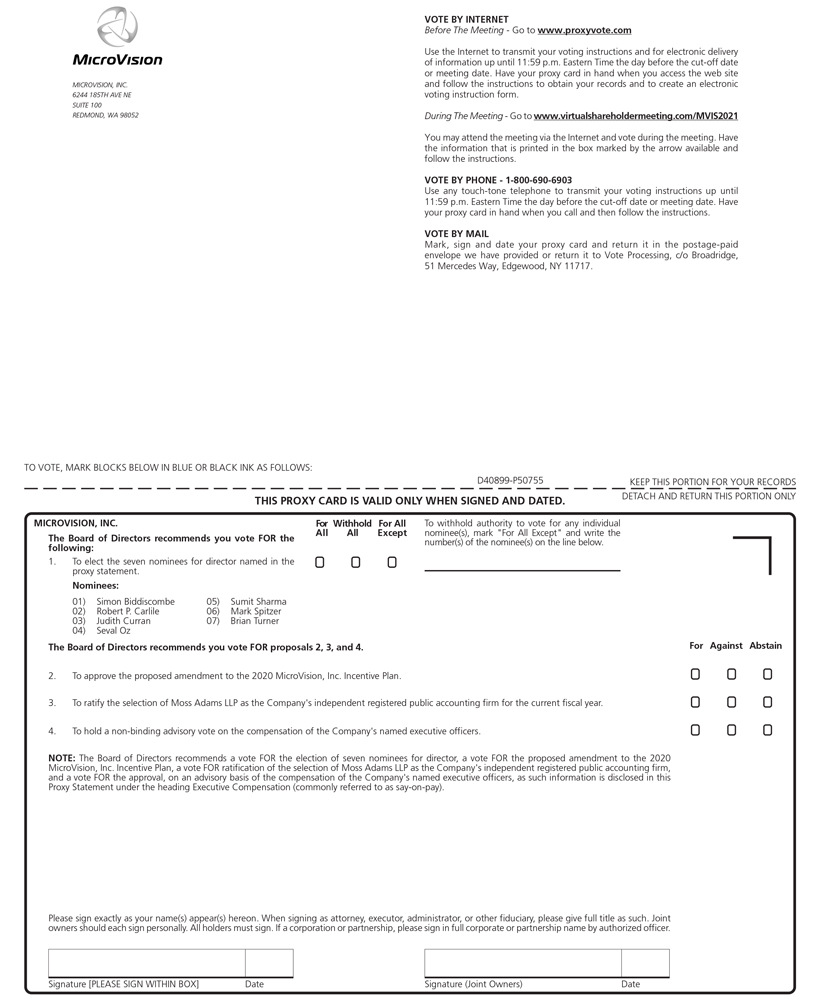

MICROVISION MICROVISION, INC. 6244 185TH AVE NE SUITE 100 REDMOND, WA 98052 VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/MVIS2021 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D40899-P50755 KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. MICROVISION, INC. The Board of Directors recommends you vote FOR the following: 1. To elect the seven nominees for director named in the proxy statement. Nominees: 01) Simon Biddiscombe 02) Robert P. Carlile 03) Judith Curran 04) Seval Oz 05) Sumit Sharma 06) Mark Spitzer 07) Brian Turner For All Withhold All For All Except [ ] [ ] [ ] To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below. The Board of Directors recommends you vote FOR proposals 2, 3, and 4. 2. To approve the proposed amendment to the 2020 MicroVision, Inc. Incentive Plan. 3. To ratify the selection of Moss Adams LLP as the Company’s independent registered public accounting firm for the current fiscal year. 4. To hold a non-binding advisory vote on the compensation of the Company’s named executive officers. NOTE: The Board of Directors recommends a vote FOR the election of seven nominees for director, a vote FOR the proposed amendment to the 2020 MicroVision, Inc. Incentive Plan, a vote FOR ratification of the selection of Moss Adams LLP as the Company’s independent registered public accounting firm, and a vote FOR the approval, on an advisory basis of the compensation of the Company’s named executive officers, as such information is disclosed in this Proxy Statement under the heading Executive Compensation (commonly referred to as say-on-pay). For Against Abstain [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] [ ] Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date