NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Wednesday, May 17, 2023

at 9:00 a.m. Pacific Time

To the Shareholders of MicroVision, Inc.:

The 2023 Annual Meeting of Shareholders of MicroVision, Inc., a Delaware corporation, will be held on Wednesday, May 17, 2023 at 9:00 a.m., Pacific Time. The Annual Meeting will be a virtual meeting held online at www.virtualshareholdermeeting.com/MVIS2023 via a live webcast. Shareholders of record at the close of business on March 20, 2023 and holders of proxies for those shareholders may attend and vote at the Annual Meeting. You will be able to vote and submit questions online through the virtual meeting platform during the Annual Meeting. You will not be able to attend the Annual Meeting in person.

The meeting is being held for the following purposes, each of which is more fully described in the accompanying proxy statement:

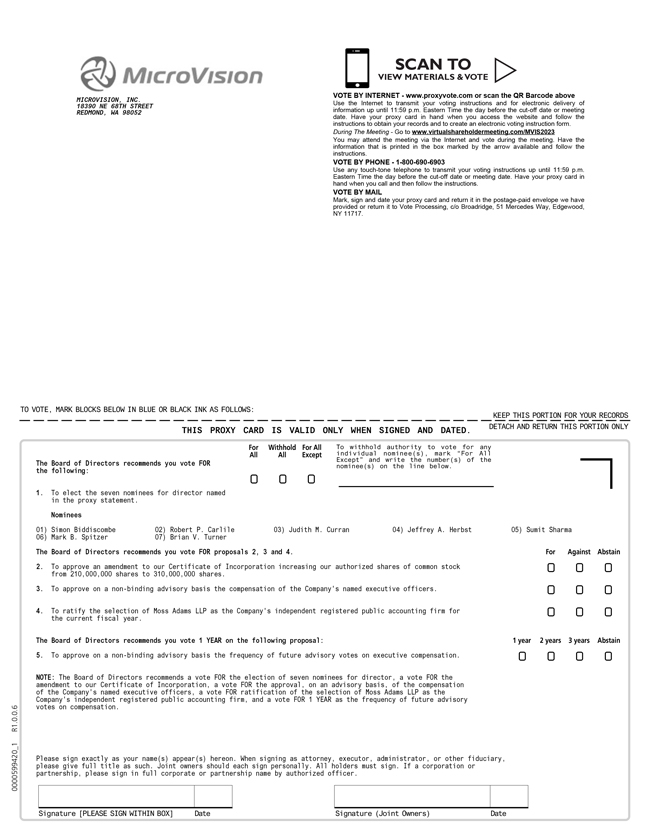

| 1. | To elect the seven director nominees named in the accompanying proxy statement to serve until the next annual meeting; |

| 2. | To approve an amendment to our Certificate of Incorporation increasing our authorized shares of common stock from 210,000,000 shares to 310,000,000 shares; |

| 3. | To conduct an advisory vote on executive compensation; |

| 4. | To ratify the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| 5. | To conduct an advisory vote on the frequency of future advisory votes on executive compensation; and |

| 6. | To transact any other business properly presented at the meeting. |

Your vote is important to us. You may vote via the internet or by telephone, or if you requested to receive printed proxy materials, by signing, dating, and returning your proxy card. If you are voting via the internet or by telephone, your vote must be received by 11:59 p.m. Eastern Time on Tuesday, May 16, 2023. For specific voting instructions, please refer to the information provided in the following proxy statement, together with your proxy card or the voting instructions you receive by e-mail or that are provided via the internet.

If you received a Notice of Internet Availability of Proxy Materials on how to access the proxy materials via the internet, a proxy card was not sent to you, and you may vote only via the internet, unless you have requested a paper copy of the proxy materials, in which case, you may also vote by telephone or by signing, dating, and returning your proxy card. Shares cannot be voted by marking, writing on, and returning the Notice of Internet Availability. Any Notices of Internet Availability that are returned will not be counted as votes. Instructions for requesting a paper copy of the proxy materials are set forth on the Notice of Internet Availability.

Thank you for your ongoing support of MicroVision.

By Order of the Board of Directors,

Drew G. Markham

Corporate Secretary

Redmond, Washington

April 5, 2023

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 17, 2023. The proxy statement and the annual report to shareholders for the fiscal year ended December 31, 2022 are available at http://www.microvision.com/investors/proxy.html.