MICROVISION, INC.

NOTICE OF 2020 ANNUAL MEETING

May 19, 2020

Dear MicroVision Shareholder:

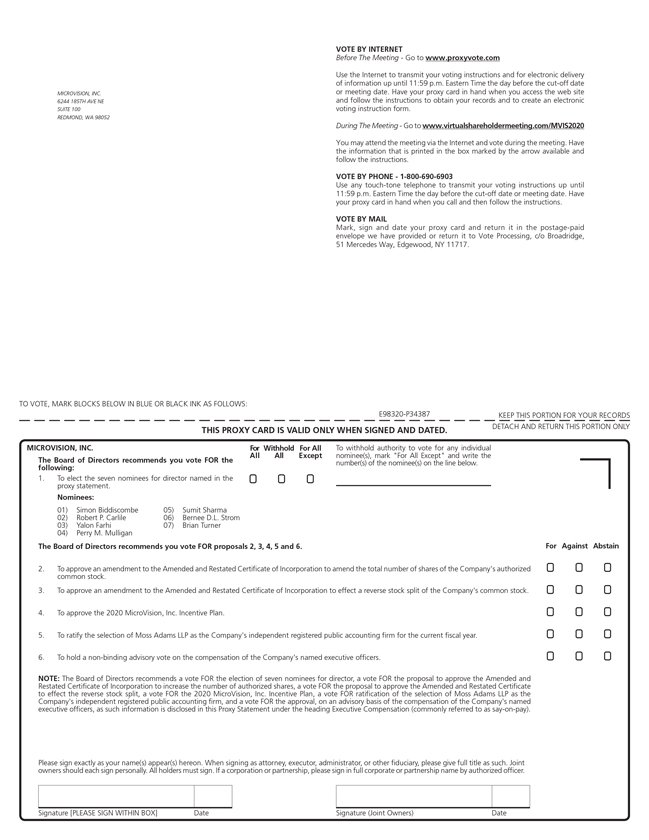

Please take notice that the Annual Meeting of Shareholders of MicroVision, Inc. (the “Company”) will be held virtually on May 19, 2020 at 9:00 a.m. Pacific Time. You will be able to attend the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/MVIS2020, Prior to the Annual Meeting, you will be able to vote at www.proxyvote.com for the following purposes:

| 1. | To elect the seven director nominees named in the accompanying proxy statement to serve until the next annual meeting; |

| 2. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”) to amend the total number of shares of the Company’s authorized common stock; |

| 3. | To approve an amendment to the Company’s Certificate of Incorporation to effect a reverse stock split of the Company’s common stock; |

| 4. | To approve the 2020 MicroVision, Inc. Incentive Plan; |

| 5. | To ratify the selection of Moss Adams LLP as the Company’s independent registered public accounting firm for the current fiscal year; |

| 6. | To hold a non-binding advisory vote on the compensation of the Company’s named executive officers; and |

| 7. | To conduct any other business that may properly come before the meeting and any adjournment or postponement of the meeting. |

Details of the business to be conducted at the meeting are more fully described in the accompanying Proxy Statement. Please read it carefully before casting your vote.

If you were a shareholder of record on March 25, 2020 (the “Record Date”), you will be entitled to vote on the above matters. A list of shareholders as of the Record Date will be available for shareholder inspection at the headquarters of the Company, 6244 185th Avenue NE, Suite 100, Redmond, Washington 98052, during ordinary business hours, from May 9, 2020 to the date of the Annual Meeting.

Important!

Whether or not you plan to attend the Annual Meeting, your vote is very important.

After reading the Proxy Statement, you are encouraged to vote by (1) toll-free telephone call, (2) the Internet or (3) completing, signing and dating the printable proxy card and returning it as soon as possible. If you are voting by telephone or the Internet, please follow the instructions on the proxy card. You may revoke your proxy at any time before it is voted by following the instructions provided below.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 19, 2020. The proxy materials and the annual report to shareholders for the fiscal year ended December 31, 2019 are available at http://www.microvision.com/investors/proxy.html.

If you need assistance voting your shares, please call Investor Relations at (425) 882-6629.

The Board of Directors recommends a vote FOR the election of the seven nominees for director named in this proxy statement, a vote FOR the approval of an amendment to the Company’s Certificate of Incorporation to amend the total number of shares of the Company’s authorized common stock, a vote FOR the approval of an amendment to the Company’s Certificate of Incorporation to effect a reverse stock split of the Company’s common stock, a vote FOR the approval of the proposed 2020 MicroVision, Inc. Incentive Plan, a vote FOR the ratification of the selection of Moss Adams LLP as the Company’s independent registered public accounting firm and a vote FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers, as such information is disclosed in this Proxy Statement under the heading Executive Compensation (commonly referred to as “say-on-pay”).

At the Annual Meeting, you will have an opportunity to ask questions about the Company and its operations. You may attend the Annual Meeting and vote your shares in person, even if you previously voted by telephone or the Internet or returned your proxy card. Your proxy (including a proxy granted by telephone or the Internet) may be revoked by sending in another signed proxy card with a later date, sending a letter revoking your proxy to the Company’s Secretary in Redmond, Washington, voting again by telephone or Internet, or attending the Annual Meeting via the Internet and vote during the meeting.

We look forward to seeing you. Thank you for your ongoing support of and interest in MicroVision, Inc.

| Sincerely, |

|

|

| David J. Westgor |

| Secretary |

| April 3, 2020 |

| Redmond, Washington |