Exhibit 99.1 Integrated LiDAR and Software Solution for ADAS L2+/L3 MicroVision Business Over view J a n u a r y 2 0 2 2

Safe Harbor Statements This presentation of MicroVision, Inc. (“MicroVision,” “the Company,” “we,” or “our”), and any accompanying oral presentation, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, among others: statements relating to expectations regarding our future growth, profitability, market position and addressable market size; projections, estimates and targets; our financial condition and liquidity; our business strategies; our product plans and partnerships; and future product performance. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements. These statements reflect our expectations, assumptions and estimates as of the date of this presentation, and actual results may differ materially from the results predicted. The preparation of forward-looking financial guidance requires us to make estimates and assumptions; actual results may differ materially from these estimates under different assumptions or conditions. Factors that could cause actual results for MicroVision to differ from the results predicted include: our history of operating losses; challenges caused by the COVID-19 pandemic; the need for additional capital; potential dependence on third party partners, including licensing partners and contract manufacturers; risks related to our technology; quarterly financial and stock price performance; continued listing of our stock; successful monetization of our product solution; competitive risks; risks associated with key customer or strategic relationships and activities; disruptions in the global financial markets and supply chains; and legal and regulatory risks. More information about potential risk factors that could affect our business and financial results is included in MicroVision’s latest annual report on Form 10-K for the year ended December 31, 2020, subsequent quarterly reports on Form 10-Q, and other reports and documents filed by MicroVision from time to time with the U. S. Securities and Exchange Commission (“SEC”). Except as required by law, we assume no obligation to update any information in this presentation to reflect events or circumstances in the future, even if new information becomes available. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organization other third-party sources and management estimates. Management’s estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us that we believe to be reasonable. In addition, projections, assumptions and estimates of future industry and Company performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above and in our SEC filings. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by MicroVision. MicroVision has rights to various trademarks, service marks and trade names used in connection with the operation of our business. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended, and does not imply, a relationship with MicroVisions, or an endorsement or sponsorship by or of MicroVision. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that MicroVision will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor in these trademarks, service marks and trade names. © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 1

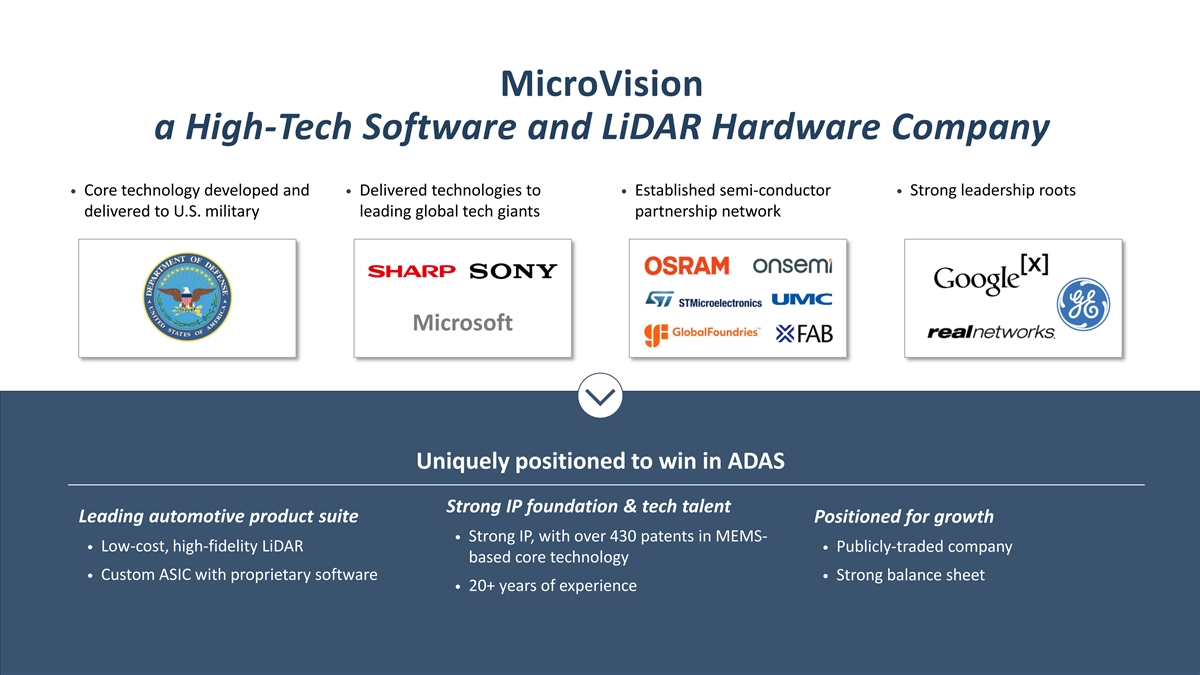

MicroVision a High-Tech Software and LiDAR Hardware Company • Core technology developed and • Delivered technologies to • Established semi-conductor • Strong leadership roots delivered to U.S. military leading global tech giants partnership network Microsoft Uniquely positioned to win in ADAS Strong IP foundation & tech talent Leading automotive product suite Positioned for growth • Strong IP, with over 430 patents in MEMS- • Low-cost, high-fidelity LiDAR • Publicly-traded company based core technology • Custom ASIC with proprietary software• Strong balance sheet • 20+ years of experience © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 2

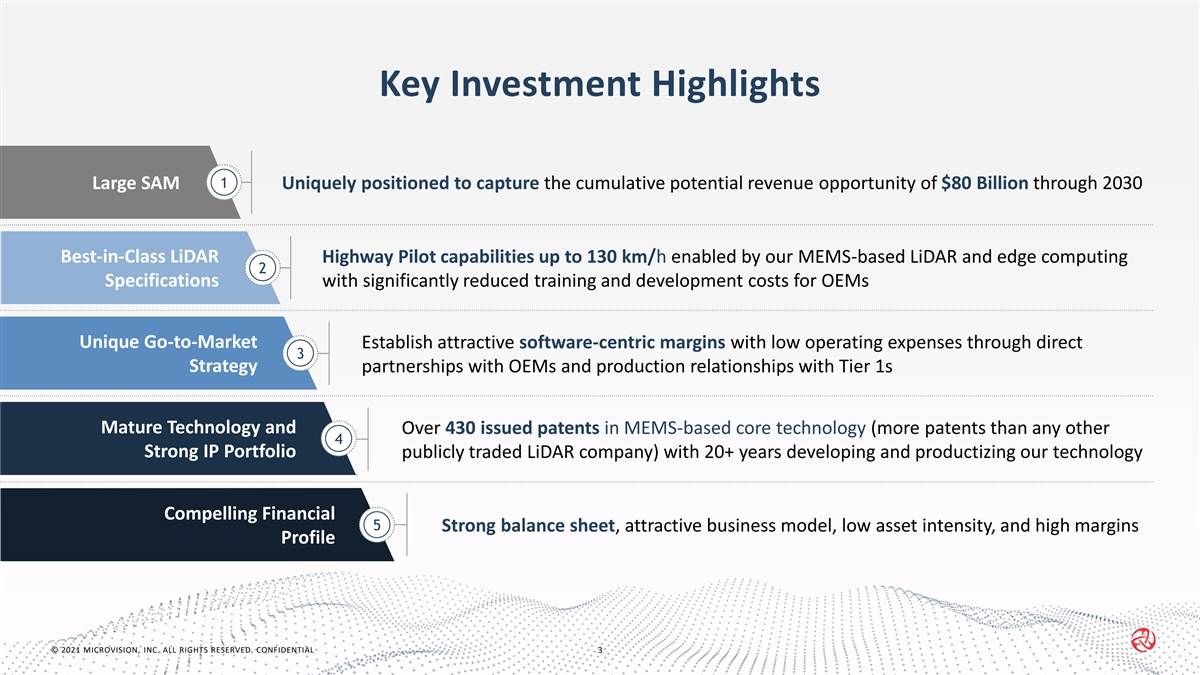

Key Investment Highlights 1 1 Large SAM Uniquely positioned to capture the cumulative potential revenue opportunity of $80 Billion through 2030 Best-in-Class LiDAR Highway Pilot capabilities up to 130 km/h enabled by our MEMS-based LiDAR and edge computing 1 2 Specifications with significantly reduced training and development costs for OEMs Unique Go-to-Market Establish attractive software-centric margins with low operating expenses through direct 3 1 Strategy partnerships with OEMs and production relationships with Tier 1s Mature Technology and Over 430 issued patents in MEMS-based core technology (more patents than any other 4 1 Strong IP Portfolio publicly traded LiDAR company) with 20+ years developing and productizing our technology Compelling Financial 5 1 Strong balance sheet, attractive business model, low asset intensity, and high margins Profile © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 3

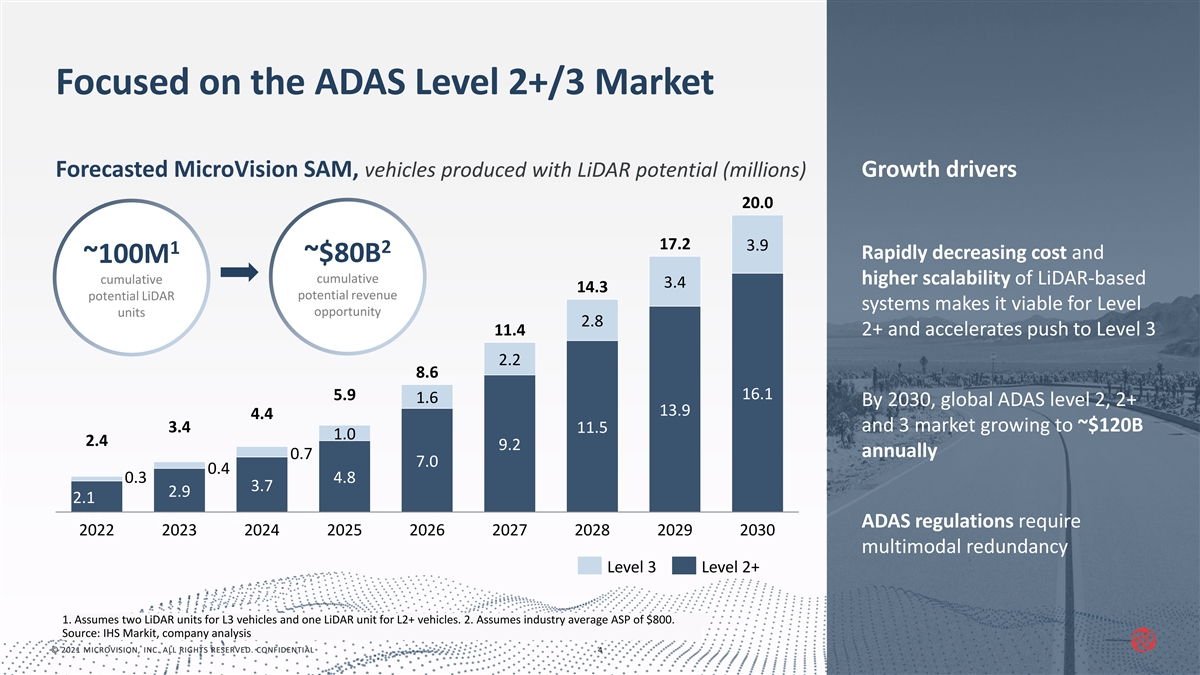

Focused on the ADAS Level 2+/3 Market Forecasted MicroVision SAM, vehicles produced with LiDAR potential (millions) Growth drivers 20.0 17.2 3.9 1 2 Rapidly decreasing cost and ~$80B ~100M cumulative cumulative higher scalability of LiDAR-based 3.4 14.3 potential LiDAR potential revenue systems makes it viable for Level opportunity units 2.8 11.4 2+ and accelerates push to Level 3 2.2 8.6 5.9 16.1 1.6 By 2030, global ADAS level 2, 2+ 13.9 4.4 and 3 market growing to ~$120B 3.4 11.5 1.0 2.4 9.2 annually 0.7 7.0 0.4 0.3 4.8 3.7 2.9 2.1 0.6 0.5 0.5 0.4 ADAS regulations require 2022 2023 2024 2025 2026 2027 2028 2029 2030 multimodal redundancy Level 3 Level 2+ 1. Assumes two LiDAR units for L3 vehicles and one LiDAR unit for L2+ vehicles. 2. Assumes industry average ASP of $800. Source: IHS Markit, company analysis © © 2 20 02 21 1 M MI IC CR RO OV VI IS SI IO ON N, , I IN NC C. . A AL LL L R RI IG GH HT TS S R RE ES SE ER RV VE ED D. . C CO ON NF FI ID DE EN NT TI IA AL L 4

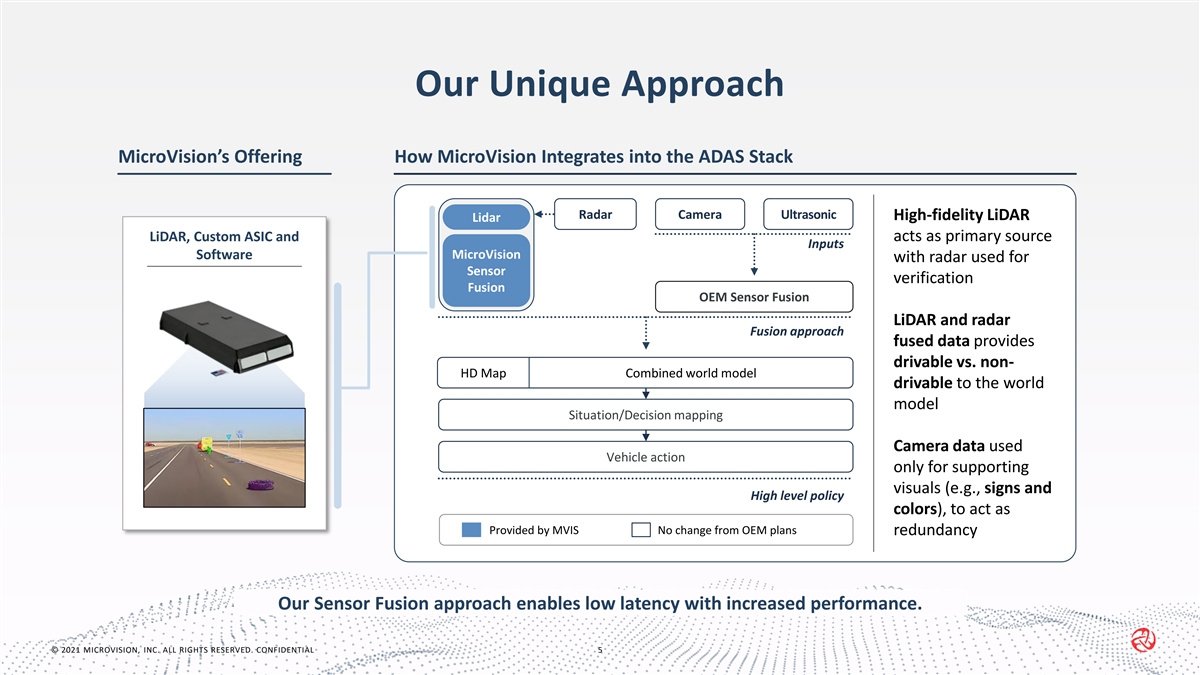

Our Unique Approach MicroVision’s Offering How MicroVision Integrates into the ADAS Stack Radar Camera Ultrasonic High-fidelity LiDAR Lidar LiDAR, Custom ASIC and acts as primary source Inputs MicroVision Software with radar used for Sensor verification Fusion OEM Sensor Fusion LiDAR and radar Fusion approach fused data provides drivable vs. non- HD Map Combined world model drivable to the world model Situation/Decision mapping Camera data used Vehicle action only for supporting visuals (e.g., signs and High level policy colors), to act as Provided by MVIS No change from OEM plans redundancy Our Sensor Fusion approach enables low latency with increased performance. © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 5

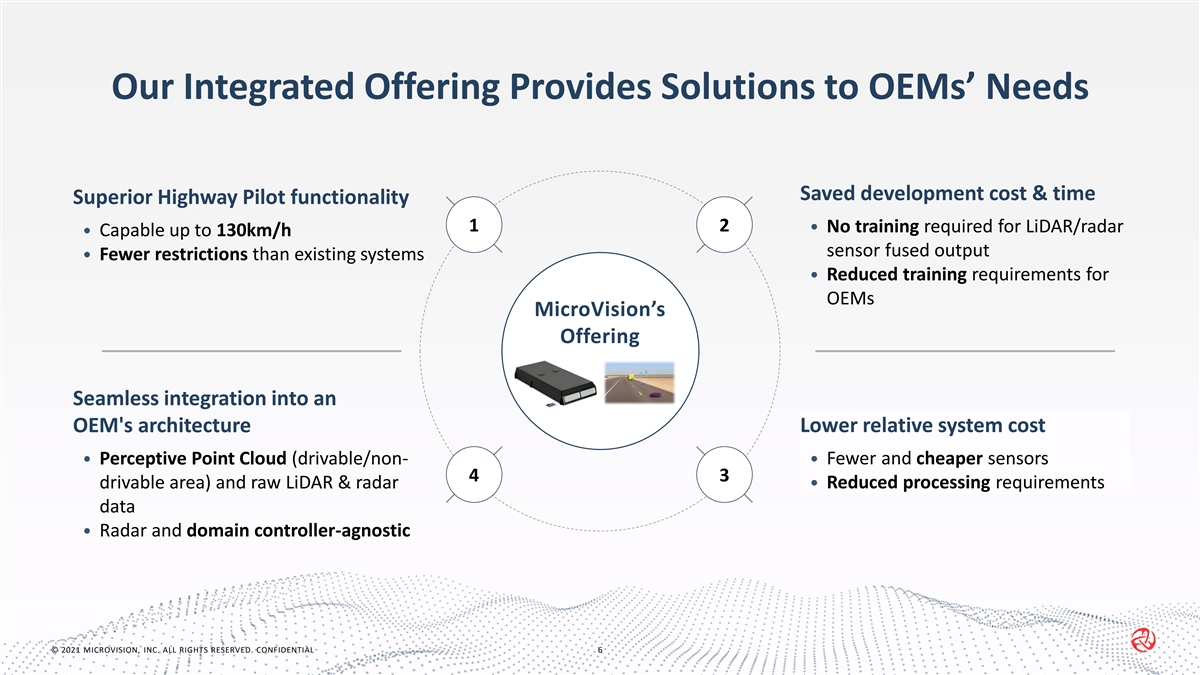

Our Integrated Offering Provides Solutions to OEMs’ Needs Saved development cost & time Superior Highway Pilot functionality 1 2 • No training required for LiDAR/radar • Capable up to 130km/h sensor fused output • Fewer restrictions than existing systems • Reduced training requirements for OEMs MicroVision’s Offering Seamless integration into an OEM's architecture Lower relative system cost • Perceptive Point Cloud (drivable/non-• Fewer and cheaper sensors 4 3 drivable area) and raw LiDAR & radar • Reduced processing requirements data • Radar and domain controller-agnostic © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 6

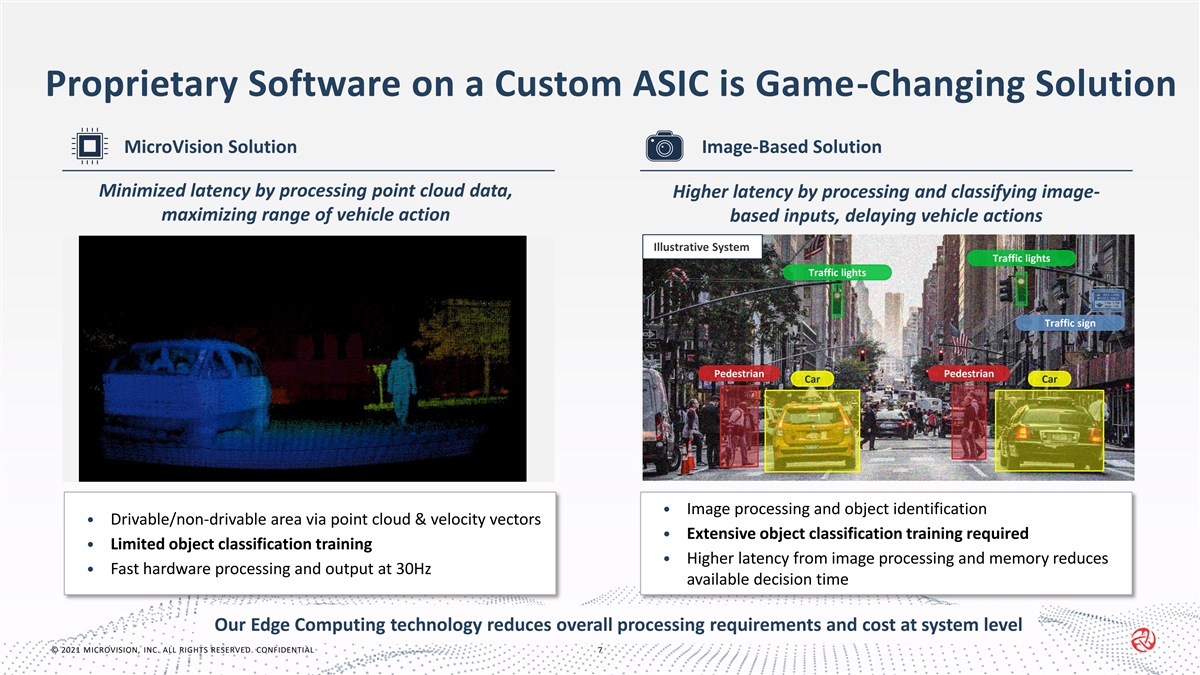

Proprietary Software on a Custom ASIC is Game-Changing Solution MicroVision Solution Image-Based Solution Minimized latency by processing point cloud data, Higher latency by processing and classifying image- maximizing range of vehicle action based inputs, delaying vehicle actions Illustrative System Traffic lights Traffic lights Traffic sign Video placeholder Replacing image Video placeholder (to show point cloud and vector) Pedestrian Pedestrian Car Car (to show point cloud and vector) • Image processing and object identification • Drivable/non-drivable area via point cloud & velocity vectors • Extensive object classification training required • Limited object classification training • Higher latency from image processing and memory reduces • Fast hardware processing and output at 30Hz available decision time Our Edge Computing technology reduces overall processing requirements and cost at system level © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 7

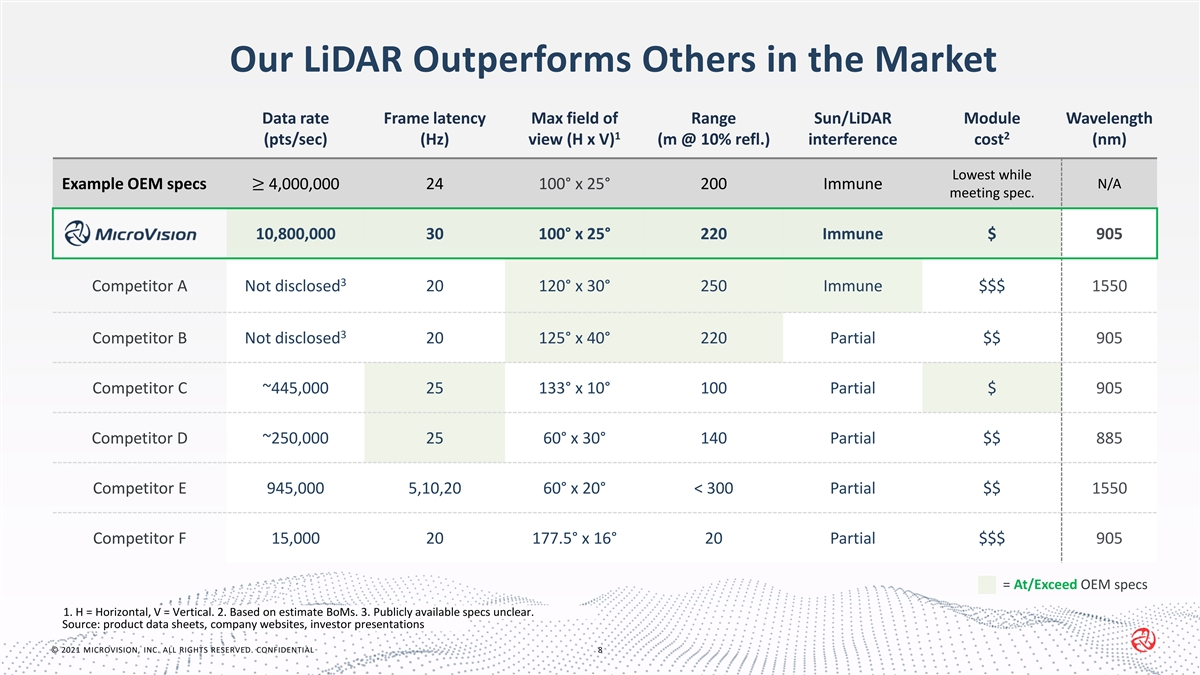

Our LiDAR Outperforms Others in the Market Data rate Frame latency Max field of Range Sun/LiDAR Module Wavelength 1 2 (pts/sec) (Hz) view (H x V) (m @ 10% refl.) interference cost (nm) Lowest while N/A Example OEM specs≥ 4,000,000 24 100° x 25° 200 Immune meeting spec. 10,800,000 30 100° x 25° 220 Immune $ 905 3 Competitor A Not disclosed 20 120° x 30° 250 Immune $$$ 1550 3 Competitor B Not disclosed 20 125° x 40° 220 Partial $$ 905 Competitor C ~445,000 25 133° x 10° 100 Partial $ 905 Competitor D ~250,000 25 60° x 30° 140 Partial $$ 885 Competitor E 945,000 5,10,20 60° x 20° < 300 Partial $$ 1550 Competitor F 15,000 20 177.5° x 16° 20 Partial $$$ 905 = At/Exceed OEM specs 1. H = Horizontal, V = Vertical. 2. Based on estimate BoMs. 3. Publicly available specs unclear. Source: product data sheets, company websites, investor presentations © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 8

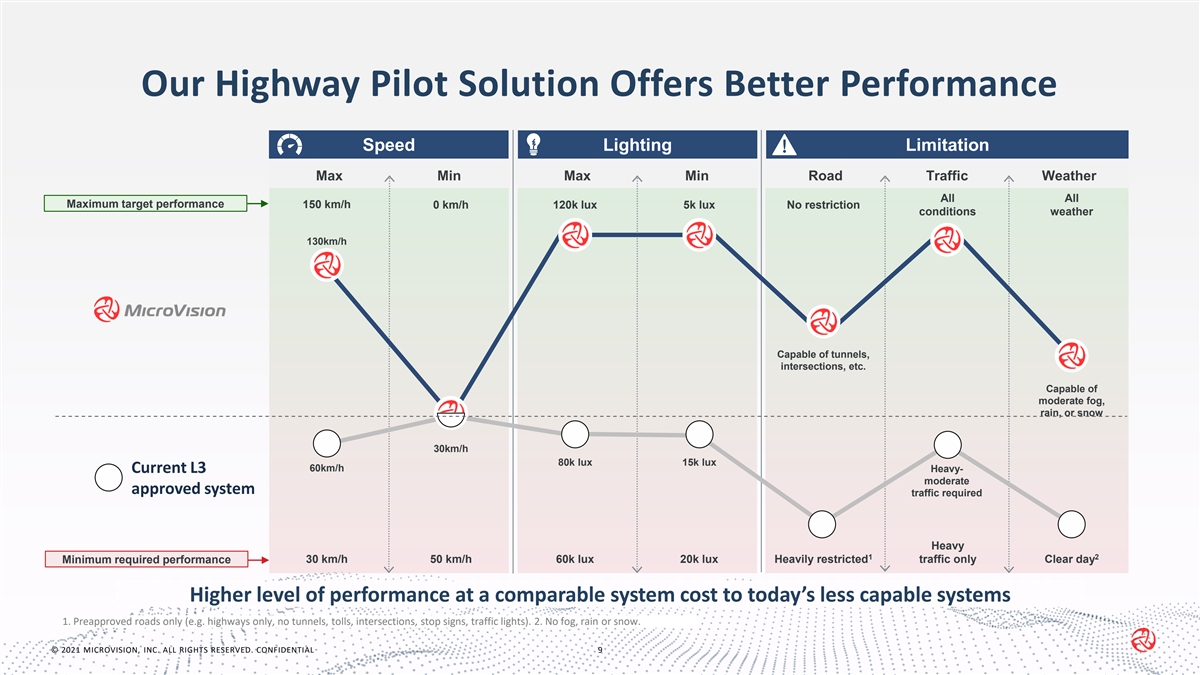

Our Highway Pilot Solution Offers Better Performance Speed Lighting Limitation Max Min Max Min Road Traffic Weather All All Maximum target performance 150 km/h 0 km/h 120k lux 5k lux No restriction conditions weather 130km/h Capable of tunnels, intersections, etc. Capable of moderate fog, rain, or snow 30km/h 80k lux 15k lux 60km/h Heavy- Current L3 moderate approved system traffic required Heavy 1 2 Minimum required performance 30 km/h 50 km/h 60k lux 20k lux Heavily restricted traffic only Clear day Higher level of performance at a comparable system cost to today’s less capable systems 1. Preapproved roads only (e.g. highways only, no tunnels, tolls, intersections, stop signs, traffic lights). 2. No fog, rain or snow. © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 9

Our Go-to-Market Strategy Direct marketing & OEM PARTNERSHIP co-development Partnering with OEMs directly to enable customized features leading to “directed buy” agreements Strategically positioned to: TIER 1 PARTNERSHIP Hardware & • Establish attractive software revenue proprietary software and Partnering with Tier 1s to license streams custom ASIC margins hardware production • Robust LiDAR hardware revenue SILICON PARTNERSHIP Included as part of reference design Partnering with silicon companies to support our hardware on their compute platforms © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 10

Our Measures of Success Cumulative metrics through 2030 Partnerships Sales Volume Revenue EBITDA ~25 – 30M+ 2+ OEMs ~$2 – $4B+ ~$1 – $2B units Source: IHS Markit, company estimates. EBITDA is a non-GAAP measure useful to management and investors as a liquidity measure and for comparison to peers but is not intended as a substitute for GAAP. © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 11

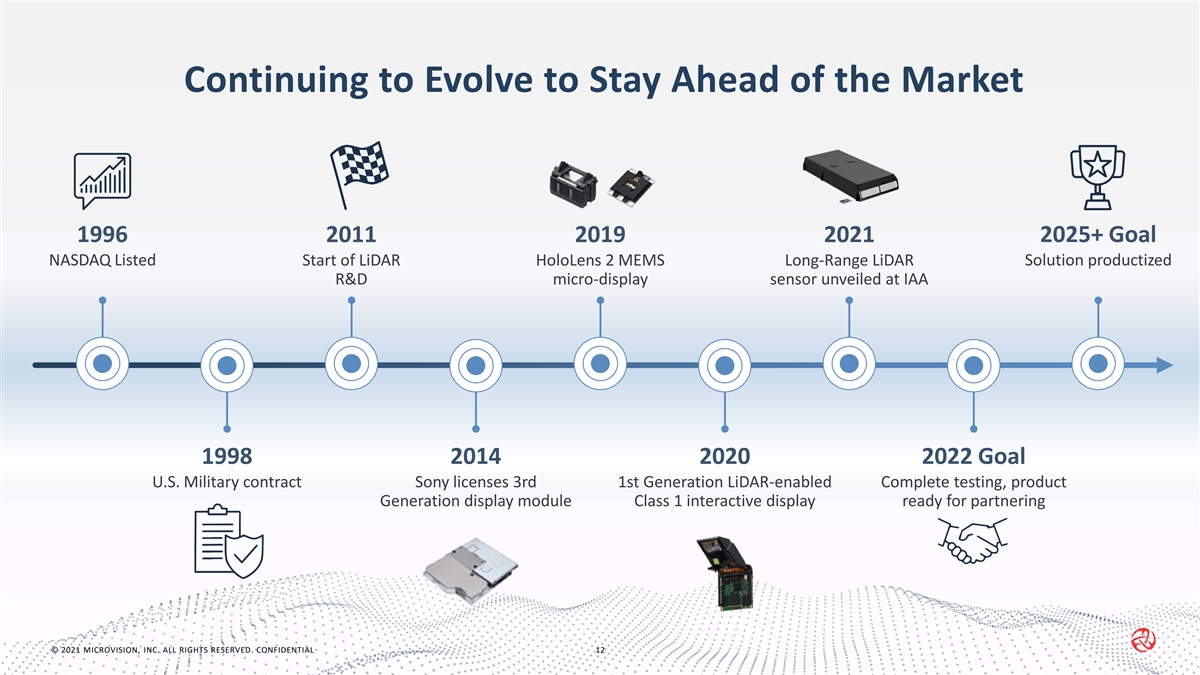

Continuing to Evolve to Stay Ahead of the Market 1996 2011 2019 2021 2025+ Goal NASDAQ Listed Start of LiDAR HoloLens 2 MEMS Long-Range LiDAR Solution productized R&D micro-display sensor unveiled at IAA 1998 2014 2020 2022 Goal U.S. Military contract Sony licenses 3rd 1st Generation LiDAR-enabled Complete testing, product Generation display module Class 1 interactive display ready for partnering © 2021 MICROVISION, INC. ALL RIGHTS RESERVED. CONFIDENTIAL 12

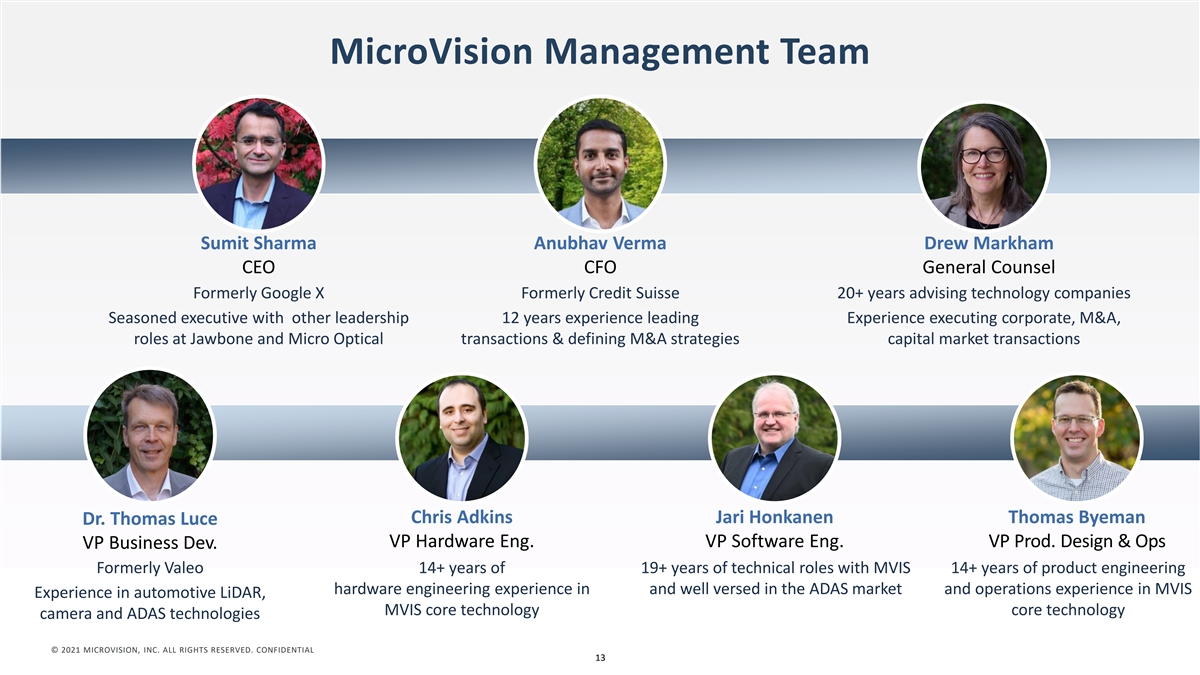

MicroVision Management Team Sumit Sharma Anubhav Verma Drew Markham CEO CFO General Counsel Formerly Google X Formerly Credit Suisse 20+ years advising technology companies Seasoned executive with other leadership 12 years experience leading Experience executing corporate, M&A, roles at Jawbone and Micro Optical transactions & defining M&A strategies capital market transactions Chris Adkins Jari Honkanen Thomas Byeman Dr. Thomas Luce VP Hardware Eng. VP Software Eng. VP Prod. Design & Ops VP Business Dev. Formerly Valeo 14+ years of 19+ years of technical roles with MVIS 14+ years of product engineering hardware engineering experience in and well versed in the ADAS market and operations experience in MVIS Experience in automotive LiDAR, MVIS core technology core technology camera and ADAS technologies © © 2 20 02 21 1 M MI IC CR RO OV VI IS SI IO ON N, , I IN NC C. . A AL LL L R RI IG GH HT TS S R RE ES SE ER RV VE ED D. . C CO ON NF FI ID DE EN NT TI IA AL L 13 13

T h a n k y o u .