable income at that time. Assuming no other applicable limitations, the amount and timing of the deduction available to the Company will correspond to the income recognized by the optionee. The application of Section 83 to ISOs exercisable for restricted stock is less clear.

Under the so-called “golden parachute” provisions of the Code, the accelerated vesting of awards in connection with a change in control of the Company may be required to be valued and taken into account in determining whether participants have received compensatory payments, contingent on the change in control, in excess of certain limits. If these limits are exceeded, a substantial portion of amounts payable to the participant, including income recognized by reason of the grant, vesting or exercise of awards under the Incentive Plan, may be subject to an additional 20% federal tax and may be nondeductible to the Company.

13

Stock options awarded under the Incentive Plan are intended to be exempt from the rules of Section 409A of the Code and guidance issued thereunder and will be administered accordingly. However, neither the Company nor the Administrator, nor any person affiliated with or acting on behalf of the Company or the Administrator, will be liable to any participant or to the estate or beneficiary of any participant by reason of any acceleration of income, or any additional tax or interest penalties, resulting from the failure of an award to satisfy the requirements of Section 409A of the Code.

Proposal Three—Ratification of the Selection of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has selected PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the current fiscal year, subject to ratification by the Company’s stockholders at the Annual Meeting. The Company has been advised by PricewaterhouseCoopers LLP that it is a registered public accounting firm with the Public Company Accounting Oversight Board (the “PCAOB”) and complies with the auditing, quality control, and independence standards and rules of the PCAOB and the SEC. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting to respond to appropriate questions and to make a statement if he or she so desires.

Although stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm is not required, the Board of Directors is nevertheless submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification. Unless contrary instructions are given, shares represented by proxies solicited by the Board of Directors will be voted for the ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2008. Should the selection of PricewaterhouseCoopers LLP not be ratified by the stockholders, the Audit Committee will reconsider the matter. Even in the event the selection of PricewaterhouseCoopers LLP is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change is in the best interests of the Company and its stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

The Company knows of no other matters to be voted on at the Annual Meeting or any adjournment or postponement of the meeting. If, however, other matters are presented for a vote at the meeting, the proxy holders (the individuals designated on the proxy card) will vote your shares according to their judgment on those matters.

14

Compensation Discussion and Analysis

Executive Compensation Objectives

The Company’s executive compensation program is designed to attract, retain, motivate and recognize high performance executive officers. The Compensation Committee is responsible for and oversees the Company’s compensation program. The Company’s philosophy is to provide compensation programs that incentivize and reward both the short and long-term performance of the executive officers relative to the Company’s performance against its business objectives. Thus, the Committee utilizes compensation components that measure execution against the Company’s annual strategic operating plan, which contains the Company’s business objectives. In addition, the Compensation Committee seeks to align the interests of the Company’s executive officers with its shareholders.

Executive Compensation Components

Overview. The principal elements of the Company’s compensation are base salary, incentive bonus awards, and equity awards. The Company’s executive compensation policy recognizes that stock price is only one measure of performance, and given industry business conditions and the long-term strategic direction and goals of the Company, it may not necessarily be the best current measure of executive performance. Thus, the Compensation Committee considers the median level of compensation of its peer group and the achievement of the Company’s business objectives when determining executive compensation.

The Compensation Committee retained Milliman, Inc. to act as a compensation consultant. Milliman was tasked with examining the compensation of the named executive officers and providing an analysis of that compensation relative to other companies. Milliman studied data from the proxy statements of a select group of publicly-traded companies and from nationally recognized surveys. Data from these two sources was equally weighted in determining the median market levels of compensation. The proxy group was selected based on input from the Committee and senior management. In selecting the proxy group, the Committee and senior management considered companies that were at a similar business stage and companies that were of a similar size in the high-technology and general industries in which the Company operates. In providing its report to the Committee, Milliman also took into account that information for the peer group was reported as of different dates for different companies. The companies comprising the proxy group were 3D Systems Corporation, Arrowhead Research Corporation, eMargin Corporation, Excel Technology, Inc., Hoku Scientific, Inc., Immersion Corporation, Keithley Instruments, Inc., Mechanical Technology Inc., MoSys, Inc., Phoenix Technologies Ltd., ThermoGenesis Corp., Universal Display Corporation, and Zygo Corp. Data from these companies was compiled and averaged over a three-year period. Since proxy data is not job specific (i.e., various positions could be represented among the named executive officers), job specific data from nationally recognized surveys was also used. The nationally recognized published surveys utilized were the Aon Executive Compensation Survey, Economic Research Institute Executive Assessor, Culpepper Technology Executive Pay Report, Mercer Executive Compensation Survey, and Watson Wyatt Top Management Compensation Survey.

Base Salary. Base salaries for the named executive officers are primarily based on the position, taking into account competitive market compensation paid by other companies in the Company’s peer group for similar positions. Recommendations from the Chief Executive Officer as to increases in base salaries for each executive officer (other than for the Chief Executive Officer) based on the Chief Executive Officer’s evaluation of the executive officer’s performance are also taken into account.

As with total executive compensation, the Compensation Committee believes that executive base salaries should generally target the median of the peer group. Each named executive officer’s base salary is also determined by reviewing the other components of the executive officer’s compensation to ensure that the total compensation is in line with the Compensation Committee’s overall compensation philosophy.

15

Based on the compensation objectives mentioned above and Alexander Tokman’s Chief Operating Officer employment agreement, Mr. Tokman’s base salary for 2007 was $330,750. The base salaries for Jeff Wilson, Thomas Walker, Sridhar Madhavan, and Ian Brown were $197,000, $206,000, $191,000, and $170,000, respectively.

Incentive Bonus. The Compensation Committee believes that a portion of an executive officer’s total compensation, an incentive bonus, should be based on the Company’s success in meeting certain performance goals. The Compensation Committee believes that structuring a significant portion of each executive officer’s annual cash compensation as an incentive bonus, and the contingent nature of that compensation, induces an executive officer to execute on both the short and long-term goals of the Company. It has structured the executive compensation program to reflect this philosophy by creating an incentive bonus framework that translates performance goals into levels of incentive bonuses.

Each of the named executive officers is eligible for an annual incentive bonus. The amount of the bonus depends on the level of achievement of the stated Company performance goals, with a target set as a percentage of base salary. The Compensation Committee approves the target bonus percentages and the actual bonus awards for all executive officers, except the Chief Executive Officer. The Compensation Committee makes a recommendation to the full Board regarding the Chief Executive Officer. Target bonus percentages are set to be approximately at the median of the peer group.

In 2007, the Compensation Committee approved 40% as a target bonus award (as a percentage of base salary) for the named executive officers other than the Chief Executive Officer. The Committee recommended to the Board, and the Board approved, 65% as a target bonus award (as a percentage of base salary) for the Chief Executive Officer. The amount of the target bonus actually awarded to executives is determined by the Company’s performance. In its discretion, the Compensation Committee may, however, award bonus payments to the named executive officers above or below the amounts determined using these calculations. However, for 2007, bonus payments were awarded based solely on the amounts determined using the calculations described below.

Funding of the Company’s Incentive Bonus Plan for 2007 was based on achieving certain performance goals. The performance goals under the Plan arose from business objectives set forth in the Company’s operating plan. The Company weighted each objective with more weight placed on the Company’s strategic objectives. In 2007, the business objectives included: (1) maturing the PicoP platform and developing a product road map; (2) developing new business growth opportunities; (3) delivering on customer commitments; (4) completing a transformation related to the bar code business; (5) improving product quality; (6) improving the effectiveness and culture of the organization; and (7) operating loss, year end cash and revenue targets of $(25.3 million), $3.1 million and $14.0 million. Overall performance was calculated by multiplying the percentage completion of each business objective by its assigned weight to achieve an amount. Each business objective amount was then summed together to achieve a total score. The target bonus payout was then made based on a sliding scale approved by the Committee that would have paid 200% of the target bonus at achievement of a score of 125% of the business objectives and 40% of target bonus at the score of 50%. The Committee determined that in 2007 the Company, in the aggregate, achieved a total score of 95% of the business objectives which corresponded to a payout of 110% of target bonuses.

To determine the total score of the 2007 business objectives the Compensation Committee assessed the Company’s performance against the various objectives. The Committee determined the Company exceeded objective 1, primarily as a result of: advancements in the design of various required PicoP subsystems; successful demonstration of prototypes to prospective customers and supply chain partners at industry forums in 2007 and early 2008; retiring certain technical risks on electronic subsystems; securing certain supply chain partners; and exceeding intellectual property portfolio related objectives. The Committee determined that the Company only substantially met objective 2 as a result of: generating commercial contract revenue slightly below plan and having a delay in launching ROV which was offset by slightly exceeding government contract funding for maturing the Company’s eyewear technology. Objective 2 was also deemed to be only substantially met because

16

the customer contracts in the consumer and automotive segments secured in 2007 were limited to development stage contracts. The Committee determined that the Company met objective 3 as a result of its success in meeting planned deliverables under its various customer contracts. The Committee determined the Company only partially met objective 4, primarily as a result of the shortfall in bar code scanner revenues from plan, which resulted from a delay in launching ROV, offset slightly by the success in transferring engineering and support resources for bar code products to India. The Committee determined that the Company only substantially met objective 5, because even though quality measurements improved, the method of measurement changed and consequently an adequate comparison measurement for this objective could not be achieved. This was offset by successful ISO recertification. The Committee determined that objective 6 was met largely as a result of the Company’s success in retaining and motivating its top talent and overall employee population in a challenging economic climate. The Committee determined that the Company exceeded objective 7 primarily by ending the year with a cash balance well in excess of plan, offset by underperforming in meeting revenue targets.

Based upon the level of success in meeting the stated performance objectives described above, the Compensation Committee recommended to the Board, and the Board approved, an incentive bonus for Alexander Tokman of $236,500. The Compensation Committee awarded Jeff Wilson, Thomas Walker, Sridhar Madhavan and Ian Brown bonuses of $86,700, $97,200, $84,000 and $74,800, respectively. With respect to the Chief Executive Officer, the Compensation Committee recommended to the Board, and the Board approved, and with respect to each of the other executive officers, the Compensation Committee approved, paying one-half of the incentive bonus in cash with the remaining half to be paid in additional stock option awards in an amount equal to one-half of the incentive bonus divided by the value of the stock option, determined for this purpose to be $1.72. The exercise price of the options was the closing market price of the Company’s common stock on the Nasdaq Global Market on the grant date. The options were fully vested upon grant with a ten year term.

Equity Awards. The Compensation Committee believes that equity participation is a key component of the Company’s executive compensation program. Equity awards are designed to attract and retain executive officers and to motivate them to enhance shareholder value by aligning the financial interests of executive officers with those of shareholders. Each year the Committee reviews the size and composition of the equity grants to ensure that they are aligned with the Company’s compensation philosophy of compensating executives at the median of the peer group. Similar to base salary, a review of equity award levels is conducted to ensure that a named executive officer’s equity compensation comports with the Compensation Committee’s overall philosophy and objectives and is competitive with the Company’s peer group.

Stock options and restricted stock awarded to the named executive officers in 2007 were granted under, and subject to, the 2006 Incentive Plan. The stock options typically vest 25% upon the first anniversary of the date of grant and 25% upon each subsequent anniversary. The option awards expire 10 years from the date of grant, and optionees who terminate their service after vesting have a limited time to exercise their options (typically three to twelve months). The options also contain a provision for acceleration of exercisability of all unvested options in the event of a change in control of the Company. The restricted stock has three-year cliff vesting, which is tied to continued employment. The exercise price of the options is the closing sale price of the Company’s common stock on the Nasdaq Global Market on the date of the grant.

The Compensation Committee’s practice is to make annual equity awards as part of its overall philosophy of performance-based compensation. Restricted stock and stock options are awarded by the Compensation Committee to executive officers based on a philosophy of providing equity incentives at the median of the peer group. In 2007, the value of the long-term incentive award was split 70% stock options and 30% restricted stock.

In 2007, the Compensation Committee approved 45% (as a percentage of base salary) for the level of equity awards to the named executive officers other than the Chief Executive Officer. The Committee recommended to the Board, and the Board approved, 110% (as a percentage of base salary) for the level of equity awarded to the Chief Executive Officer. The percentages were used to determine a total dollar value. Stock options were valued using the Black-Scholes model and restricted stock was valued using the grant price. Those values were then utilized to calculate the respective number of shares of options and restricted stock to award to an executive.

17

In 2007, Mr. Tokman was awarded 215,750 stock options, 15,750 of which were granted in lieu of a portion of Mr. Tokman’s 2006 cash bonus. Jeff Wilson, Thomas Walker, Sridhar Madhavan and Ian Brown were awarded 107,614, 108,008, 82,000 and 46,800 stock options, respectively, including, 7,614, 8,008, 7,000 and 6,800 stock options granted in lieu of a portion of 2006 cash bonuses for Jeff Wilson, Thomas Walker, Sridhar Madhavan and Ian Brown, respectively.

Tax Deductibility of Compensation

Limitations on the deductibility of compensation may occur under Section 162(m) of the Internal Revenue Code of 1986, which generally limits a public company’s tax deduction for compensation paid to its named executive officers to $1 million in any year. In addition, Section 162(m) specifically exempts certain performance-based compensation from the deduction limit. It is the intent of the Compensation Committee to have the Company’s compensation program be deductible without limitation. However, the Compensation Committee will take into consideration various other factors, together with Section 162(m) considerations, in making executive compensation decisions and could, in certain circumstances, approve and authorize compensation that is not fully tax deductible.

Processes and Procedures

Role of the Compensation Committee and the Chief Executive Officer in the Compensation Process. The Chief Executive Officer, with the assistance and support of the human resources department, provides recommendations regarding the compensation of the executive officers, including himself. The Compensation Committee considers these recommendations and consults with the Chief Executive Officer as to his recommendations for the executive officers. The Compensation Committee considers the Chief Executive Officer’s recommendations, together with the Committee’s philosophy, objectives and market data in approving these recommendations. The Compensation Committee makes a recommendation on the Chief Executive Officer’s compensation to the full Board of Directors, who then has the authority to approve it.

Role of Compensation Consultants in the Compensation Process. The Compensation Committee’s charter provides the Committee with the authority to retain a compensation consulting firm in its discretion. In 2007, the Committee retained Milliman, Inc. Milliman’s role is more fully described under “Executive Compensation Components – Overview.”

The Compensation Committee has reviewed and discussed this Compensation Discussion and Analysis with management. Based on the review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement for filing with the Securities and Exchange Commission.

Compensation Committee

Slade Gorton

Jeanette Horan

Marc Onetto (Chairman)

18

Summary Compensation Table for 2007